Key Takeaways

- Intensifying competition and regulatory uncertainty may hinder GoTo's ability to convert digital economy tailwinds into sustained revenue and earnings growth.

- Cost discipline and operational efficiency challenges, alongside credit and integration risks, could limit margin improvements despite ongoing investments and user growth.

- Rising competition, macroeconomic challenges, unclear profitability, reliance on ecosystem synergies, and regulatory risks threaten future growth and margin expansion.

Catalysts

About GoTo Gojek Tokopedia- Provides and operates on-demand services in Indonesia and internationally.

- Although GoTo continues to benefit from Indonesia's vast underpenetrated digital economy and rising digital payment adoption, the intensifying competition from global and regional players like Grab, Shopee, and TikTok raises the risk that these addressable market tailwinds may not fully translate into increased revenue or market share for GoTo over time, especially if competitors offer more compelling integrations or incentives.

- While GoTo's ongoing investments in technology infrastructure, such as the recent cloud migration and in-country AI development, should lead to lower unit costs and better operating leverage, there remains a significant challenge in sustaining cost discipline as the company balances innovation, speed, and product rollouts against high ongoing capex and engineering expenses required to maintain differentiation-potentially limiting future margin improvement.

- Despite strong gains in FinTech user growth and loan book expansion, with monthly transacting users up 29% year-on-year and loans outstanding nearly doubling, this rapid growth exposes GoTo to heightened credit risk and portfolio quality deterioration if macroeconomic headwinds in Indonesia persist or worsen, which could impact both revenue growth and net margins if delinquency rates rise.

- Although ecosystem synergies and cross-platform engagement are expected to reduce acquisition costs and increase transaction frequency, challenges remain in realizing full integration benefits and operational efficiencies across business units, especially if consumer preferences change or cross-ecosystem engagement plateaus, which would constrain gross margin improvements and overall earnings growth.

- While secular drivers such as urbanization and a growing middle class should underpin long-term growth in e-commerce and on-demand services, regional regulatory uncertainty-including data privacy rules, increasing digital fees, or protectionist policies-could raise compliance costs and delay GoTo's timeline for achieving healthy net income, regardless of continued topline expansion.

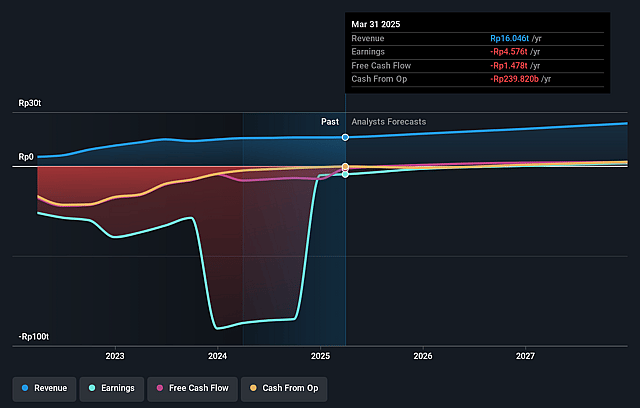

GoTo Gojek Tokopedia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GoTo Gojek Tokopedia compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GoTo Gojek Tokopedia's revenue will grow by 11.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -18.2% today to 4.3% in 3 years time.

- The bearish analysts expect earnings to reach IDR 987.6 billion (and earnings per share of IDR 0.83) by about September 2028, up from IDR -3035.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 108.9x on those 2028 earnings, up from -19.5x today. This future PE is greater than the current PE for the ID Multiline Retail industry at 10.1x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.94%, as per the Simply Wall St company report.

GoTo Gojek Tokopedia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in Indonesia's on-demand and digital payments space from major players like Grab, Shopee/Sea Limited, and TikTok Shop threatens to erode GoTo's market share and could compress future revenue growth.

- Persistent macroeconomic headwinds such as weakening consumer confidence, tightening discretionary spending, and a softening retail environment in Indonesia may limit acceleration in GoTo's gross transaction value and net revenues over the long term.

- Although the company shows positive adjusted EBITDA, concerns remain around its lack of sustainable net profitability, as reliance on noncash adjustments and the impact of Tokopedia results could obscure true underlying earnings potential.

- Ongoing dependence on ecosystem synergies and cross-platform integration poses risk if execution falters or if consumer preferences shift to more specialized competitors, potentially stalling monetization and revenue scalability.

- Regulatory headwinds, especially around data sovereignty, digital payments, and lending operations, may necessitate costly compliance investments, impacting net margins and earnings as the company expands its FinTech and ecosystem partnerships.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GoTo Gojek Tokopedia is IDR70.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GoTo Gojek Tokopedia's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR140.0, and the most bearish reporting a price target of just IDR70.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be IDR22949.3 billion, earnings will come to IDR987.6 billion, and it would be trading on a PE ratio of 108.9x, assuming you use a discount rate of 14.9%.

- Given the current share price of IDR56.0, the bearish analyst price target of IDR70.0 is 20.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.