Catalysts

About HUTCHMED (China)

HUTCHMED is an innovation driven, oncology focused biopharmaceutical company developing and commercializing targeted therapies in China and globally.

What are the underlying business or industry changes driving this perspective?

- Although fruquintinib and FRUZAQLA are expanding globally into multiple colorectal and endometrial cancer indications, intensifying competition from generics and novel regimens in China and abroad may cap pricing power and limit sustained revenue growth.

- Despite a broad late stage pipeline in lung, renal and gastric cancers, increasing crowding in targeted oncology, including competing MET inhibitors and antibody based combinations, raises the risk that future approvals deliver smaller than expected incremental market share and pressure operating margins.

- While the ATTC antibody targeted conjugate platform could theoretically move into earlier line combinations with chemotherapy and immunotherapy, the unproven clinical profile, complex development path and potential safety trade offs may delay meaningful contribution to earnings for many years.

- Although HUTCHMED has over 1.3 billion dollars in cash and is exploring business development to accelerate growth, deploying this capital into acquisitions or partnerships in a saturated oncology landscape risks value dilutive deals and lower returns on invested capital.

- While China remains a large and growing oncology market with rising diagnosis rates, ongoing pricing reforms, NRDL renegotiations and anticorruption driven prescribing changes could structurally compress net margins and offset volume driven revenue gains.

Assumptions

This narrative explores a more pessimistic perspective on HUTCHMED (China) compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

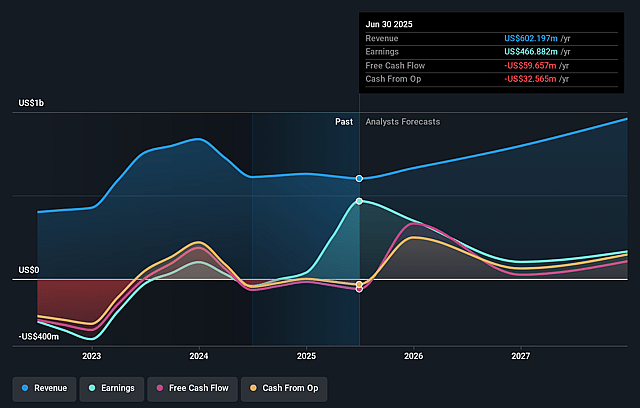

- The bearish analysts are assuming HUTCHMED (China)'s revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 77.5% today to 0.4% in 3 years time.

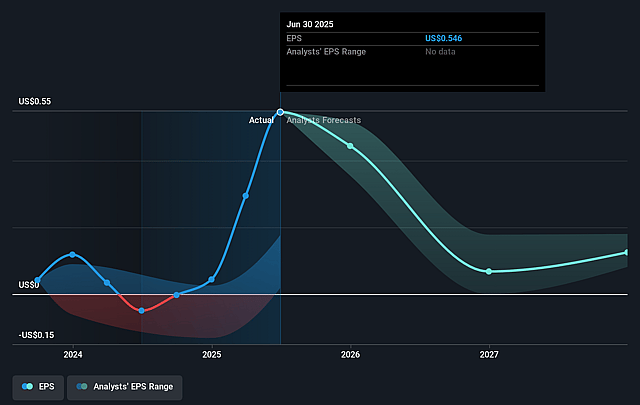

- The bearish analysts expect earnings to reach $2.7 million (and earnings per share of $0.0) by about December 2028, down from $466.9 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $83.6 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 1099.8x on those 2028 earnings, up from 5.0x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 21.0x.

- The bearish analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Multiple late stage pipeline catalysts over the next 12 to 24 months, including Phase III readouts for SAFFRON and SAMETA, additional NDAs in China and new FRUZAQLA launches globally, could deliver better than expected efficacy and uptake, driving a step change in revenue growth and improving earnings sustainability.

- The company’s over 1.3 billion dollars of cash and incremental 600 million dollars from the SHPL divestment provide capacity to accelerate global ATTC development and in licensing, and if these investments convert into successful first in class products, they could materially improve long term revenue, operating leverage and net income.

- If the ATTC antibody targeted therapy conjugate platform achieves clinical proof of concept and can move into frontline combination regimens with chemotherapy, immunotherapy and targeted agents with a favorable safety profile, it could open large new indications and significantly lift future sales and margins.

- Global expansion of fruquintinib and savolitinib through partners like Takeda and AstraZeneca, combined with further label expansions in colorectal, endometrial, renal and lung cancers, may offset China headwinds and lead to a higher international revenue mix, stronger overall top line growth and more resilient earnings.

- Resolution of near term China specific pressures, such as anticorruption related prescribing changes, NRDL renegotiations and increased competition, together with HUTCHMED’s repositioned commercial strategy, could result in a stronger than expected recovery in China oncology volumes, stabilizing or expanding net margins and supporting a higher equity valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for HUTCHMED (China) is £2.04, which represents up to two standard deviations below the consensus price target of £3.56. This valuation is based on what can be assumed as the expectations of HUTCHMED (China)'s future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.36, and the most bearish reporting a price target of just £2.04.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $726.9 million, earnings will come to $2.7 million, and it would be trading on a PE ratio of 1099.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of £2.04, the analyst price target of £2.04 is 0.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on HUTCHMED (China)?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.