Key Takeaways

- Cyient's strategic partnerships and diversification in key sectors promise potential growth in renewable energy and intelligent mobility, stabilizing revenue streams.

- Experienced leadership and focus on Global Capability Centers and M&A strategies position Cyient to enhance efficiency and explore new revenue channels.

- Operational challenges, macroeconomic uncertainties, and industry-specific issues pose risks to Cyient's revenue stability and earnings growth, needing strategic focus and leadership adjustments.

Catalysts

About Cyient- Provides geospatial, engineering design, information technology (IT) solutions, and data analytic services in North America, Europe, and the Asia Pacific.

- Cyient's ongoing success in securing major deals, such as the engineering of a green hydrogen production project and a partnership with Micware Navigations, symbolizes growth potential in the renewable energy and intelligent mobility sectors, likely driving future revenue growth.

- The diversification strategy across three business vectors—DET (Digital Engineering Technology), semiconductor, and design-led manufacturing (DLM)—offers a platform for balanced growth and reduced dependency on any single industry or geography, potentially stabilizing revenue streams and improving earnings.

- The appointment of experienced leaders, like Sukamal Banerjee and Suman Narayan, positions Cyient to capitalize on accelerating growth opportunities through enhanced execution and strategic focus, particularly in semiconductor and technology convergence, which could improve operational efficiency and drive earnings.

- The strategic focus on GCC (Global Capability Centers) could unlock new business opportunities and revenue streams as Cyient aligns its business model to engage more robustly with these centers, supporting revenue growth and maintaining margin stability.

- With substantial cash reserves and plans for possible inorganic growth through mergers and acquisitions, Cyient is well-positioned to invest in technology and address portfolio gaps, potentially driving revenue expansion and enhancing profitability over the long term.

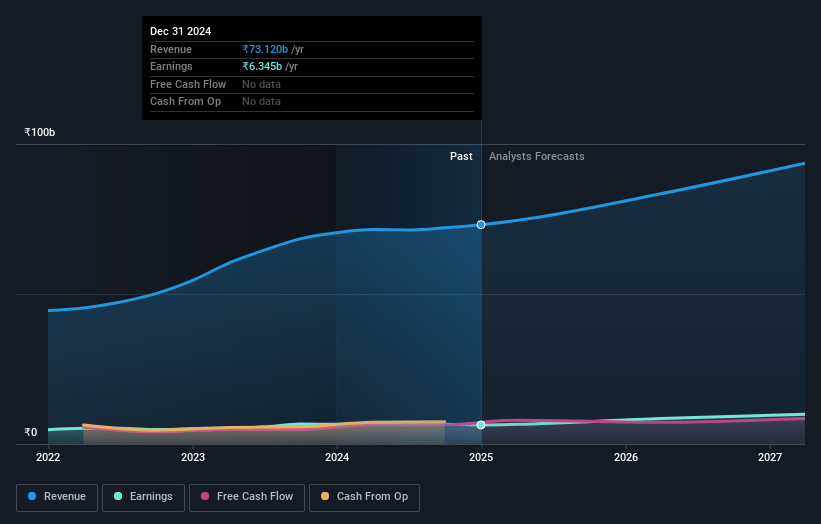

Cyient Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cyient's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 9.8% in 3 years time.

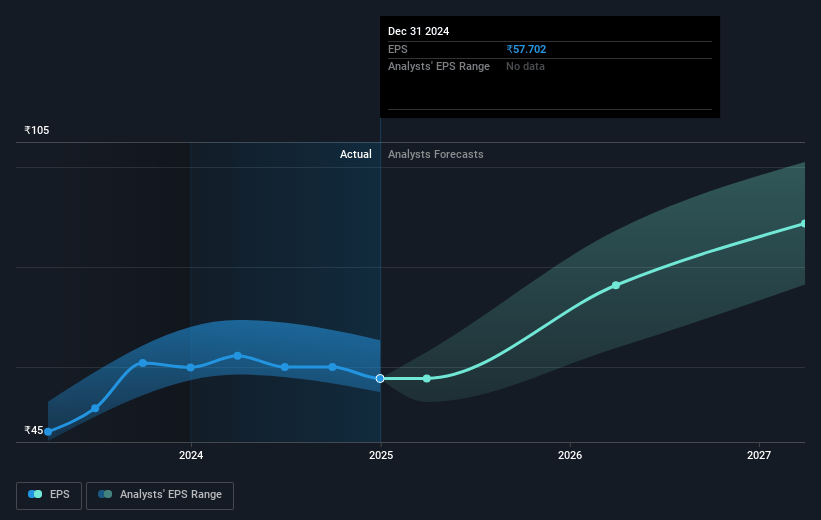

- Analysts expect earnings to reach ₹9.4 billion (and earnings per share of ₹84.11) by about July 2028, up from ₹6.2 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹11.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.1x on those 2028 earnings, up from 22.9x today. This future PE is lower than the current PE for the IN IT industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.5%, as per the Simply Wall St company report.

Cyient Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's decision to stop providing guidance due to the current macroeconomic environment indicates uncertainty, which may lead to difficulties in predicting future revenue and earnings.

- A decline in the connectivity and new growth areas suggests that the macroeconomic challenges could affect these segments, potentially impacting revenue and net margins.

- The softness in Q4 results and the expectation of a soft start to Q1 due to global uncertainties and delay in project execution might indicate potential risks to short-term earnings growth.

- With the aerospace vertical experiencing potential impacts from external factors like tariffs and declining travel demand, there is risk to revenue stability from key sectors.

- The focus on execution and potential need for changes in leadership/execution strategy highlights current operational challenges, which could affect net margins if not addressed quickly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1390.545 for Cyient based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2198.0, and the most bearish reporting a price target of just ₹1050.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹95.9 billion, earnings will come to ₹9.4 billion, and it would be trading on a PE ratio of 25.1x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹1280.0, the analyst price target of ₹1390.55 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.