Key Takeaways

- Exposure to energy transition risks and renewables growth threatens Medco's long-term fossil fuel demand, reserve stability, and future earnings sustainability.

- High leverage, refinancing dependence, and market volatility may increase funding costs and limit growth opportunities as ESG expectations rise.

- Reliance on declining fossil fuel reserves, regulatory risks, and high leverage all threaten profitability, especially amid global decarbonization and volatile oil and gas markets.

Catalysts

About Medco Energi Internasional- Explores for and produces oil and gas in Indonesia, Asia, Africa, the Middle East, the United States of America, and Europe.

- While Medco Energi stands to benefit from rising energy demand in Southeast Asia and secured long-term gas sales agreements that provide resilient cash flows, the company could struggle to sustain earnings growth as accelerating global decarbonization efforts and a shift towards renewables start to erode long-term fossil fuel demand, pressuring future revenues.

- Although ongoing investment in gas assets and the ramp-up of newly acquired, high-margin fields like Corridor and Natuna are set to drive immediate production and operating cash flow growth, prolonged exposure to declining oil fields and uncertainties surrounding production-sharing contract extensions may lead to reserve depletion risks, negatively impacting revenue stability and future earnings.

- Despite strong recent operational execution, cost efficiencies, and solid reserve replacement ratios, Medco remains vulnerable to the long-cycle, capital-intensive nature of oil and gas projects-raising the possibility of stranded assets and underperforming investments as energy transition accelerates and electrification reduces hydrocarbon consumption, ultimately constraining future net margins.

- While Medco is making tangible progress in climate action, renewables expansion, and ESG ratings improvement, rising investor preference for ESG-compliant assets globally may still increase the cost of capital and limit access to future financing, posing a threat to funding both organic growth and acquisition initiatives, which could dampen future earnings growth.

- Even as new strategic acquisitions and expansion projects provide a near-term uplift to production and EBITDA, high leverage levels, reliance on refinancing, and exposure to fluctuating oil and gas prices leave Medco exposed to credit tightening and interest rate hikes, which may elevate interest expense and compress net profit over time.

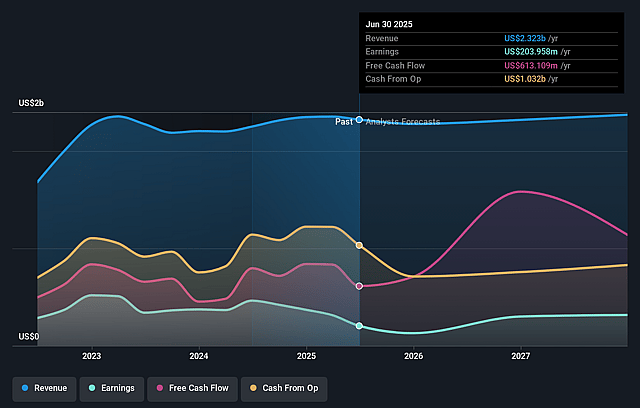

Medco Energi Internasional Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Medco Energi Internasional compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Medco Energi Internasional's revenue will decrease by 5.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.8% today to 11.1% in 3 years time.

- The bearish analysts expect earnings to reach $214.5 million (and earnings per share of $0.01) by about August 2028, up from $204.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, up from 9.2x today. This future PE is greater than the current PE for the ID Oil and Gas industry at 10.8x.

- Analysts expect the number of shares outstanding to decline by 1.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.18%, as per the Simply Wall St company report.

Medco Energi Internasional Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on oil and gas production exposes it to ongoing global decarbonization trends and potential long-term reductions in fossil fuel demand, which could materially erode future revenues and cash flows as governments and energy buyers shift to lower-carbon alternatives.

- Despite recent acquisitions and production ramp-ups, a significant portion of Medco's reserves are in fields experiencing natural decline, such as Corridor and Natuna, raising concerns about reserve depletion and the risk that production volumes and earnings may structurally decline over the next decade if reserve replacement efforts fall short.

- Exposure to Indonesia and Southeast Asia subjects Medco to substantial political and regulatory risks, including possible increases in royalty rates, taxes, and changes to production sharing contract (PSC) terms, which could compress net margins and reduce overall profitability.

- The company's elevated leverage from acquisition-driven growth (with substantial new debt at floating rates and repayment targets tied to operational performance) increases vulnerability to interest rate hikes or tightening credit, risking higher interest expense and pressure on net income during periods of financial stress or commodity price downturns.

- Volatile oil and gas prices, as evidenced by a recent drop in Brent and the company's own year-on-year EBITDA and net income declines, demonstrate that Medco's earnings remain sensitive to commodity cycles and market shocks, challenging the stability and predictability of both revenue and shareholder returns over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Medco Energi Internasional is IDR1305.56, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Medco Energi Internasional's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR2159.81, and the most bearish reporting a price target of just IDR1305.56.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $214.5 million, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 17.2%.

- Given the current share price of IDR1240.0, the bearish analyst price target of IDR1305.56 is 5.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.