Key Takeaways

- Strong customer retention and innovative product launches are expected to drive recurring revenue growth well beyond current market expectations.

- Investment in AI, regulatory engagement, and new analytics offerings positions Trustpilot for premium pricing, diversified income streams, and sustained margin expansion.

- Rising regulatory scrutiny, growing fake review concerns, SMB churn risk, and mounting competition threaten Trustpilot's revenue growth, brand value, and long-term earnings stability.

Catalysts

About Trustpilot Group- Engages in the development and hosting of an online review platform for businesses and consumers in the United Kingdom, North America, Europe, and internationally.

- Analyst consensus views Trustpilot's recent net dollar retention rebound as a steady trend, but retention rates across all four focus markets over 100 percent, coupled with a robust product roadmap and upcoming flagship releases, signal a multi-year compounding effect on recurring revenue growth far above market expectations.

- While consensus already accounts for strong U.S. bookings and revenue growth, the surging brand awareness-up ten percentage points-in North America combined with demonstrated enterprise momentum suggests Trustpilot could accelerate expansion and achieve scale, materially increasing top-line growth and margin uplift through operating leverage.

- The continued migration of global commerce online is likely to drive exponential growth in review volume and platform engagement, positioning Trustpilot as an indispensable infrastructure provider for trust and transparency, and fueling sustained revenue outperformance.

- Trustpilot's early and ongoing investment in AI-driven fraud detection and proactive regulatory engagement will solidify its position as the most credible review platform, enabling premium pricing, reduced churn, and long-term net margin expansion as barriers to entry rise for competitors.

- Expansion of data analytics and new use cases-like TrustLayer and standalone insights APIs-will unlock multi-channel monetization opportunities, pushing ARPU higher and diversifying income streams well beyond traditional SaaS subscriptions, supporting both revenue and earnings growth.

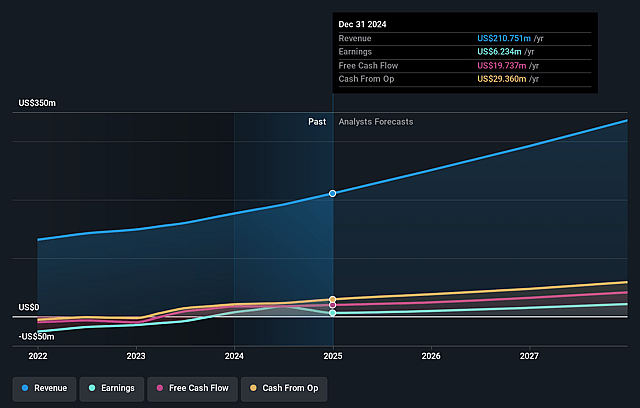

Trustpilot Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Trustpilot Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Trustpilot Group's revenue will grow by 22.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.0% today to 9.6% in 3 years time.

- The bullish analysts expect earnings to reach $37.1 million (and earnings per share of $0.09) by about September 2028, up from $6.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 79.7x on those 2028 earnings, down from 180.5x today. This future PE is greater than the current PE for the GB Interactive Media and Services industry at 28.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.15%, as per the Simply Wall St company report.

Trustpilot Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Escalating regulatory scrutiny and more stringent global data privacy laws, such as GDPR and CCPA, could restrict Trustpilot's data collection and use, which is core to platform monetization and product innovation, and this may suppress long-term revenue growth and limit future earnings potential.

- Widespread consumer skepticism about the reliability of online content, intensified by the proliferation of fake and AI-generated reviews, could erode trust in review platforms like Trustpilot; this undermines user engagement and reduces the perceived value of the platform to business clients, negatively impacting both customer acquisition and retention-driven revenues.

- Ongoing and persistent issues with fake reviews, despite investments in detection technologies and legal actions, risk damaging Trustpilot's brand credibility; if the company cannot convincingly guarantee authenticity, customer churn could increase and long-term retention rates may decline, leading to revenue contraction and impaired net margins.

- The company's strong focus on acquiring and serving SMBs creates exposure to high churn risk, especially during economic downturns; as smaller customers optimize costs or go out of business, gross retention rates may falter, pressuring predictable recurring revenue and threatening overall earnings stability.

- Intensifying industry competition from tech giants integrating their own review systems, alongside alternative platforms offering commoditized review services, could reduce industry pricing power and marginalize third-party providers like Trustpilot, leading to downward pressure on premium pricing models, stunted revenue growth, and compressed operating leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Trustpilot Group is £4.18, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Trustpilot Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.18, and the most bearish reporting a price target of just £1.99.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $386.2 million, earnings will come to $37.1 million, and it would be trading on a PE ratio of 79.7x, assuming you use a discount rate of 8.1%.

- Given the current share price of £2.01, the bullish analyst price target of £4.18 is 51.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.