Last Update 05 Dec 25

Fair value Decreased 0.43%GOTO: Golden Share Merger Structure Will Drive Future Market Dominance

Analysts have made a marginal downward revision to their price target on GoTo Gojek Tokopedia, trimming fair value to the equivalent of approximately $91.81 from $92.20. This reflects slightly lower profit margin expectations that more than offset modestly higher projected revenue growth and a marginally lower discount rate.

What's in the News

- Indonesia is discussing a potential merger or acquisition between Grab and GoTo Gojek, which together could control over 91 percent of the local market if combined (Reuters).

- Grab and GoTo are in talks to offer Indonesia's sovereign wealth fund, Danantara, a golden share with special rights over Indonesian operations to help secure approval for a possible 29 billion dollar merger (Financial Times).

- GoTo announced that chief executive officer Patrick Walujo will step down after two and a half years, with chief operating officer Hans Patuwo nominated as his successor, pending approval at an extraordinary shareholders meeting on December 17, 2025 (company announcement).

- GoTo will hold a special or extraordinary shareholders meeting on December 17, 2025, in Jakarta. Key items are expected to include leadership transition and governance matters linked to its profitability push (company filing).

Valuation Changes

- Fair Value: reduced slightly to the equivalent of approximately 91.81 dollars from 92.20 dollars, reflecting a marginally less optimistic outlook.

- Discount Rate: edged down modestly to about 14.75 percent from 14.78 percent, indicating a slightly lower perceived risk profile.

- Revenue Growth: revised up slightly to around 17.78 percent from 17.75 percent, signaling a marginally stronger top line outlook.

- Net Profit Margin: trimmed marginally to roughly 12.21 percent from 12.23 percent, pointing to slightly weaker profitability assumptions.

- Future P/E: eased slightly to about 42.26 times from 42.44 times, suggesting a small downward adjustment in the valuation multiple.

Key Takeaways

- Digital adoption, urbanization, and a growing middle class are expanding GoTo's user base, fueling increased demand and supporting revenue growth across its ecosystem.

- Tech investments and platform integration are boosting efficiency and engagement, enhancing profitability and unlocking new high-margin fintech revenue streams.

- Intensifying competition, macroeconomic challenges, and ecosystem concentration risks threaten revenue growth, profitability, and long-term earnings stability across GoTo's core business segments.

Catalysts

About GoTo Gojek Tokopedia- Provides and operates on-demand services in Indonesia and internationally.

- The rapid shift of Indonesia's vast and underpenetrated population toward digital platforms-driven by greater smartphone penetration, rising digital payment adoption, and expanding digital infrastructure-is expected to significantly grow GoTo's user base, transaction volumes, and average order values, providing long-term tailwinds for revenue and gross merchandise volume (GMV) expansion.

- A large, young, and increasingly affluent middle class in Indonesia is fueling higher discretionary spending, which, combined with continued urbanization, should bolster demand for on-demand and financial services within GoTo's super-app ecosystem, positively impacting topline revenue and supporting higher GMV per user.

- GoTo's strategic investments in proprietary AI models, tech talent, and cloud infrastructure are driving significant improvements in operational efficiency and user experience, resulting in lower unit costs, faster innovation cycles, and material reductions in cloud expenditures-supporting both margin expansion and sustainable EBITDA growth.

- The ongoing integration of Gojek's mobility/fintech and Tokopedia's e-commerce platforms is unlocking cross-selling opportunities (e.g., more seamless lending and payment products across apps), which is expected to raise customer retention, drive higher engagement, and increase revenue per user at minimal additional acquisition cost, thereby enhancing profitability.

- Rapid scaling of GoPay and GoTo Financial's recurring fintech revenue streams-including lending, insurance, and QR-code payments-offers new high-margin business lines, and partnerships with major regional players (TikTok, Telkomsel) are set to further expand distribution and user engagement, improving overall net margins and earnings quality going forward.

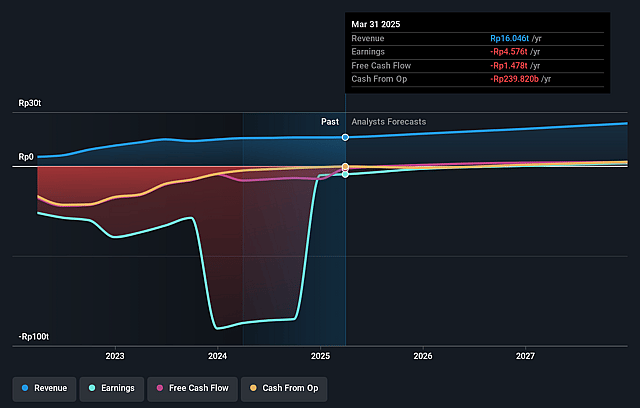

GoTo Gojek Tokopedia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GoTo Gojek Tokopedia's revenue will grow by 17.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -18.2% today to 11.0% in 3 years time.

- Analysts expect earnings to reach IDR 2958.7 billion (and earnings per share of IDR 2.85) by about September 2028, up from IDR -3035.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting IDR3337.3 billion in earnings, and the most bearish expecting IDR690.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.0x on those 2028 earnings, up from -20.2x today. This future PE is greater than the current PE for the ID Multiline Retail industry at 10.7x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.92%, as per the Simply Wall St company report.

GoTo Gojek Tokopedia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently slowing consumer confidence and retail sales growth in Indonesia, as acknowledged by management, may limit top-line expansion in On-Demand Services and e-commerce, constraining revenue growth prospects despite a long runway for digital adoption.

- Intensified competition-particularly in mobility and delivery-from regional rivals is already leading to targeted responses and near-term margin pressures; continued escalation may require heavier investment in discounts and subsidies, reducing net margins and threatening long-term earnings stability.

- The company's heavy reliance on ecosystem expansion and cross-selling within GoPay, Gojek, and Tokopedia brings concentration risk; any plateau in user growth or fragmentation of digital ecosystems in Indonesia could erode customer retention and reduce transaction volumes, affecting recurring revenues.

- Sustained profitability at the net income level remains unproven, with ongoing adjustments needed for share-based compensation and deconsolidation effects; inability to convert adjusted EBITDA improvements to actual net profits could undermine investor confidence and compress valuation multiples.

- Increased macroeconomic volatility and potential external shocks-including rising interest rates or regulatory tightening-could dampen loan growth quality or increase credit risks in the FinTech segment, resulting in higher NPLs and credit losses, directly impacting net earnings and balance sheet resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of IDR96.32 for GoTo Gojek Tokopedia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR140.0, and the most bearish reporting a price target of just IDR70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be IDR26949.5 billion, earnings will come to IDR2958.7 billion, and it would be trading on a PE ratio of 50.0x, assuming you use a discount rate of 14.9%.

- Given the current share price of IDR58.0, the analyst price target of IDR96.32 is 39.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on GoTo Gojek Tokopedia?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.