Key Takeaways

- Widespread adoption of autonomous vehicles and OEMs internalizing safety tech may drastically reduce Seeing Machines' market and revenue growth potential.

- Intensifying price competition, regulatory hurdles, and required ongoing R&D investment threaten profitability and long-term financial viability.

- Regulatory mandates, strategic partnerships, and superior technology drive higher adoption, recurring revenues, and margin expansion, securing Seeing Machines' market position and long-term profitability.

Catalysts

About Seeing Machines- Provides driver and occupant monitoring system technologies in Australia, North America, the Asia Pacific, Europe, and internationally.

- Advancements in fully autonomous vehicle technology may significantly erode the long-term demand for driver monitoring systems, directly threatening Seeing Machines' core automotive royalty revenue as the underlying need for DMS is mechanistically removed as hands-free and driverless vehicle penetration increases.

- Increasing commoditization of DMS hardware and software as these technologies mature could compress average selling prices across the sector, forcing Seeing Machines to compete on price and resulting in sustained downward pressure on net margins and earnings as price competition replaces differentiation.

- Major automotive OEMs are expected to further internalize DMS and broader in-cabin safety feature development, seeking to control intellectual property and reduce costs, which will shrink the future addressable market for Seeing Machines and lead to lower growth in embedded unit volumes as external suppliers become marginalized.

- Tighter data privacy regulations and a heightened global focus on consumer data rights are likely to increase deployment friction, compliance costs, and curtail the monetization potential from DMS analytics, thus diluting both top-line revenue opportunities and profitability over the next several years.

- Persistent high R&D spending will be required to keep up with escalating feature and certification demands from OEMs and evolving Euro NCAP/US NHTSA protocols, but larger competitors with more extensive resources can outspend Seeing Machines, making future operating leverage and path to consistently positive net earnings highly uncertain.

Seeing Machines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Seeing Machines compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

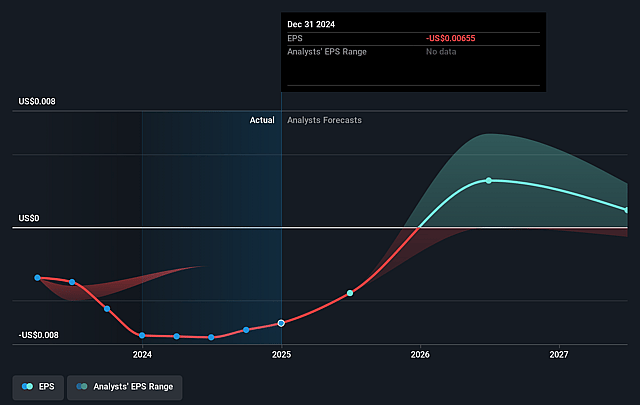

- The bearish analysts are assuming Seeing Machines's revenue will grow by 16.0% annually over the next 3 years.

- The bearish analysts are not forecasting that Seeing Machines will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Seeing Machines's profit margin will increase from -44.2% to the average GB Electronic industry of 7.9% in 3 years.

- If Seeing Machines's profit margin were to converge on the industry average, you could expect earnings to reach $8.3 million (and earnings per share of $0.0) by about August 2028, up from $-29.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.6x on those 2028 earnings, up from -6.4x today. This future PE is greater than the current PE for the GB Electronic industry at 27.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

Seeing Machines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing and imminent regulatory mandates in Europe (GSR 2026) will require 100% of all new cars sold to include camera-based driver monitoring systems, leading to a significant and predictable increase in demand for Seeing Machines' core technology, supporting higher royalty revenues and stronger cash flow.

- Major OEM adoption and minimum volume guarantees, including substantial programs with Volkswagen and other partners, create a visible and increasing base of royalty and license revenue through at least 2028, giving long-term revenue growth and improving gross margins.

- Strategic partnerships, notably with Mitsubishi Electric Mobility Corporation, not only provide financial backing but rapidly open new distribution channels, particularly in North America, while also aiding in manufacturing cost reductions, enhancing the likelihood of further top-line and margin gains.

- Launch and ramp-up of Generation 3 Guardian product, with much higher gross margins, reduced production cost, and improved technical performance compared to prior generations, will substantially raise profitability and expand recurring revenues as sales accelerate outside of Australia and New Zealand.

- Increasing regulatory emphasis not just on DMS inclusion but on system quality and integration with advanced safety features (Euro NCAP 2026 and beyond) favors Seeing Machines' best-in-class technology, defending its market share against commoditization and supporting premium pricing, thus boosting both future revenue potential and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Seeing Machines is £0.03, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Seeing Machines's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.1, and the most bearish reporting a price target of just £0.03.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $104.8 million, earnings will come to $8.3 million, and it would be trading on a PE ratio of 29.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of £0.03, the bearish analyst price target of £0.03 is 2.3% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.