Key Takeaways

- Forthcoming regulatory changes and safety trends position Seeing Machines for significant revenue growth and market leadership, especially as OEM production ramps up.

- Operational efficiencies, new partnerships, and expanded product capabilities are increasing margins, improving profitability, and supporting geographic expansion.

- Heavy dependence on a few automotive partners, unpredictable revenue pre-regulation, ongoing cash burn, and challenges scaling in key markets threaten profitability and growth.

Catalysts

About Seeing Machines- Provides driver and occupant monitoring system technologies in Australia, North America, the Asia Pacific, Europe, and internationally.

- Upcoming regulatory mandates in Europe will require all cars produced from July 2026 to be fitted with camera-based driver monitoring systems (DMS), and industry experts anticipate near-total compliance at a 100% fitment rate. This creates a steep, predictable increase in Seeing Machines' addressable auto royalties, with production volumes expected to ramp ~10x over the next 15 months, directly driving higher top-line revenue and cash flow.

- Global momentum toward in-cabin monitoring for both regulatory and consumer-driven safety (including the prioritized role of DMS in NCAP safety ratings) plays to Seeing Machines' core technology strengths, and positions the company as a likely market leader in new OEM production awards. This supports sustained revenue growth and strengthens future order pipelines.

- Removal of supply constraints on the Gen 3 Guardian aftermarket product-which is now in production and delivers higher performance and substantially better hardware and services margins-unlocks channel expansion into North America and Europe, directly increasing both hardware gross margins and high-margin recurring revenue from services.

- Structural cost reductions in headcount, R&D approach, and organizational efficiency are already implemented, saving ~$12 million per year and immediately improving operating margins and reducing cash burn. Combined with a shift toward higher-margin revenue streams, this materially grows net margins and accelerates the path to profitability.

- Strategic partnership with Mitsubishi Electric, providing not only a major new sales channel into over 1 million trucks in the U.S. but also design and cost-optimization expertise, is set to support international expansion and further margin improvement, driving both revenue growth and net profitability.

Seeing Machines Future Earnings and Revenue Growth

Assumptions

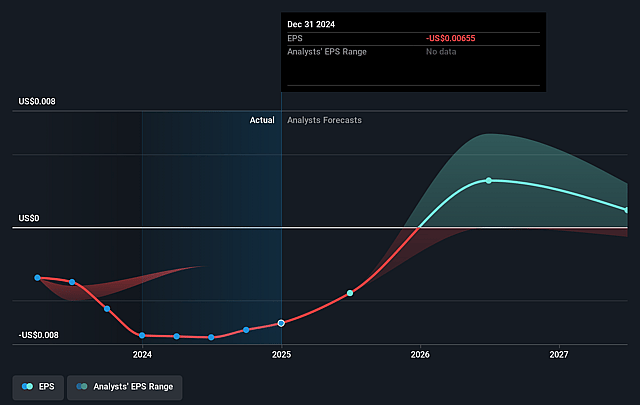

How have these above catalysts been quantified?- Analysts are assuming Seeing Machines's revenue will grow by 18.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -44.2% today to 13.9% in 3 years time.

- Analysts expect earnings to reach $15.8 million (and earnings per share of $0.0) by about September 2028, up from $-29.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.8x on those 2028 earnings, up from -6.4x today. This future PE is greater than the current PE for the GB Electronic industry at 29.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

Seeing Machines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant uncertainty remains around automotive royalty revenue growth prior to the July 2026 GSR deadline, as highlighted by the unexpected 30% reduction in royalty flow in Q4 last year due to OEMs opting for lower feature count vehicles, leading to revenue volatility and challenging the assumption of linear growth; this exposes Seeing Machines to unpredictable short-term revenue performance.

- Heavy reliance on a few key OEM and Tier 1 automotive customers for both current revenue and future growth entails concentration risk; delays or failures to secure or ramp up new OEM contracts, as well as the potential loss of major partners, would have an outsized negative impact on recurring revenues and earnings.

- Persistent cash burn despite operational cost reductions has strained Seeing Machines' balance sheet, with profitability highly dependent on timely, large-scale regulatory-driven royalty volume increases in 2026; any delay in regulatory enforcement or OEM fitment could jeopardize cash flow generation and the company's ability to meet debt obligations such as the Magna convertible note.

- The Chinese DMS market is largely inaccessible due to its low pricing and rapid development pace, limiting addressable market size and potentially excluding Seeing Machines from the world's fastest-growing automotive segment, which could cap future global growth and top-line revenue expansion.

- Heavy R&D investment and recent significant headcount reduction (with over 100 employees laid off) introduce long-term execution risk; if the streamlined organization is unable to scale product innovation and delivery to meet the surge in demand from new RFQs and regulatory requirements, Seeing Machines could face persistent margin pressure and risk falling behind more agile or better-resourced competitors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £0.063 for Seeing Machines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.1, and the most bearish reporting a price target of just £0.03.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $113.1 million, earnings will come to $15.8 million, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of £0.03, the analyst price target of £0.06 is 54.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.