Key Takeaways

- Recent acquisitions and contract upgrades secure stable cash flow, while operational improvements and asset integration support further cost reduction and earnings upside.

- Accelerated renewable expansion and strong public-private partnerships position the company for margin growth and sustained market leadership amid rising domestic energy demand.

- Structural industry shifts, high leverage, asset maturity, commodity price volatility, and slow renewables expansion collectively threaten long-term earnings stability and revenue diversification.

Catalysts

About Medco Energi Internasional- Explores for and produces oil and gas in Indonesia, Asia, Africa, the Middle East, the United States of America, and Europe.

- Analysts broadly agree the Corridor acquisition will lift production and cash flow, but this is likely understated as Corridor's long-term fixed gas contracts, recent reserve upgrade, and new development drilling combine to deliver not only immediate EBITDA gains but lock in multiyear visible earnings-positioning Medco to outperform on revenue stability and upside.

- Analyst consensus sees renewables expansion gradually offsetting conventional margin volatility, but with Medco having exceeded its own renewable capacity targets ahead of schedule and benefitting from strong government partnerships and visibility on further solar/geothermal expansion, there is potential for surging high-margin power sales and step-changes in consolidated net margins as regulatory and ESG-driven capital flows intensify.

- Indonesia's decade-plus surge in energy demand, fueled further by energy security needs and regional policy support, all but ensures Medco's production ramp and growing domestic gas-market exposure will translate into runaway revenue growth and improved contracts, creating longevity to earnings and market share that investors have yet to fully price in.

- Medco's consistent track record of reserve replacement above 160 percent, low finding and development costs, and ability to extend PSCs well past current terms indicate years of sustainable production and minimal decline risk, setting the stage for compounding free cash flow and dividend upside.

- Digitalization initiatives and operational best-practice rollouts, alongside the integration of newly acquired and upgraded assets, are set to unlock further cost reductions and asset utilization gains not yet visible in consensus forecasts, positioning net income and ROE to surprise to the upside.

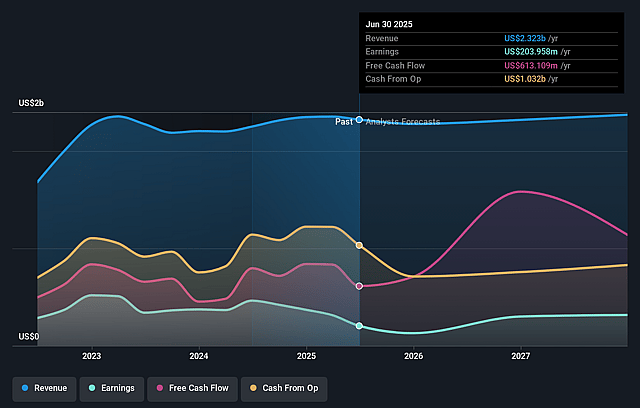

Medco Energi Internasional Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Medco Energi Internasional compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Medco Energi Internasional's revenue will grow by 5.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.8% today to 21.5% in 3 years time.

- The bullish analysts expect earnings to reach $589.2 million (and earnings per share of $0.02) by about September 2028, up from $204.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 9.0x today. This future PE is lower than the current PE for the ID Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 1.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.57%, as per the Simply Wall St company report.

Medco Energi Internasional Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing global transition to renewable energy, intensifying net-zero commitments, and rising ESG-related pressures may lead to structural declines in long-term demand for fossil fuels, which could erode Medco Energi's market share and reduce future revenues and profitability.

- High leverage resulting from recent acquisitions like the Corridor PSC, combined with a substantial portion of new debt at floating interest rates, exposes the company to financing cost inflation and refinancing risk, which is likely to weigh on net margins and constrain earnings growth.

- A significant portion of Medco's core oil and gas assets are mature and experiencing natural production declines, necessitating sustained high levels of capital expenditure merely to maintain output, which can diminish free cash flow and ultimately threaten long-term revenue stability.

- The company's exposure to volatile commodity prices-evident in the recent drop in Brent and resultant revenue softness-means that Medco's earnings and top-line are highly sensitive to prolonged periods of low oil and gas prices, particularly for the 52 percent of production not under fixed-price contracts.

- Despite progress, Medco's renewables segment remains small relative to its hydrocarbon portfolio; execution risk and possible delays or cost overruns in expanding renewables could result in less revenue diversification and challenge the company's ability to offset declining oil and gas earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Medco Energi Internasional is IDR2159.81, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Medco Energi Internasional's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR2159.81, and the most bearish reporting a price target of just IDR1305.56.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $589.2 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 17.6%.

- Given the current share price of IDR1230.0, the bullish analyst price target of IDR2159.81 is 43.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.