Key Takeaways

- Investor optimism may overestimate revenue growth and margin expansion due to defense spending, early tech successes, and international interest, despite competitive and contract risks.

- Overvaluation risk remains high given early-stage recurring revenue streams, regulatory threats, evolving counter-drone tech, and intensifying global competition.

- Robust demand, strong R&D, expanding international presence, recurring revenue focus, and supportive policies position ideaForge for sustainable growth and premium market positioning.

Catalysts

About ideaForge Technology- Engages in the manufacture and marketing of unmanned aerial vehicle (UAV) systems for security and surveillance applications in India and internationally.

- The rapid acceleration of drone procurement and increased government focus on defense-indigenous solutions, evidenced by large emergency procurement budgets and cycles (such as the ₹9,000 crore allocation to the Indian Army and ongoing Make-II programs), may have driven investor expectations for sustained top-line growth, creating the perception of a robust addressable market and high revenue visibility.

- Heightened expectations for margin expansion may be linked to successful demonstrations of electronic warfare (EW) resilient platforms and AI-driven analytics-capabilities that set ideaForge apart in technical trials, but may not translate into sustainable pricing power or higher-margin contracts amid rising competitive intensity, potentially leading to margin disappointment.

- The company's progression into international markets-highlighted by early-stage adoption programs in the US and growing traction in Europe and Africa-could be overstating the near-term impact on revenue growth and diversification, given the uncertainty and slow pace of contract conversions in new geographies.

- Market optimism around recurring revenues from software and cloud analytics platforms (such as FLYGHT Cloud and Drone as a Service) may be factoring in a faster transition to high-margin, stable earnings than justified by current scale, as management notes these segments remain in early growth or proof-of-concept phases with limited near-term contribution to earnings.

- Despite increasing regulatory and government support, overvaluation risk may stem from underappreciated threats such as global regulatory crackdown, rapid developments in anti-drone and electronic countermeasure technologies, and intensifying competition from startups and defense majors-all of which pose risks to medium-term revenue growth, customer wins, and sustainable profitability.

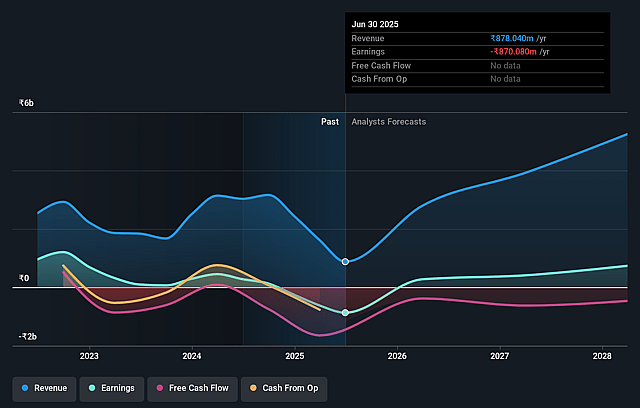

ideaForge Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ideaForge Technology's revenue will grow by 93.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -99.1% today to 15.6% in 3 years time.

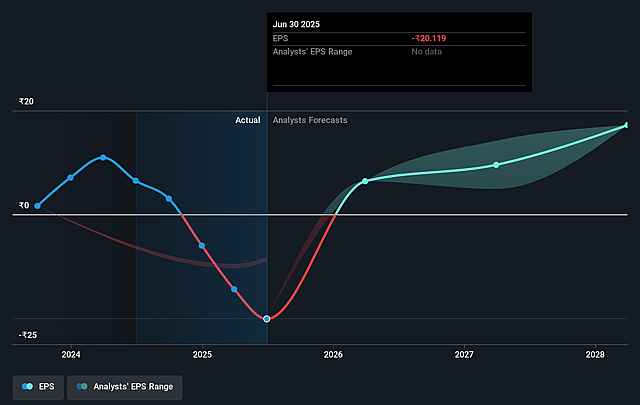

- Analysts expect earnings to reach ₹993.0 million (and earnings per share of ₹15.28) by about September 2028, up from ₹-870.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.3x on those 2028 earnings, up from -25.7x today. This future PE is lower than the current PE for the IN Aerospace & Defense industry at 55.0x.

- Analysts expect the number of shares outstanding to grow by 1.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.03%, as per the Simply Wall St company report.

ideaForge Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global and domestic demand for UAVs is expected to rise significantly in both defense and commercial sectors, as illustrated by India's recurring emergency procurement cycles, growing government budget allocations, and new application areas, which may drive robust top-line growth for ideaForge over several years.

- ideaForge continues to invest in R&D and proprietary IP (e.g., electronic warfare resilience, AI integrations, military-certification), giving it product differentiation and enabling premium pricing and margin improvements, with a strong track record of anticipating customer needs ahead of the market.

- Ongoing expansion into international markets (e.g., US Early Adopter Program, African border security demos, European interest/NATO) and collaborations with global and domestic players (e.g., HFCL) diversify ideaForge's revenue streams, reducing dependence on any single contract or geography and supporting sustained earnings growth.

- Development of recurring revenue streams through Drone as a Service and the FLYGHT Cloud analytics platform, coupled with active pilot customer engagements and software feature improvements, is positioned to boost earnings stability and higher-margin recurring EBITDA contributions over time.

- Government policy signals (including the ₹1 lakh crore innovation fund and expected PLI 2.0 for the drone industry), as well as regulatory momentum to accelerate drone adoption for smart infrastructure, disaster management, and agriculture, are likely to benefit leading indigenous deep-tech companies like ideaForge, increasing long-term revenue visibility and supporting multiple expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹385.5 for ideaForge Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹500.0, and the most bearish reporting a price target of just ₹271.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹6.3 billion, earnings will come to ₹993.0 million, and it would be trading on a PE ratio of 25.3x, assuming you use a discount rate of 14.0%.

- Given the current share price of ₹516.95, the analyst price target of ₹385.5 is 34.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.