Key Takeaways

- Growing regulatory scrutiny, fake reviews, and user skepticism threaten Trustpilot's data quality, user participation, and long-term revenue prospects.

- Reliance on small businesses and rising competition from tech giants and new content trends could erode platform relevance and destabilize earnings.

- Strong enterprise adoption, product innovation, and regulatory compliance position the company for sustained growth, higher margins, and long-term market leadership in online reviews.

Catalysts

About Trustpilot Group- Engages in the development and hosting of an online review platform for businesses and consumers in the United Kingdom, North America, Europe, and internationally.

- Trustpilot remains highly vulnerable to rising regulatory scrutiny around data privacy laws in key markets such as Europe and the United States, which could drastically increase compliance and operational costs while also restricting the collection and monetization of user data, thereby reducing future user engagement and diminishing long-term revenue streams.

- The threat posed by increasingly sophisticated AI-generated fake reviews is expected to intensify, undermining consumer trust in online platforms; if Trustpilot's detection capabilities fail to keep pace, the perceived value of its services could erode, leading to higher customer churn and stalling revenue growth.

- The business continues to face elevated risk from the growing consumer fatigue and skepticism towards review platforms, which threatens to reduce both participation rates and the authenticity of submitted content, ultimately compromising the volume and quality of monetizable user-generated data and putting significant pressure on top-line growth.

- With a large portion of revenues still deriving from small and medium-sized businesses-historically more sensitive to macroeconomic conditions and downturns-Trustpilot's revenue base is likely to remain volatile, and any increase in SMB churn will materially hurt net retention and earnings predictability.

- Intensifying competitive pressure from tech giants developing proprietary, embedded review ecosystems, as well as a secular shift in consumer preferences toward short-form video and influencer-driven content for purchasing decisions, could sharply reduce the relevance and reach of Trustpilot's platform, creating significant headwinds for future revenue growth and sustainable margin expansion.

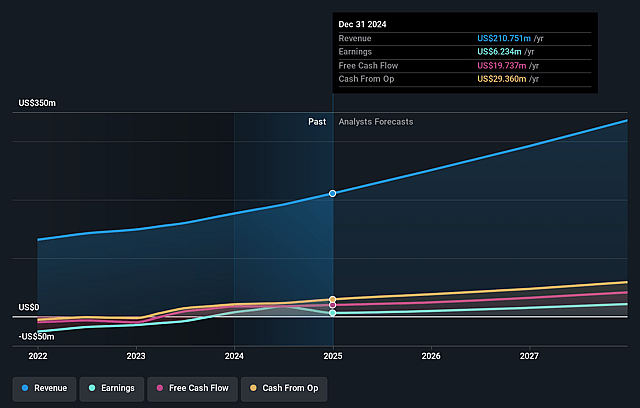

Trustpilot Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Trustpilot Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Trustpilot Group's revenue will grow by 16.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.0% today to 4.6% in 3 years time.

- The bearish analysts expect earnings to reach $15.4 million (and earnings per share of $0.03) by about August 2028, up from $6.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 88.1x on those 2028 earnings, down from 199.5x today. This future PE is greater than the current PE for the GB Interactive Media and Services industry at 28.9x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.23%, as per the Simply Wall St company report.

Trustpilot Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growing adoption of e-commerce and increased consumer preference for digital purchasing continues to fuel global demand for verified online reviews, which expands Trustpilot's addressable market and supports long-term revenue growth.

- Persistent product innovation, particularly through new features and bundled packages targeted at enterprise clients, has driven the company's net dollar retention rate to record highs and may result in higher average revenue per client and improved earnings stability over time.

- Expanding enterprise client wins-including major brands such as HSBC, Revolut, NS&I, easyJet, and Western Union-are increasing the share of recurring subscription revenue, enhancing customer stickiness and providing stronger visibility into future revenues.

- Operating leverage from technology investment and automation has led to higher adjusted EBITDA margins, and the SaaS model provides significant scope for further margin expansion as the business matures, which could boost future profitability.

- Heightened regulatory scrutiny around fake reviews benefits established players with robust compliance, and Trustpilot's proactive legal and technological measures to remove fraudulent content help reinforce its brand's competitive moat and long-term market leadership, potentially supporting sustained revenue and margin resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Trustpilot Group is £1.96, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Trustpilot Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.22, and the most bearish reporting a price target of just £1.96.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $335.7 million, earnings will come to $15.4 million, and it would be trading on a PE ratio of 88.1x, assuming you use a discount rate of 8.2%.

- Given the current share price of £2.22, the bearish analyst price target of £1.96 is 13.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Trustpilot Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.