Key Takeaways

- Rapid global adoption of in-cabin monitoring systems, driven by regulatory and safety requirements, will unlock much larger markets and accelerate recurring, high-margin revenue streams.

- Unique technological advantages and advanced R&D processes create strong competitive moats, supporting dominant market share and sustained premium margin expansion across multiple industries.

- Heavy dependence on few customers, high R&D needs, and global competition create ongoing risks for revenue growth, margin sustainability, and geographical diversification.

Catalysts

About Seeing Machines- Provides driver and occupant monitoring system technologies in Australia, North America, the Asia Pacific, Europe, and internationally.

- While analyst consensus expects a 100% fitment rate under European GSR for camera-based DMS beginning July 2026, a more bullish interpretation considers that the combination of GSR and escalating Euro NCAP requirements is likely to force rapid, global OEM adoption-potentially pushing DMS fitment to near-100% not just in Europe but also accelerating adoption in North America and other advanced markets, vastly increasing both volume and revenue from auto royalties well beyond current forecasts.

- Analysts broadly agree that cost reductions and production ramp of Gen 3 Guardian will improve margins and cash generation, but the scale and pace appear understated; with Gen 3 hardware margins expected to reach up to 50% and recurring service revenue from larger, enterprise fleet contracts in North America and Europe, margin expansion could drive substantial outperformance in net earnings and recurring cash flow versus current models.

- Seeing Machines' unique end-to-end "system" expertise, deep data assets, and leadership recognized by OEMs and Euro NCAP create high barriers to entry, making it plausible that the company's long-term share in new DMS/OMS awards will materially exceed the often-cited 35%-sustaining a dominant position and supporting continued above-industry revenue growth and high-margin royalty streams.

- The explosive proliferation of semi-autonomous vehicles and increasingly stringent insurance and fleet risk requirements are likely to turn advanced in-cabin monitoring into a standard across all classes of vehicles, rapidly expanding the addressable market to include commercial, legacy vehicles (via aftermarket), and even segments such as aviation and rail, creating new high-margin, multi-vertical growth runways that are underappreciated in current financial projections.

- Accelerated advances in R&D methodology-including machine learning-driven development, increased synthetic data utilization, and digitally enabled engineering processes-are set to drive a structural increase in feature rollout pace and software differentiation, resulting in higher customer retention, premium pricing power, and durable net margin improvement over time.

Seeing Machines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Seeing Machines compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Seeing Machines's revenue will grow by 24.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -44.2% today to 22.0% in 3 years time.

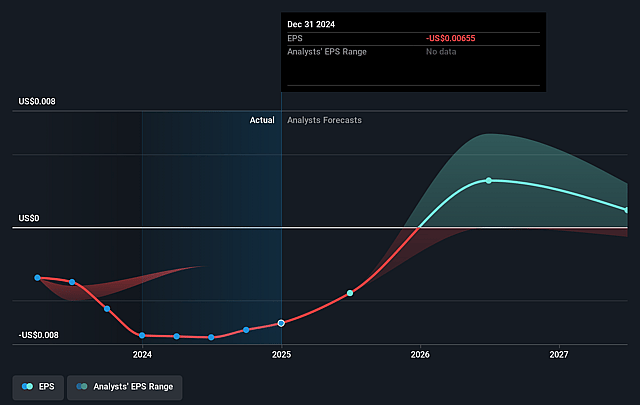

- The bullish analysts expect earnings to reach $28.3 million (and earnings per share of $0.01) by about September 2028, up from $-29.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.1x on those 2028 earnings, up from -6.4x today. This future PE is greater than the current PE for the GB Electronic industry at 27.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

Seeing Machines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced an unanticipated and significant 30% reduction in automotive royalty flows in late 2023, which was largely attributed to a mix shift and OEMs fitting the absolute lowest feature count to combat price competition, highlighting the potential for continued revenue volatility and long-term pressure on royalties if price competition intensifies or if OEMs further optimize costs.

- Seeing Machines remains highly dependent on a limited number of large automotive programs and customers, with much of its expected revenue growth tied to successful ramp-ups and regulatory-driven fitment; failure to win or scale new programs, loss of a key customer, or delays in the regulatory timeline such as GSR implementation could dramatically impact both revenue growth and earnings.

- Ongoing high R&D expenditures and the need to invest in rapid feature development and advanced AI/ML tools to stay technologically competitive have required significant headcount and restructuring efforts; if cost controls weaken or if technological leadership erodes due to accelerated sector innovation or new entrants, the company could face long-term margin dilution and prolonged lack of positive free cash flow.

- The path to growing Aftermarket revenues remains unclear outside of Australia and New Zealand, with the vast majority of recurring revenue still geographically concentrated; failure to translate initial North American or European aftersales pilots into material, profitable deployments could limit diversification, resulting in limited top-line growth and sustained pressure on overall net margins.

- The market for driver monitoring systems faces the risk of future commoditization and intense price competition, especially as Tier 1s, OEMs, and emerging competitors leverage alternative sensor technologies or AI-based solutions; in the long run, this could compress industry-wide margins, undermine Seeing Machines' pricing power, and negatively impact future profitability and operating cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Seeing Machines is £0.1, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Seeing Machines's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.1, and the most bearish reporting a price target of just £0.03.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $128.7 million, earnings will come to $28.3 million, and it would be trading on a PE ratio of 28.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of £0.03, the bullish analyst price target of £0.1 is 69.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.