Key Takeaways

- Accelerating operating leverage and unique data advantages could drive stronger-than-expected margin and earnings improvements, outperforming current analyst projections.

- GoTo's integrated ecosystem, scale, and rising adoption in Southeast Asia position it for sustained growth, market leadership, and increased pricing power.

- Economic headwinds, integration challenges, competitive pressures, and rising regulatory compliance threaten GOTO's growth, margin expansion, and long-term financial stability.

Catalysts

About GoTo Gojek Tokopedia- Provides and operates on-demand services in Indonesia and internationally.

- Analyst consensus expects improved margins from premium users and AI-led cost reductions, but with demonstrated record adjusted EBITDA and net margin expansion even during seasonally weak quarters, GoTo could materially outperform expectations as operating leverage continues to accelerate, driving stronger-than-anticipated improvements to EBITDA and net income.

- Whereas analysts broadly agree GoTo's lending and FinTech growth are contingent on prudent risk management, the combination of rapid consumer adoption, ecosystem-level proprietary data for credit scoring, and a seamlessly integrated digital bank partnership could lead to outsized growth in lending revenue and significantly increase recurring high-margin income well ahead of consensus timelines.

- GoTo is uniquely positioned to capture the ongoing surge in digital and smartphone penetration across Indonesia and Southeast Asia, which could deliver compounding top-line revenue growth as new segments of the population transition rapidly to online payments, commerce, and services for the first time.

- The company's expanding role as a vital multifunctional digital platform for Indonesia's fast-growing urban middle class establishes GoTo as a core beneficiary of rising discretionary spending and transaction frequency, accelerating both gross merchandise value and cross-sell rates-leading to sustained double-digit annual revenue growth potential.

- GoTo's integrated logistics, payment, and data infrastructure, coupled with its scale and data advantages, creates a substantial barrier to entry that is increasingly likely to result in industry consolidation in the region; this could significantly boost long-term pricing power and structural margins, driving a step change in future earnings.

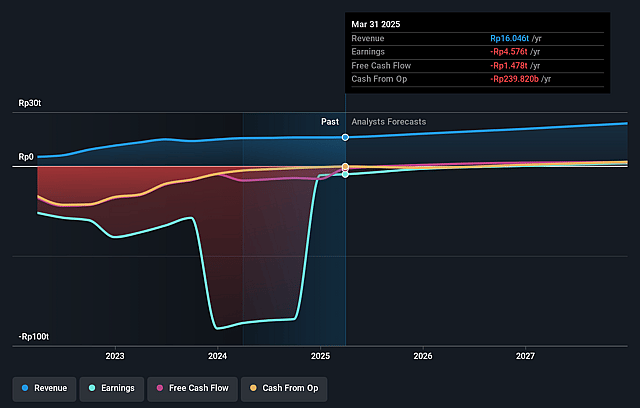

GoTo Gojek Tokopedia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GoTo Gojek Tokopedia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GoTo Gojek Tokopedia's revenue will grow by 20.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -28.5% today to 16.1% in 3 years time.

- The bullish analysts expect earnings to reach IDR 4522.7 billion (and earnings per share of IDR 3.76) by about July 2028, up from IDR -4576.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.8x on those 2028 earnings, up from -13.8x today. This future PE is greater than the current PE for the ID Multiline Retail industry at 11.1x.

- Analysts expect the number of shares outstanding to decline by 2.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.8%, as per the Simply Wall St company report.

GoTo Gojek Tokopedia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent economic uncertainty in Indonesia and broader Southeast Asia could constrain consumer spending and reduce demand for GOTO's digital services, resulting in slower growth for both revenue and core gross transaction value.

- GOTO's continued dependence on promotional spending and aggressive incentive programs to drive adoption exposes net margins and profitability to risk if customer behavior shifts or if competitor pricing strategies intensify.

- Delayed or unrealized synergies between the Gojek, Tokopedia, and GoTo Financial platforms, as well as complexities in fully integrating new services and AI capabilities, may impede operating margin expansion and sustainable improvement in earnings.

- Intensifying competition from regional and local super-apps and digital platforms threatens to compress take rates, raise customer acquisition costs, and erode GOTO's pricing power, ultimately putting pressure on both revenue and profit margins.

- Increased regulatory scrutiny and evolving compliance requirements in fintech, e-commerce, and on-demand services could drive up operational costs and restrict innovation, negatively affecting GOTO's long-term earnings potential and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GoTo Gojek Tokopedia is IDR129.19, which represents two standard deviations above the consensus price target of IDR98.4. This valuation is based on what can be assumed as the expectations of GoTo Gojek Tokopedia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR140.0, and the most bearish reporting a price target of just IDR73.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be IDR28116.8 billion, earnings will come to IDR4522.7 billion, and it would be trading on a PE ratio of 42.8x, assuming you use a discount rate of 14.8%.

- Given the current share price of IDR60.0, the bullish analyst price target of IDR129.19 is 53.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives