Key Takeaways

- Strong positioning in high-growth, less cyclical sectors and strategic partnerships drives sustained margin expansion and revenue predictability.

- Robust financials and targeted M&A focus enable market share consolidation and accelerated long-term profitability.

- Declining core revenues, exposure to volatile legacy sectors, execution issues, and rising talent costs threaten long-term growth and margin stability amid industry disruption.

Catalysts

About Cyient- Provides geospatial, engineering design, manufacturing, networks and operations, data transformation, and analytic services in North America, Europe, Middle East, and the Asia Pacific.

- Analyst consensus sees large deal wins such as the green hydrogen project and Micware partnership as growth levers, but this could be understated-as Cyient's ability to secure first-of-their-kind, high-profile deals in structurally expanding sectors like renewables and smart mobility positions it to capture outsized multi-year revenues from global investment waves in energy transition and intelligent infrastructure.

- While consensus highlights diversification across DET, semiconductors, and DLM as a stabilizing force, the accelerating ramp-up in the high-growth DLM segment (27 percent year-on-year) and semiconductor spin-off-with dedicated leadership-signals an inflection where business mix shifts rapidly to higher-margin, less cyclical domains, enabling a stronger-than-expected expansion in group net margins and earnings quality.

- Cyient is strategically positioned to leverage rapid global digitalization and the surge in Industry 4.0 adoption, as its pivot to digital engineering, AI, and platform-based services allows it to win larger, value-added contracts and unlock an expanded addressable market, driving sustained revenue compounding and net margin improvement.

- The company's renewed focus on execution excellence and integration of returning top talent and specialized leadership, together with robust client relationships-evidenced by multi-decade partnerships and top customer growth-create a foundation for structurally improved revenue predictability and lower earnings volatility than in past business cycles.

- With a record cash balance, zero net long-term debt, and an explicit mandate to pursue targeted M&A and accelerate portfolio enhancement, Cyient is uniquely placed to fill technology gaps and consolidate market share amid global vendor rationalization, anticipating step-changes in both revenue scale and long-term profitability.

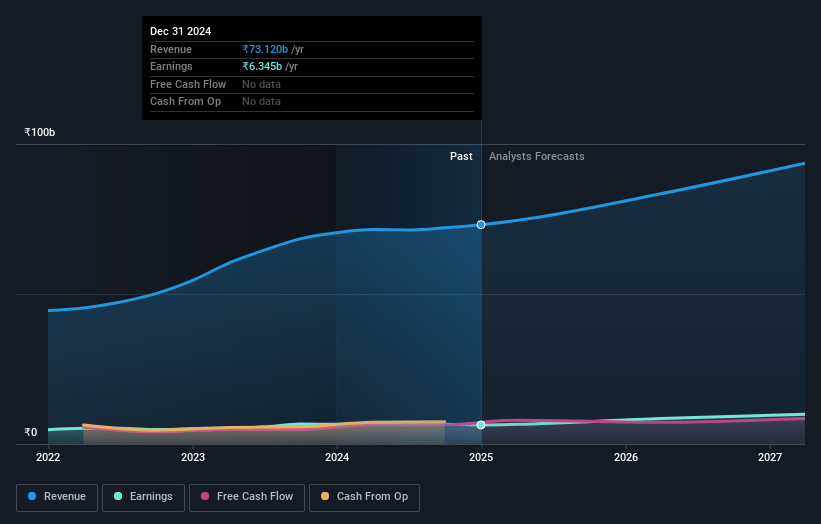

Cyient Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cyient compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cyient's revenue will grow by 12.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.4% today to 11.6% in 3 years time.

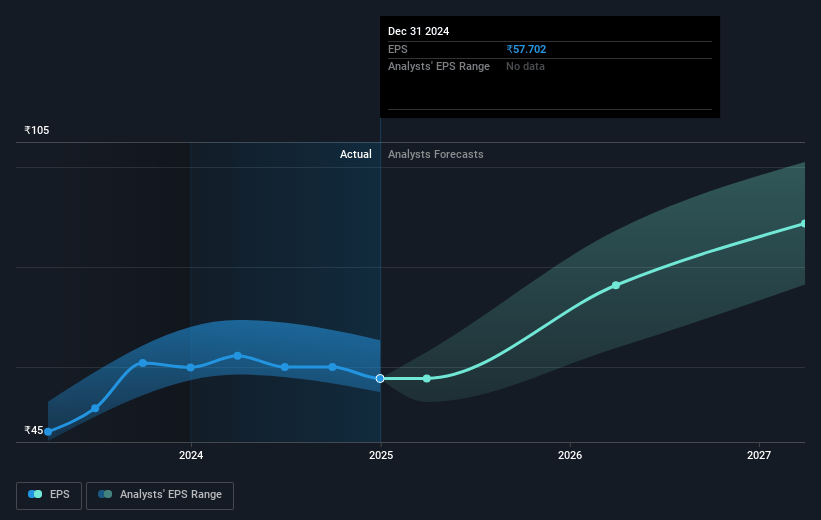

- The bullish analysts expect earnings to reach ₹12.0 billion (and earnings per share of ₹108.0) by about July 2028, up from ₹6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.7x on those 2028 earnings, up from 23.2x today. This future PE is lower than the current PE for the IN IT industry at 31.3x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.47%, as per the Simply Wall St company report.

Cyient Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cyient's core engineering services experienced a year-on-year revenue decline and continuing margin compression, which, coupled with the broader trend of commoditization and automation in engineering, could depress future revenue growth and profitability.

- The company has stopped providing forward-looking guidance due to ongoing macroeconomic uncertainty, increasing unpredictability in deal closures, and sector-specific volatility, putting the sustainability of revenue and earnings growth at risk.

- Cyient remains significantly exposed to legacy industries such as aerospace, where ongoing global protectionism, deglobalization, and weakening demand from major clients present risks of sudden revenue contraction and heightened earnings volatility.

- Management acknowledged persistent execution challenges and a historical lack of growth predictability, suggesting that fundamental issues around sales and operational delivery could continue to suppress stable long-term earnings expansion.

- Rising talent acquisition and retention costs, ongoing sector-wide attrition, and the need for continued wage hikes threaten to erode net margins further, as the company also faces pressure to accelerate its transition to higher-value digital and analytics offerings to stay relevant and defend market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cyient is ₹2033.29, which represents two standard deviations above the consensus price target of ₹1427.04. This valuation is based on what can be assumed as the expectations of Cyient's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2230.0, and the most bearish reporting a price target of just ₹1050.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹103.3 billion, earnings will come to ₹12.0 billion, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹1296.0, the bullish analyst price target of ₹2033.29 is 36.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.