Key Takeaways

- Strategic focus on AI, cloud, and multiyear contracts positions Birlasoft for accelerated revenue growth, margin improvement, and sustained high-quality earnings.

- Leadership overhaul and targeted client expansion are set to drive robust deal flow, increased wallet share, and outperformance versus market expectations.

- Heavy reliance on discretionary projects, concentrated client exposure, limited scale, intense competition, and rising compliance costs all constrain Birlasoft's growth and margin prospects.

Catalysts

About Birlasoft- Provides software development services in India, the Americas, Europe, the United Kingdom, and internationally.

- Analyst consensus expects AI and GenAI investments to drive future growth, but with Birlasoft closing significant multiyear global AI-powered engagements and positioning its Agentic AI solutions as a differentiator in large enterprise digital transformations, the company is poised to capture larger, higher-margin deals at a pace and scale that may substantially outperform expectations, fueling both revenue acceleration and margin expansion.

- While consensus expects deal wins-including a new logo in Europe-to support moderate revenue and earnings improvement, the pipeline is far more robust, with several large annuity-based deals and a strategic reduction of project-based volatility: this shift towards high-recurrence, multiyear contracts offers a powerful uplift to predictable top-line growth and higher-quality earnings.

- Birlasoft's ongoing overhaul of leadership across key verticals and front-end sales, coupled with targeted investments in opening "must-have" accounts and aggressive mining of both new and existing clients, is likely to trigger a step-function increase in client additions and wallet share, creating sustained deal flow and revenue compounding well beyond current projections.

- The accelerating global migration to cloud and managed services, along with Birlasoft's renewed focus on its ERP and infrastructure offerings, strongly positions the company to harness the next wave of enterprise cloud adoption, driving lasting growth in both revenues and margins as businesses modernize at scale.

- Global talent shortages and heightened demand for IT outsourcing are expected to disproportionately benefit nimble offshore providers like Birlasoft-its best-in-class DSO, robust cash generation, and ongoing R&D investments give it strategic flexibility to seize premium contracts, rapidly expand vertical domain expertise, and deliver best-in-class profit conversion over the medium and long term.

Birlasoft Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Birlasoft compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Birlasoft's revenue will grow by 9.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.9% today to 11.7% in 3 years time.

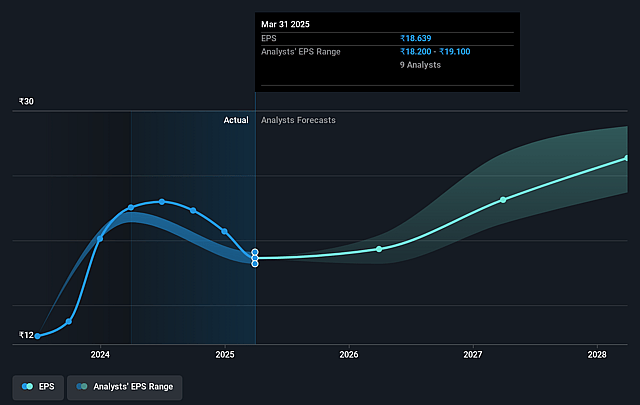

- The bullish analysts expect earnings to reach ₹8.1 billion (and earnings per share of ₹28.22) by about August 2028, up from ₹4.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, up from 21.9x today. This future PE is lower than the current PE for the IN Software industry at 39.5x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.48%, as per the Simply Wall St company report.

Birlasoft Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Birlasoft's high dependence on project-based and discretionary spend work-currently about seventy percent of overall revenues-creates significant volatility, as economic cycles and rapid technological change can suppress demand for non-core IT projects and increase revenue cyclicality, threatening both short

- and long-term revenue growth.

- Concentration risk remains acute, with a substantial portion of revenue linked to just a few key industry verticals like manufacturing and MedTech, and large clients who are currently in-sourcing technology or curbing external spend, which could further erode Birlasoft's top line and earnings stability if these trends persist or accelerate.

- The company's limited scale compared to larger Indian IT peers constrains its ability to invest heavily in next-generation technologies such as automation and generative AI, and to compete for large, transformative digital deals, thereby hampering Birlasoft's prospects for margin expansion and future revenue growth.

- Intense and rising competition from "digital-native" hyperscalers as well as ongoing client pressure for lower prices, especially in commoditized and legacy IT services, are likely to cause continued margin compression and restrict Birlasoft's ability to achieve and sustain higher earnings.

- Increased compliance costs driven by global data privacy regulations, cybersecurity complexities, and the need to continuously attract and retain skilled talent amid wage inflation are raising operational expenses, which may further squeeze net margins and dampen earnings potential over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Birlasoft is ₹505.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Birlasoft's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹505.0, and the most bearish reporting a price target of just ₹340.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹69.6 billion, earnings will come to ₹8.1 billion, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹372.2, the bullish analyst price target of ₹505.0 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.