Last Update 27 Aug 25

Fair value Increased 4.07%The consensus price target for Sunny Optical Technology (Group) has been revised upward, reflecting improved investor sentiment driven by higher projected profitability and an increase in forward valuation multiples, with the fair value estimate rising from HK$96.07 to HK$99.68.

What's in the News

- Board meeting scheduled to review and approve the draft interim report and interim results announcement for the six months ended 30 June 2025, and to consider other business matters.

Valuation Changes

Summary of Valuation Changes for Sunny Optical Technology (Group)

- The Consensus Analyst Price Target has risen slightly from HK$96.07 to HK$99.68.

- The Future P/E for Sunny Optical Technology (Group) has risen from 23.93x to 25.43x.

- The Net Profit Margin for Sunny Optical Technology (Group) has risen from 9.06% to 9.62%.

Key Takeaways

- Growth in automotive, smartphone, and XR markets is boosting demand for advanced optical products, strengthening both market position and profit potential.

- Diversification into AI-enabled devices and process innovations are expanding revenue streams and improving operational efficiency, supporting long-term earnings growth.

- Stagnant mobile demand, uncertain XR adoption, high R&D costs, customer concentration, and geopolitical dependency pose growth, margin, and profitability risks for the company.

Catalysts

About Sunny Optical Technology (Group)- An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

- Accelerating adoption of advanced driver-assistance systems (ADAS), autonomous driving, and LiDAR in global automotive markets is driving rapid growth in Sunny Optical's automotive lens, module, and sensor segments; increasing both revenue and gross profit potential as premium content per vehicle rises and market share with overseas OEMs expands.

- Surging demand for sophisticated optical components in next-gen smartphones (main cameras, periscope/multi-element lenses) and XR devices (AR/VR smart glasses) is supporting higher average selling prices and profit margins, particularly as Sunny Optical's technological leadership in miniaturization and hybrid lens sets wins more business with leading global OEMs; this is expected to bolster revenue and margins despite handset market volume pressures.

- The proliferation of AI-powered IoT devices, robotics, and smart hardware beyond traditional consumer electronics is unlocking new high-growth verticals for Sunny Optical, diversifying revenue streams and expanding the addressable market, which is likely to support multi-year top-line growth.

- Continued investment in R&D, process automation, and AI-driven manufacturing is enabling Sunny Optical to sustain technical barriers, improve yields, and drive ongoing margin expansion-directly increasing future earnings and operational efficiency.

- The company's deepening collaborations with major global clients (including leading smartphone and automotive OEMs, and key names in AR/VR) enhance both revenue stability and order pipeline visibility, reducing customer concentration risk and underpinning longer-term revenue growth.

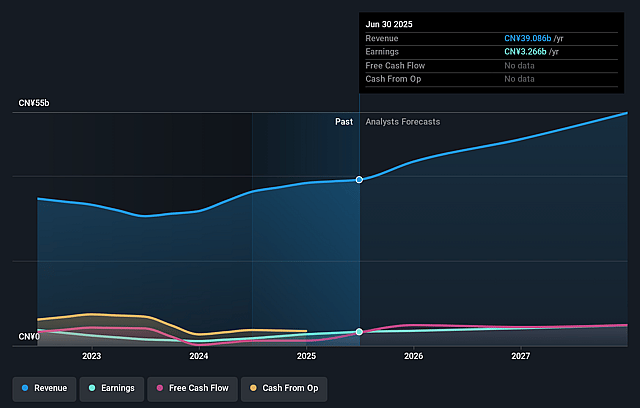

Sunny Optical Technology (Group) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sunny Optical Technology (Group)'s revenue will grow by 13.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 9.6% in 3 years time.

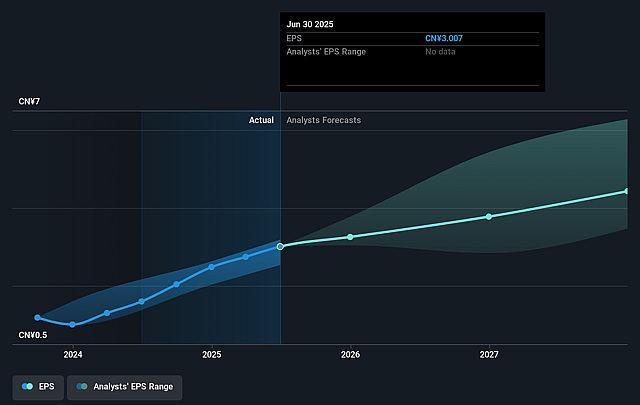

- Analysts expect earnings to reach CN¥5.4 billion (and earnings per share of CN¥5.0) by about September 2028, up from CN¥3.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥6.5 billion in earnings, and the most bearish expecting CN¥3.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.4x on those 2028 earnings, down from 24.0x today. This future PE is greater than the current PE for the HK Electronic industry at 12.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.59%, as per the Simply Wall St company report.

Sunny Optical Technology (Group) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management highlighted that global smartphone shipment volume is not expected to increase, with growth focused on premium models and higher-ASP camera modules, suggesting a risk of overall market saturation and potential stagnation in core mobile revenue long-term.

- The XR (AR/VR) and smart glasses segment, touted as a future growth driver, currently faces uncertain mass adoption timing, challenging supply chain dependencies (e.g., microLED), and no clear large-scale orders, which could weigh on near

- and medium-term revenue and return on investment.

- Increasing CAPEX and substantial R&D investments into emerging technologies (e.g., LiDAR, AR/VR waveguides) may not translate into proportional revenue, especially as key customers' deployment pace is slow or subject to abrupt adjustments-raising concerns over free cash flow and profitability.

- Competitive pricing pressures in overseas automotive and AR/VR end-markets, combined with the company's reliance on a handful of major customers for high-end modules, create gross margin risk and revenue concentration, especially if customer procurement strategies or market share shifts.

- The company's manufacturing relies heavily on China, and its planned (but flexible) overseas expansion is sensitive to international geopolitical developments, export controls, and localized customer preferences, exposing long-term overseas revenue and profit growth to external shocks and regulatory risks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$99.98 for Sunny Optical Technology (Group) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$163.75, and the most bearish reporting a price target of just HK$68.44.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥56.6 billion, earnings will come to CN¥5.4 billion, and it would be trading on a PE ratio of 23.4x, assuming you use a discount rate of 8.6%.

- Given the current share price of HK$78.8, the analyst price target of HK$99.98 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.