Key Takeaways

- Operational upgrades and new product streams are poised to substantially elevate profit margins, free cash flow, and shareholder returns through sustained efficiency and innovation.

- Strategic positioning in key global trends, including ethical sourcing and infrastructure growth, enables premium pricing and long-term revenue outperformance versus peers.

- Dependence on a single asset, rising capital costs, regulatory uncertainties, ESG pressures, and adverse market shifts threaten profitability and financial stability.

Catalysts

About Kenmare Resources- Engages in the production and sale of mineral sand products in China, rest of Asia, Europe, the United States, and internationally.

- While analysts broadly agree that the WCP A move and ongoing capital projects will boost production and efficiency, they may be underestimating how quickly these investments will unlock substantial, sustained output increases and cost reductions, which could result in a step-change in EBITDA margins and free cash flow from 2026 as operational leverage improves markedly.

- Analyst consensus recognizes the monetization of a new concentrate product as a marginal benefit, but this innovation could spark a structural uplift in profit margins by converting previously discarded resource into high-value revenue, with further upside if selective mining operations enable significantly more product streams and ongoing margin expansion.

- As global urbanization and infrastructure spending accelerate-particularly in developing economies-Kenmare's global supply share, unmatched resource longevity, and reliable delivery position it to achieve above-market pricing power and premium contract terms, generating outsized long-term revenue growth.

- The surging requirement for ethically sourced, low-carbon minerals in renewable energy, electrification, and global supply chain diversification could catapult Kenmare into a preferred-supplier status for tier-1 manufacturers, leading to strategic premiums, larger offtake agreements, and structurally higher net margins.

- With minimal major capital requirements post-2025, Kenmare's combination of strong balance sheet, disciplined capital allocation, and increasing operational cash flows paves the way for potential acceleration of buybacks and special dividends, materially increasing earnings per share and total shareholder return.

Kenmare Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kenmare Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kenmare Resources's revenue will grow by 4.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 15.6% today to 14.9% in 3 years time.

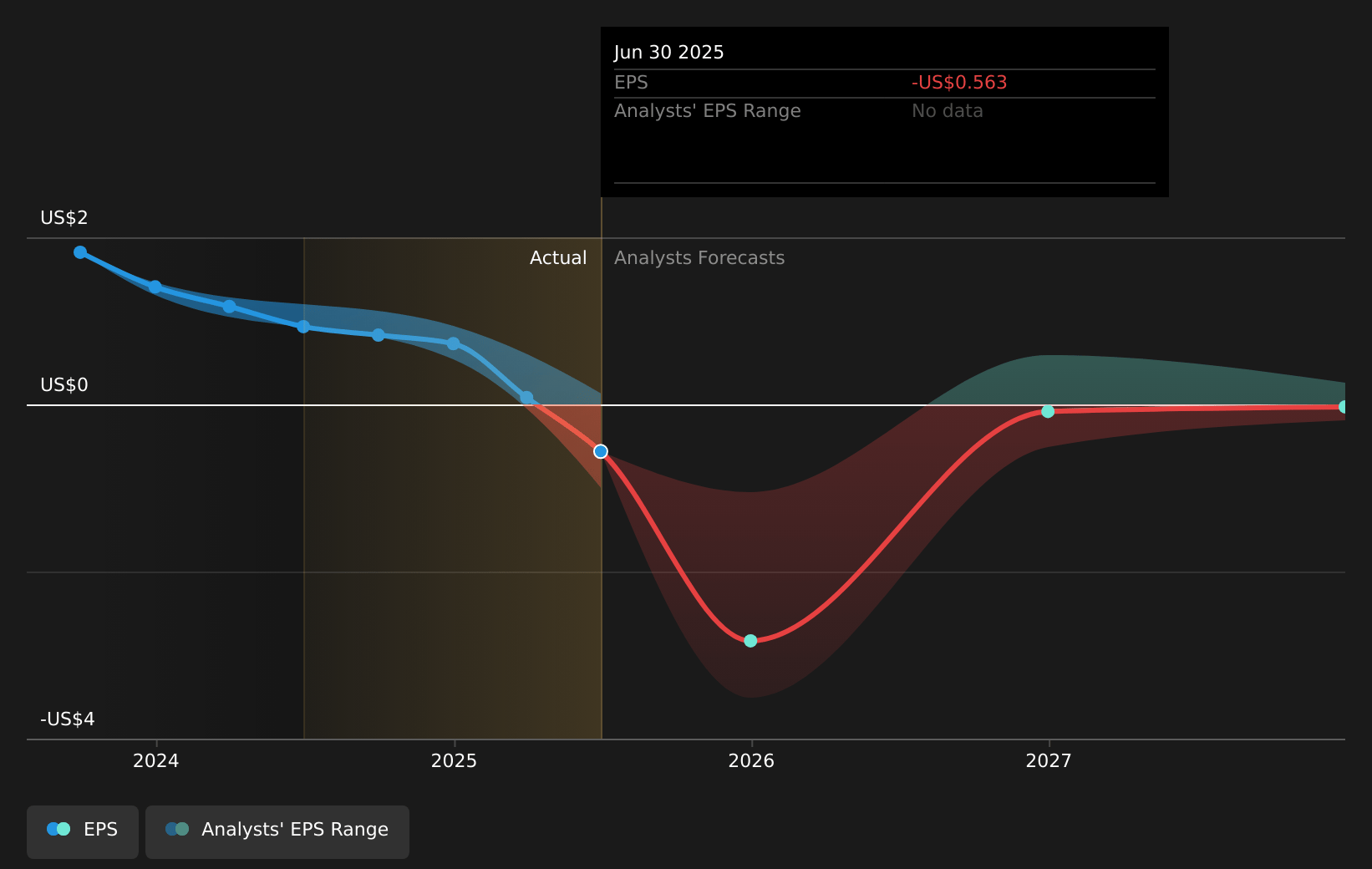

- The bullish analysts expect earnings to reach $70.9 million (and earnings per share of $0.76) by about July 2028, up from $64.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, up from 6.0x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 8.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

Kenmare Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kenmare's heavy reliance on the Moma mine as its only revenue-generating asset exposes it to significant concentration risk; any long-term operational disruption, ore-body depletion, or technical failures would have a material negative impact on revenue and earnings.

- The company is entering a period of heightened capital intensity, with large sustaining and development expenditures required to maintain or expand production amid declining head feed grades; persistent increases in capital needs or cost overruns could constrain free cash flow and limit dividend payments and future growth.

- Mozambique's volatile political and regulatory outlook, underscored by recent civil unrest and upcoming agreement renewals, places Kenmare at risk of higher royalties, taxes, or even expropriation, which could reduce net margins and jeopardize earnings predictability.

- The long-term global shift toward decarbonization and stricter ESG requirements may translate into higher compliance costs and more challenging access to capital markets for heavy emitters, pressuring operating margins and potentially raising financing costs.

- Market dynamics for titanium feedstocks face structural headwinds from increased recycling, material substitution, new low-cost producers, and unpredictable demand levels in key sectors; these trends could compress pricing power and erode Kenmare's addressable market, negatively impacting revenue streams and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kenmare Resources is £8.48, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kenmare Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.48, and the most bearish reporting a price target of just £3.71.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $477.4 million, earnings will come to $70.9 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 7.9%.

- Given the current share price of £3.26, the bullish analyst price target of £8.48 is 61.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.