Key Takeaways

- Sunny Optical's leadership in LiDAR, vision tech, and vertically-integrated AI capabilities positions it as a dominant force in automotive, XR, and smart hardware sectors.

- Strategic moves into AI manufacturing and turnkey solutions boost margins and operational efficiency, giving the company a durable competitive and profitability advantage.

- Heavy reliance on a few key clients and saturated markets, combined with high R&D spending, intense price competition, and geopolitical risks, threatens profitability and stable growth.

Catalysts

About Sunny Optical Technology (Group)- An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

- Analyst consensus highlights solid revenue growth potential in automotive and XR, but this still underestimates the impact of Sunny Optical's deep tech leadership in LiDAR and vision tech, as the company is primed to become the unchallenged supplier as autonomous driving and smart vehicle adoption accelerates globally, which could push both revenue and margin expansion well above current expectations.

- Analysts broadly agree that AI-enabled XR and smart glasses can drive material growth, but they are likely understating the full runway-Sunny's vertically-integrated capabilities across component, devices, and algorithms position it to dominate a rapidly scaling AI hardware cycle and to capture a disproportionate share of industry profits as AR/VR device shipments surge over the coming decade and ASPs climb.

- The explosion of IoT and smart hardware is catalyzing a new revenue stream for Sunny Optical via generational upgrades in machine vision for robotics, smart home, and wearables, with the company's recent foray into turnkey system and control solutions creating new, higher-margin addressable markets that will underpin both top-line and bottom-line acceleration.

- Sunny Optical's pioneering integration of AI into manufacturing and R&D is turbocharging output quality, yield, and production agility, setting a new global standard for gross margin improvement and sustaining a long-term edge in capital efficiency and net profitability that competitors will struggle to match.

- The global ramp of advanced 5G and the forthcoming 6G era will drive an industry-wide leap in camera and sensor content per device for smartphones, AR/VR, and automotive, where Sunny's pipeline of premium, high-complexity products ensures not only accelerating revenue but also a sustained lift in gross and net margins as product mixes shift ever further upscale.

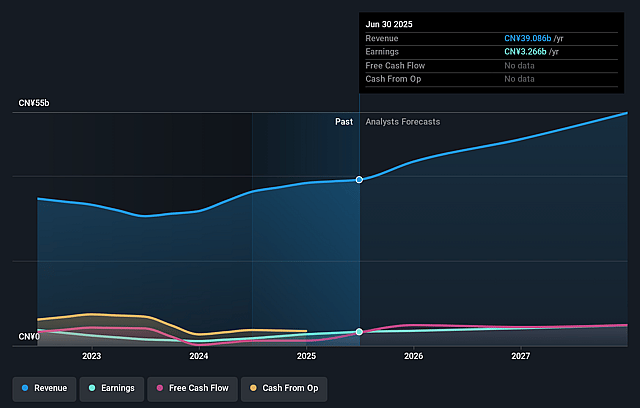

Sunny Optical Technology (Group) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sunny Optical Technology (Group) compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sunny Optical Technology (Group)'s revenue will grow by 22.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.4% today to 9.9% in 3 years time.

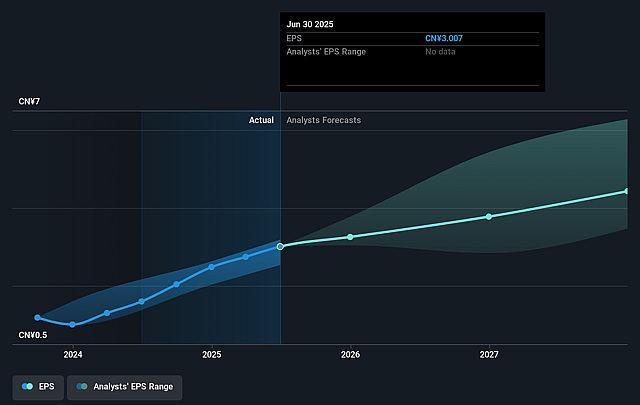

- The bullish analysts expect earnings to reach CN¥7.1 billion (and earnings per share of CN¥6.53) by about September 2028, up from CN¥3.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.8x on those 2028 earnings, down from 24.7x today. This future PE is greater than the current PE for the HK Electronic industry at 12.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Sunny Optical Technology (Group) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core mobile business remains highly exposed to the saturated smartphone market, with management themselves admitting global smartphone market growth will not increase in size, potentially capping future revenue growth from its largest segment.

- Sunny Optical's heavy emphasis on high-end clients and products-evidenced by leadership highlighting close relationships with a handful of major customers such as Apple and Meta-creates over-reliance on a small number of key accounts, increasing the risk of revenue volatility if any major customer shifts supplier or insources production.

- The management repeatedly stresses large investments in R&D and early-stage projects for AR/VR and LiDAR, but admits that many of these markets (such as AR glasses and microLED-based devices) face uncertain mass adoption timeframes and technological hurdles, raising the risk of mounting R&D costs outpacing near-term returns, which can compress net margins.

- Industry-wide price competition is indicated as intense, especially in overseas markets; leadership mentions that overseas business is "very competitive," and highlights the challenge of negotiating margins even with premium international clients, which could lead to lower gross margins as rivals pressure prices.

- Geopolitical tensions and shifting regulatory environments are acknowledged barriers-especially in discussions of flexible plans for overseas expansion in places like Vietnam-creating ongoing risk of higher compliance costs and disrupted global supply chains, which may pressure both revenue and company-wide net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sunny Optical Technology (Group) is HK$133.17, which represents two standard deviations above the consensus price target of HK$100.01. This valuation is based on what can be assumed as the expectations of Sunny Optical Technology (Group)'s future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$163.8, and the most bearish reporting a price target of just HK$68.46.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥72.2 billion, earnings will come to CN¥7.1 billion, and it would be trading on a PE ratio of 23.8x, assuming you use a discount rate of 8.7%.

- Given the current share price of HK$81.3, the bullish analyst price target of HK$133.17 is 38.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.