Key Takeaways

- Rising automation, stricter data regulations, and sector concentration are increasing revenue risks, margin pressures, and making Cyient vulnerable to industry downturns and regulatory changes.

- Challenges in digital transformation, talent shortages, and wage inflation threaten Cyient's market relevance and hinder future earnings and margin growth.

- Diversified growth across engineering, semiconductors, and manufacturing, strong client retention, and a solid balance sheet position Cyient for sustained stability and future expansion.

Catalysts

About Cyient- Provides geospatial, engineering design, manufacturing, networks and operations, data transformation, and analytic services in North America, Europe, Middle East, and the Asia Pacific.

- The accelerating adoption of AI-driven automation is expected to further dampen long-term growth for engineering and traditional IT services, eroding Cyient's pricing power and resulting in continued top-line revenue pressure as clients look for lower-cost, fully automated solutions rather than outsourcing to human-driven providers.

- Intensifying data privacy regulations and increasingly strict digital sovereignty requirements are set to raise compliance costs, constrain Cyient's ability to deliver cross-border digital services, and could substantially squeeze net margins over the next several years as regulatory complexity and costs escalate globally.

- Cyient's persistent heavy client concentration in aerospace, defense, and transportation heightens the company's vulnerability to sector-specific downturns and contract losses, which, combined with recent profit warnings across the aerospace sector and ongoing macro uncertainty, creates a structurally higher risk of unpredictable revenue declines in future cycles.

- Despite efforts to transition into digital and high-margin services, Cyient continues to lag larger competitors in scaling innovative, platform-based digital offerings, increasing the risk of margin compression and subdued earnings growth as commoditization pressures intensify in legacy service lines.

- Talent shortages and escalating wage inflation in India's technology sector are likely to persist, driving further upward pressure on operational costs and undermining EBIT margin expansion efforts, while global clients increasingly prefer integrated, end-to-end digital transformation partners, gradually shrinking Cyient's addressable market and putting medium

- to long-term earnings stability at risk.

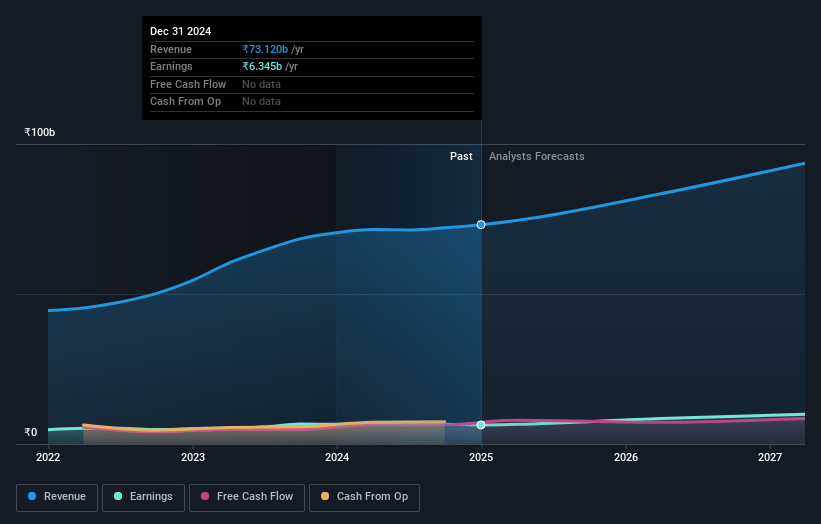

Cyient Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cyient compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cyient's revenue will grow by 7.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.4% today to 9.7% in 3 years time.

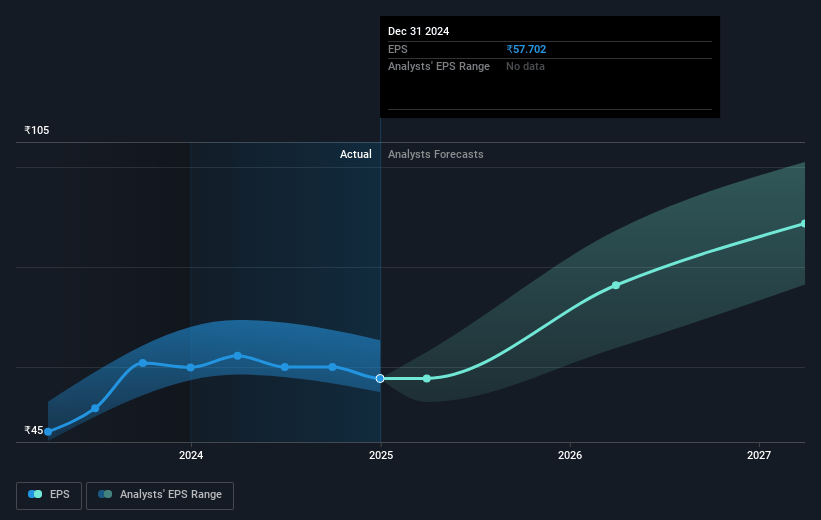

- The bearish analysts expect earnings to reach ₹8.8 billion (and earnings per share of ₹73.36) by about July 2028, up from ₹6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.1x on those 2028 earnings, down from 22.9x today. This future PE is lower than the current PE for the IN IT industry at 29.9x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.53%, as per the Simply Wall St company report.

Cyient Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cyient has demonstrated a long-term track record of revenue expansion, having doubled revenues in the past 7 years and tripled over 12 years, indicating an underlying ability to capture secular growth trends and drive top-line expansion even through periods of near-term volatility.

- The company's business is well-diversified across three high-growth vectors-engineering services evolving into digital engineering technology, the fast-growing semiconductor segment, and design-led manufacturing-all of which reduces dependency on any single vertical or geography and supports long-term revenue and earnings stability.

- Recent strategic wins in green hydrogen, intelligent mobility, and large turnkey projects, as well as alliances with companies like Micware Navigation, position Cyient to benefit from long-term industry shifts towards sustainability, smart transportation, and the digital transformation of infrastructure, potentially accelerating future revenue growth.

- Cyient maintains strong client relationships, with top 5 and top 10 customers both posting year-on-year growth and the pipeline characterized by high customer stickiness and visibility, supporting sustained cash flows and protecting against sharp revenue drops.

- The company is maintaining a robust balance sheet with record-high cash generation, zero long-term debt, and ongoing cost control, giving it the flexibility to invest in growth opportunities or weather macro headwinds, thereby helping support future net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cyient is ₹1050.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cyient's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2230.0, and the most bearish reporting a price target of just ₹1050.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹91.0 billion, earnings will come to ₹8.8 billion, and it would be trading on a PE ratio of 20.1x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹1277.95, the bearish analyst price target of ₹1050.0 is 21.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.