Key Takeaways

- Geopolitical tensions and structural demand decline threaten overseas growth and increase dependence on the Chinese market, limiting long-term revenue expansion.

- Margin pressures mount from commoditization, OEM vertical integration, high R&D outlays, and tighter ESG regulations, challenging profitability and free cash flow sustainability.

- Diversification into automotive and XR, technological leadership, and operational efficiency are driving sustainable margin expansion, reducing smartphone reliance, and supporting long-term profitability and growth.

Catalysts

About Sunny Optical Technology (Group)- An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

- Intensifying technology decoupling and growing geopolitical tensions between China and the United States are likely to restrict access to key overseas markets for Sunny Optical, resulting in stagnant or even shrinking export revenues and increasing revenue concentration risk in the domestic Chinese market over the long term. This could put sustained pressure on total revenue growth and operational resilience.

- The maturing smartphone market and plateauing global handset penetration mean the company's core business is facing significantly weaker structural demand, and even as it pivots to higher-end modules, unit shipment numbers are already declining. This trend will ultimately limit addressable market expansion and permanently constrain long-term top-line revenue growth.

- Increased vertical integration and in-house production by major OEM customers, as well as industry-wide commoditization of lens sets and modules, are poised to erode Sunny Optical's pricing power and accelerate average selling price declines, leading to ongoing gross margin compression and reduced net earnings potential as manufacturing becomes less differentiated.

- Massive and ongoing R&D investments into AR/VR optical technologies, LiDAR, and Waveguide solutions have yet to yield clear, scalable commercial wins; delays in new product commercialization combined with uncertain returns raise the risk that incremental expenditures will not translate into revenue or margin expansion, placing persistent downward pressure on free cash flow and long-term profitability.

- Increased regulatory scrutiny and tightening global ESG standards will drive up compliance, supply chain, and operational costs, making it more difficult to maintain historical net margin and profit levels, especially as Sunny Optical's exposure to carbon-intensive and heavily regulated markets continues to grow.

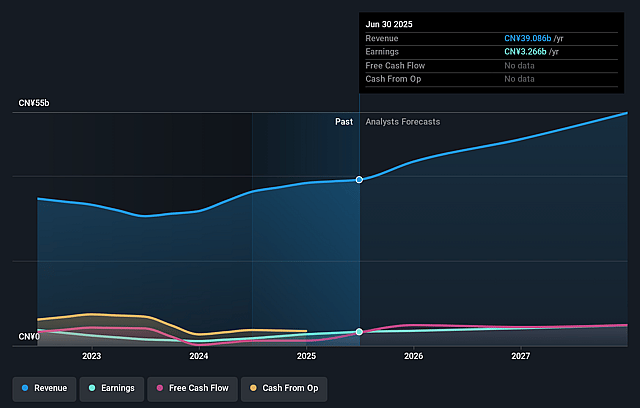

Sunny Optical Technology (Group) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sunny Optical Technology (Group) compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sunny Optical Technology (Group)'s revenue will grow by 9.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 8.4% today to 7.8% in 3 years time.

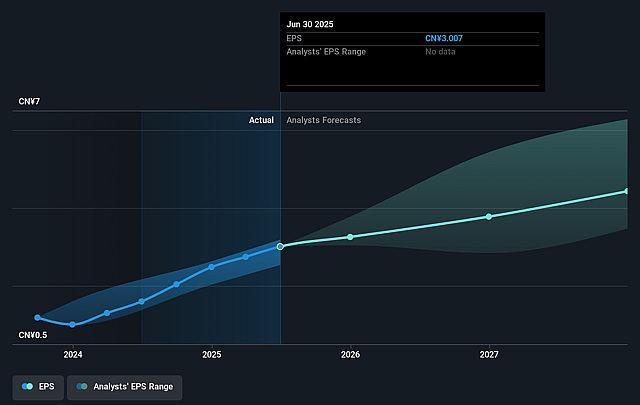

- The bearish analysts expect earnings to reach CN¥4.0 billion (and earnings per share of CN¥3.67) by about September 2028, up from CN¥3.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, down from 24.7x today. This future PE is greater than the current PE for the HK Electronic industry at 12.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Sunny Optical Technology (Group) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing strong long-term growth in high-margin and high-end product segments, including handset lens sets and hybrid lens sets, and explicitly guides to increased gross profit margins (exceeding 25 percent and aiming for 30 percent in handset lenses), which suggests durable margin expansion and earnings growth rather than compression.

- Sunny Optical is rapidly diversifying beyond mobile phones into high-growth markets such as automotive (including ADAS cameras and LiDAR) and XR/AR/VR, with vehicle and XR business revenues both growing over 18 percent and 21 percent respectively and leadership in technological innovation, which could drive sustained revenue growth and reduce dependence on smartphones.

- The company has established clear leadership in core and emerging technologies such as ultra-miniaturized molding, periscope cameras, LiDAR modules, and AI-enabled smart glasses, positioning itself to capture future market demand and maintain premium pricing, which is likely to support net margin resilience.

- Sunny Optical is leveraging vertical integration, organizational optimization, and manufacturing automation with artificial intelligence integration to enhance process yield, production efficiency, and cost controls, which are expected to structurally improve profitability and cash flow over the long term.

- The secular trends of the proliferation of connected devices, AI-driven computer vision, IoT, robotics, and smart automotive technology all support rising content per device and expanding addressable markets for Sunny Optical, which together indicate a significant runway for top-line growth well beyond current headwinds in smartphone shipments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sunny Optical Technology (Group) is HK$68.46, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sunny Optical Technology (Group)'s future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$163.8, and the most bearish reporting a price target of just HK$68.46.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥51.4 billion, earnings will come to CN¥4.0 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 8.7%.

- Given the current share price of HK$81.3, the bearish analyst price target of HK$68.46 is 18.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.