Key Takeaways

- Expansion in China and innovative digital tools could significantly outpace current growth and margin expectations through rapid market share gains and operational efficiencies.

- Rising demand for advanced polymers positions the company to secure higher volumes and pricing, while new downstream products boost margins and accelerate profit growth.

- Intensifying price pressure, market concentration, operational challenges, rising competition, and delays in commercializing innovation threaten revenue growth, margins, and long-term earnings stability.

Catalysts

About Victrex- Through its subsidiaries, engages in the manufacture and sale of polymer solutions worldwide.

- Analyst consensus sees the new China plant as underpinning regional growth, but this likely understates its transformative potential: by supporting rapid market share gains in local Automotive, Electronics, and E-mobility segments as Chinese OEMs expand, the China asset could accelerate double-digit revenue growth and drive much higher utilization and operating leverage, swiftly boosting net margins.

- While analyst consensus expects Project Vista and self-help actions to improve sales efficiency and margins, the full rollout of advanced digital tools and AI-driven go-to-market strategies may unleash compounding efficiencies and significantly outperform current margin expectations by structurally lowering SG&A and unlocking premium pricing through better customer targeting.

- Surging global demand for lightweight, high-performance specialty polymers-particularly as Aerospace, advanced air mobility, and Electronics OEMs race to miniaturize and lighten components-positions Victrex to win outsized volumes, command greater pricing power, and structurally expand group gross margin.

- The accelerating global adoption of electric vehicles and renewable energy infrastructure is set to drive an inflection in multi-market order flow, with Victrex's innovation pipeline (such as Magma and advanced battery applications) ideally placed to capitalize on the need for materials with superior heat and electrical resistance; this could propel recurring high-margin revenue streams not yet reflected in consensus models.

- The company's move into downstream value-added finished and semi-finished products is progressing faster than expected, with recent contract wins in Advanced Air Mobility, CMF (cranio-maxillofacial), and non-Spine medical segments suggesting a multi-year mix shift toward higher ASPs and gross margins, setting the stage for robust earnings compound growth as Medical grows as a share of group profits.

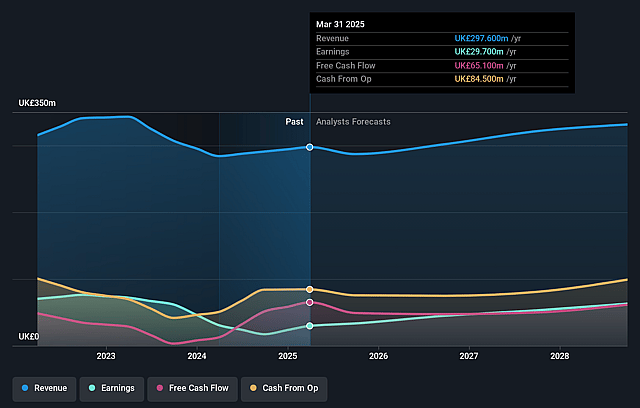

Victrex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Victrex compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Victrex's revenue will grow by 5.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.0% today to 21.3% in 3 years time.

- The bullish analysts expect earnings to reach £74.3 million (and earnings per share of £0.84) by about September 2028, up from £29.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, down from 21.3x today. This future PE is lower than the current PE for the GB Chemicals industry at 21.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Victrex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing price pressure in key markets, especially within Value Added Resellers and some Medical segments, has led to lower average selling prices and compressing gross margins, which could weigh on both top-line revenue and net margins over the long term if the trend persists.

- Victrex's continued exposure to cyclical and concentrated end markets such as Aerospace, Automotive, and Medical leaves its revenue and earnings vulnerable to economic downturns, industry slowdowns, and destocking cycles, which have already caused notable revenue and margin volatility.

- Operational challenges and higher costs in scaling up the new China plant have resulted in a £2 million profit headwind and underutilization of the facility so far; persistent issues or future regulatory, competitive, or geopolitical hurdles in Asia may further impair margins and profit growth.

- The emergence of new, lower-cost international competitors and ongoing advancements in alternative materials-such as biopolymers and composites-poses substitution risk and could lead to further pricing pressure, market share loss, and weakened future revenue streams for Victrex.

- While Victrex is investing in innovation, a slowdown in mega-programme commercialization, pipeline delays, and customer-driven time line uncertainties raise the risk of prolonged periods of stagnant or below-expected growth, which would directly impact long-term revenue and earnings trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Victrex is £11.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Victrex's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £11.0, and the most bearish reporting a price target of just £6.75.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £348.5 million, earnings will come to £74.3 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 7.6%.

- Given the current share price of £7.26, the bullish analyst price target of £11.0 is 34.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.