Key Takeaways

- Expanded gas assets, operational efficiency, and reserve growth support stable cash flow, margin strength, and position Medco to benefit from rising regional energy demand.

- Investment in renewables and disciplined capital management enhance ESG credentials, earnings resilience, and set the stage for future acquisitions and valuation gains.

- Exposure to energy transition, acquisition-driven leverage, declining assets, commodity price volatility, and shifting investor preferences threaten revenue stability, funding access, and long-term growth prospects.

Catalysts

About Medco Energi Internasional- Explores for and produces oil and gas in Indonesia, Asia, Africa, the Middle East, the United States of America, and Europe.

- The recent acquisition increasing Medco's Corridor PSC ownership from 46% to 70% significantly strengthens its natural gas portfolio with stable, long-term fixed price contracts (80% of Corridor gas sales), supporting predictable, recurring cash flow and reducing exposure to commodity price swings-directly benefitting revenue stability and EBITDA margins as gas demand in Southeast Asia grows.

- Ongoing production ramp-ups from new fields (Forel, Terubuk), asset optimization, and successful reserve replacement (10.7-year reserve life, 163% 5-year average reserve replacement ratio) position Medco to capitalize on rising regional energy consumption, supporting top-line growth and sustained free cash flow generation.

- Accelerated expansion in renewables, including commercial operations at Ijen Geothermal and East Bali Solar PV and an expanding pipeline (e.g., Phase 2 Ijen, ELB Batam add-on), is boosting Medco's ESG credentials and diversifying revenue streams, making the company well-placed as decarbonization drives future energy policy-likely improving long-term earnings quality and market valuation.

- Continued disciplined operational efficiency and cost control (sub-$10/BOE cash costs, unchanged CapEx guidance despite growing scale and acquisitions) bolster net margins and strengthen Medco's ability to self-fund growth projects-even in a volatile pricing environment-leading to stronger earnings resilience and attractive shareholder returns.

- Enhanced capital management (refinancing, debt maturities extended, proactive buybacks, maintained dividend payouts) demonstrates management's confidence in future growth, with a flexible balance sheet that can support additional strategic acquisitions as regional LNG demand rises, suggesting potential upside to future earnings and valuation multiples.

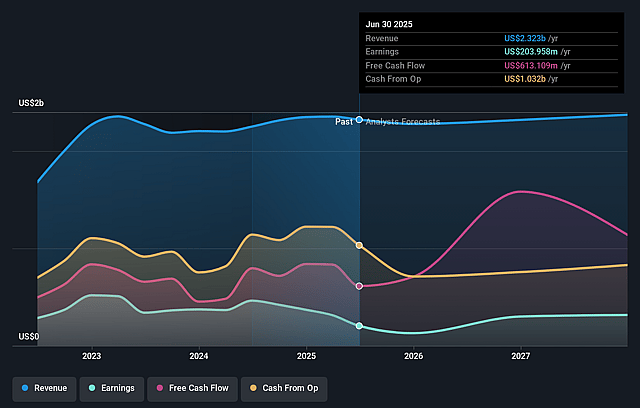

Medco Energi Internasional Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Medco Energi Internasional's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.8% today to 16.2% in 3 years time.

- Analysts expect earnings to reach $383.7 million (and earnings per share of $0.01) by about August 2028, up from $204.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $509 million in earnings, and the most bearish expecting $187.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, up from 9.2x today. This future PE is lower than the current PE for the ID Oil and Gas industry at 10.8x.

- Analysts expect the number of shares outstanding to decline by 1.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.18%, as per the Simply Wall St company report.

Medco Energi Internasional Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural decline risks remain from the global transition away from fossil fuels, with advances in renewables and battery technology along with increasingly stringent decarbonization and carbon taxation policies. These could erode long-term oil and gas demand and result in sustained pressure on Medco's revenues and net margins.

- Medco's approach to growth through significant acquisitions (e.g., Corridor PSC using 66% new debt) raises exposure to interest rate risk and refinancing risk, especially as a temporary rise in net debt/EBITDA is expected; this could negatively impact net income and constrain financial flexibility if commodity prices fall or rates rise further.

- The company's core oil and gas assets are experiencing natural production declines (e.g., Corridor and overall 7% YoY production drop), with near-term production increases reliant on project ramp-ups, successful PSC extensions, and sustained reserve replacement-a risk to revenue stability and capital expenditure efficiency if these initiatives under-deliver or face delays.

- With 52% of production (including a material portion of gas exports) exposed to volatile, market-indexed prices, Medco's earnings remain sensitive to global oil price downturns and potential supply gluts, which could increase revenue and EBITDA volatility.

- Growing investor and lender preference for low-carbon assets could increase Medco's long-term funding costs and limit access to capital, potentially affecting its ability to refinance debt on favorable terms, fund future M&A, or deliver shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of IDR1717.856 for Medco Energi Internasional based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR2159.81, and the most bearish reporting a price target of just IDR1305.56.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $383.7 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 17.2%.

- Given the current share price of IDR1240.0, the analyst price target of IDR1717.86 is 27.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.