Last Update 05 Sep 25

HUTCHMED (China)’s valuation outlook has improved with a notable drop in its future P/E ratio from 35.13x to 26.14x while net profit margin held steady, resulting in no change to the consensus analyst price target, which remains £3.62.

What's in the News

- Dr. Weiguo Su takes medical leave as CEO; CFO Johnny Cheng appointed Acting CEO while retaining CFO role.

- Full-year 2025 oncology revenue guidance revised to $270–350 million due to deferred milestone payments and delayed sovleplenib China NDA review.

- Patient enrollment completed for SANOVO Phase III trial (ORPATHYS + TAGRISSO) in first-line EGFRm, MET+ NSCLC; topline results expected in H2 2026 to support potential sNDA in China.

- Combination of ORPATHYS and TAGRISSO approved by China NMPA for post-EGFR TKI, MET-amplified advanced NSCLC, based on strong Phase II/III data (SAVANNAH, SACHI).

- SAFFRON global Phase III trial of ORPATHYS + TAGRISSO ongoing for registration filings in the US and globally; received US FDA Fast Track Designation.

Valuation Changes

Summary of Valuation Changes for HUTCHMED (China)

- The Consensus Analyst Price Target remained effectively unchanged, at £3.62.

- The Future P/E for HUTCHMED (China) has significantly fallen from 35.13x to 26.14x.

- The Net Profit Margin for HUTCHMED (China) remained effectively unchanged, at 15.56%.

Key Takeaways

- New product launches, expanded indications, and global growth are expected to drive significant revenue gains, leveraging increased healthcare demand and broader reimbursement.

- Strategic investments, innovative R&D, and recovery in China sales position the company for stronger margins and more stable long-term earnings growth.

- Heavy dependence on few products, regulatory hurdles, price competition, policy shifts, and unproven R&D ventures pose risks to revenue stability, earnings, and international growth.

Catalysts

About HUTCHMED (China)- HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies to treat cancer and immunological diseases in Hong Kong, the United States, and internationally.

- Expansion of approved indications and upcoming NDA submissions for key oncology products (savolitinib and fruquintinib) are set to drive higher revenue growth, leveraging strong demand from an aging population and increased chronic disease prevalence in China and globally.

- Launches and global expansion of FRUZAQLA, including strong growth outside China (notably in Japan and anticipation of further global rollouts), position the company to capture rising healthcare spending and broader reimbursement coverage, supporting robust top-line growth.

- Acceleration of the ATTC platform (Antibody-Targeted Therapy Conjugates), with imminent clinical trial initiations and a novel approach integrating small molecule and antibody expertise, is likely to boost R&D productivity and support long-term earnings growth if clinical proof-of-concept succeeds.

- Strategic investments fueled by a strong cash position (over $1.3 billion), including the potential acquisition of innovative products and partnerships, are expected to enhance the drug pipeline and future operating leverage, positively impacting revenues and margins.

- Recovery in China sales performance (post-commercial team transition and after anticorruption-driven compliance headwinds), alongside the expansion of reimbursement and new product launches, is anticipated to restore revenue momentum and improve earnings stability in the coming quarters.

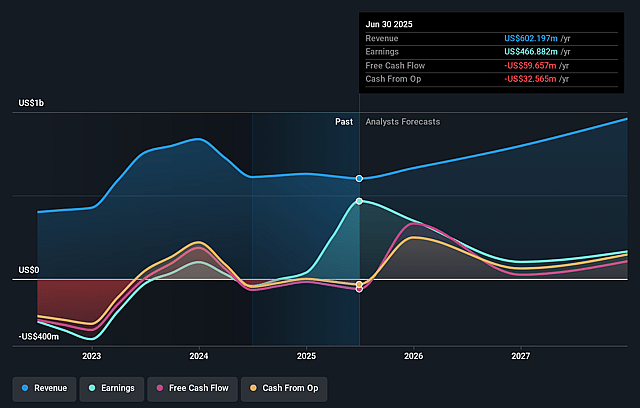

HUTCHMED (China) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HUTCHMED (China)'s revenue will grow by 16.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 77.5% today to 15.6% in 3 years time.

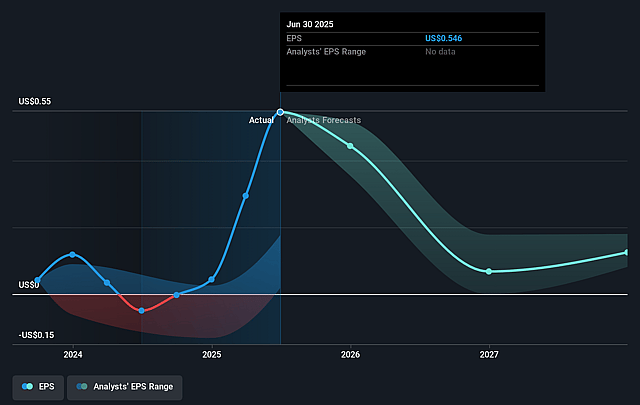

- Analysts expect earnings to reach $147.3 million (and earnings per share of $0.15) by about September 2028, down from $466.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $220 million in earnings, and the most bearish expecting $7.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.1x on those 2028 earnings, up from 5.6x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

HUTCHMED (China) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing competition from generics and new entrants in China's CRC and MET-TKI markets, as well as broader price pressure due to centralized procurement and NRDL negotiations, threatens HUTCHMED's ability to maintain premium pricing and stable market share, potentially compressing revenues and net margins.

- Reliance on a handful of lead products for growth (fruquintinib/FRUZAQLA, savolitinib/ORPATHYS); regulatory delays (such as the SYK inhibitor and savolitinib commercial launch postponement) and slow uptake or approval outside China heighten the risk of revenue concentration, earnings volatility, and missed growth targets.

- Heightened regulatory scrutiny and systemic changes in China (e.g., anti-corruption campaigns leading to reduced off-label sales, compliance-related shifts in physician behavior) create near-term sales headwinds and increase the risk of recurring compliance costs, impacting both revenues and margins.

- Geopolitical uncertainty surrounding China–Western relations-including potential new pharmaceutical tariffs and restrictions on global capital flows-could inhibit HUTCHMED's ability to expand internationally, limiting growth opportunities and negatively affecting long-term valuation and revenue diversification.

- Persistent high R&D expenditures and significant investment in early-stage innovation platforms like ATTC, which have yet to demonstrate clinical proof of concept, create uncertainty over future ROI; if late-stage trials or new platforms disappoint, this could strain net margins and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.624 for HUTCHMED (China) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.5, and the most bearish reporting a price target of just £2.05.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $946.7 million, earnings will come to $147.3 million, and it would be trading on a PE ratio of 35.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of £2.28, the analyst price target of £3.62 is 37.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on HUTCHMED (China)?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.