Key Takeaways

- Large-scale government drone adoption and ideaForge's technological edge may deliver significant recurring revenue growth, unlocking premium pricing and high-value defense contracts.

- Ongoing innovation and global expansion in both hardware and software position ideaForge for a structurally expanding, diversified, and high-margin revenue base.

- ideaForge faces ongoing losses, concentrated customer risk in Indian defense, intense global competition, slow export growth, and potential margin pressures from evolving technology and regulatory shifts.

Catalysts

About ideaForge Technology- Engages in the manufacture and marketing of unmanned aerial vehicle (UAV) systems for security and surveillance applications in India and internationally.

- While analyst consensus is already positive on government acceleration of drone procurement, they may actually be underestimating the pace and scale of adoption; the imminent sixth emergency procurement cycle and substantial multi-year pipeline (~₹400 crore outside of emergency procurement, plus further unquantified EP opportunities) could drive a step-change in order flows and recurring revenues for ideaForge, materially boosting top-line growth and visibility.

- Analysts broadly agree that ideaForge's technical edge in electronic warfare-resilient and AI-integrated drones supports a strong margin profile, but given the company's proven ability to anticipate and pre-empt customer requirements, this leadership is increasingly likely to translate into premium pricing and greater share of high-value defense and government contracts, enabling faster and more sustainable gross margin expansion than expected.

- The company's R&D investments have yielded indigenous, differentiated platforms like Switch, ZOLT, and YETI, strategically positioning ideaForge to capture the compounding global demand for drones in both military and large-scale civilian domains such as infrastructure, mining, and precision agriculture, which underpins a structurally expanding revenue base.

- Deep and expanding engagement with U.S., European, and African markets-not just proof-of-concept deployments but live technical trials, early adopter programs, and strategic partnerships-suggests a coming inflection in export sales and customer diversification, with potential for significant non-linear upside in foreign earnings once regulatory and commercial milestones are achieved.

- Ongoing scale-up and commercialization of FLYGHT Cloud (analytics platform), Drone as a Service, and geospatial/data solutions-already showing early customer traction-will likely shift the revenue mix toward recurring, high-margin software and services, driving meaningful improvement in operating leverage, cash conversion, and overall return on capital in the medium

- to long-term.

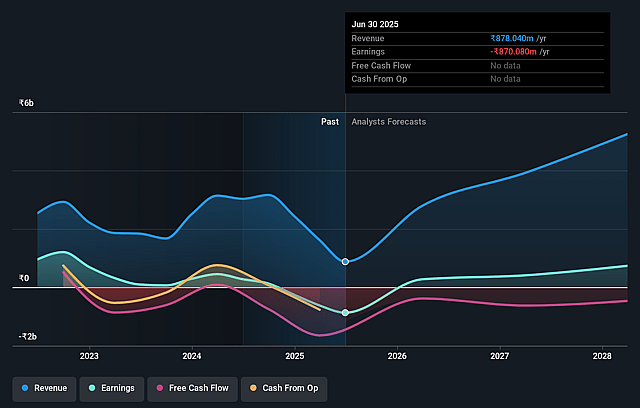

ideaForge Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ideaForge Technology compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ideaForge Technology's revenue will grow by 91.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -99.1% today to 15.9% in 3 years time.

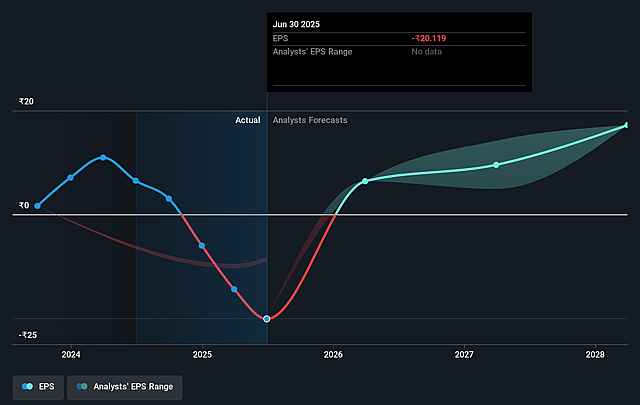

- The bullish analysts expect earnings to reach ₹984.0 million (and earnings per share of ₹22.96) by about September 2028, up from ₹-870.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 33.2x on those 2028 earnings, up from -24.7x today. This future PE is lower than the current PE for the IN Aerospace & Defense industry at 64.7x.

- Analysts expect the number of shares outstanding to grow by 1.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.06%, as per the Simply Wall St company report.

ideaForge Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's financials reveal ongoing losses at both EBITDA and net level across the past four quarters, and management would not commit to a clear timeline for a return to profitability, suggesting future earnings could remain under pressure if revenue does not scale rapidly.

- ideaForge is heavily reliant on Indian defense contracts, and any delays or reductions in government procurement-as seen during the prior year's industry slowdown-could result in unpredictable revenue cycles and heightened year-to-year volatility in revenues and earnings.

- Rapid technological advancements in drones globally, especially by international competitors and increased focus on swarming or autonomous drone technology, mean that ideaForge's current R&D pace might leave it vulnerable to falling behind, compressing margins and risking loss of market share, which would impact both top-line revenue and profitability.

- The company's international expansion is still at an early stage, with only limited traction in markets such as the US and Europe, so weak global presence could cap export revenue growth and expose ideaForge to incremental costs-potentially squeezing net margins if overseas expansion is pursued aggressively.

- Intensifying competition, both from global players with deeper R&D pockets and from low-cost Chinese manufacturers, along with possible changes in global regulatory or security environments, could compress industry-wide margins and shrink accessible markets, directly impacting future revenue expansion and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ideaForge Technology is ₹500.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ideaForge Technology's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹500.0, and the most bearish reporting a price target of just ₹271.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹6.2 billion, earnings will come to ₹984.0 million, and it would be trading on a PE ratio of 33.2x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹497.15, the bullish analyst price target of ₹500.0 is 0.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ideaForge Technology?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.