Key Takeaways

- Growth prospects are tied to emerging market development and are threatened by macroeconomic volatility, structural demand shifts, and single-asset dependency.

- Margin expansion efforts are offset by ore depletion, rising costs, regulatory compliance burdens, and risk of oversupply from lower-cost competitors.

- Exposure to operational, regulatory, and market risks threatens Kenmare's profitability, especially if cost pressures persist and the company fails to diversify or adapt to shifting demand.

Catalysts

About Kenmare Resources- Engages in the production and sale of mineral sand products in China, rest of Asia, Europe, the United States, and internationally.

- Although Kenmare is well positioned to benefit from ongoing global urbanization and rising demand for titanium feedstocks in emerging markets, the company's long-term revenue growth remains dependent on continued economic development in regions like Asia and Africa as well as the pace of infrastructure investment, both of which are subject to macroeconomic volatility and potential slowdowns.

- While the increasing use of titanium-based products in energy-efficient and lightweight applications should provide pricing power and help support margin expansion, the acceleration of circular economy initiatives and material substitution could reduce demand for primary ilmenite and zircon, posing structural risks to topline growth over the long term.

- The business has made notable operational improvements and is mid-way through a capital investment cycle that aims to increase mining efficiency and production at the Moma mine, potentially supporting higher throughput and EBITDA margins in coming years; however, the company faces ongoing exposure to rising operational costs due to orebody depletion and declining grades, which may ultimately pressure net margins and require sustained capital outlay.

- Kenmare's focus on sustainability, a low-carbon footprint, and strong stakeholder relations could help preserve access to premium markets and mitigate regulatory risks, but increasing global decarbonisation requirements and environmental regulations may drive up compliance costs, thereby constraining earnings growth or limiting expansion opportunities.

- Although global supply constraints for high-quality ilmenite and zircon could support favorable industry pricing, new supply from lower-cost producers and the potential for oversupply present a persistent risk to realized revenues and profitability, with the company's reliance on a single asset in Mozambique heightening its vulnerability to local geopolitical or operational disruptions.

Kenmare Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kenmare Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kenmare Resources's revenue will grow by 1.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 15.6% today to 10.0% in 3 years time.

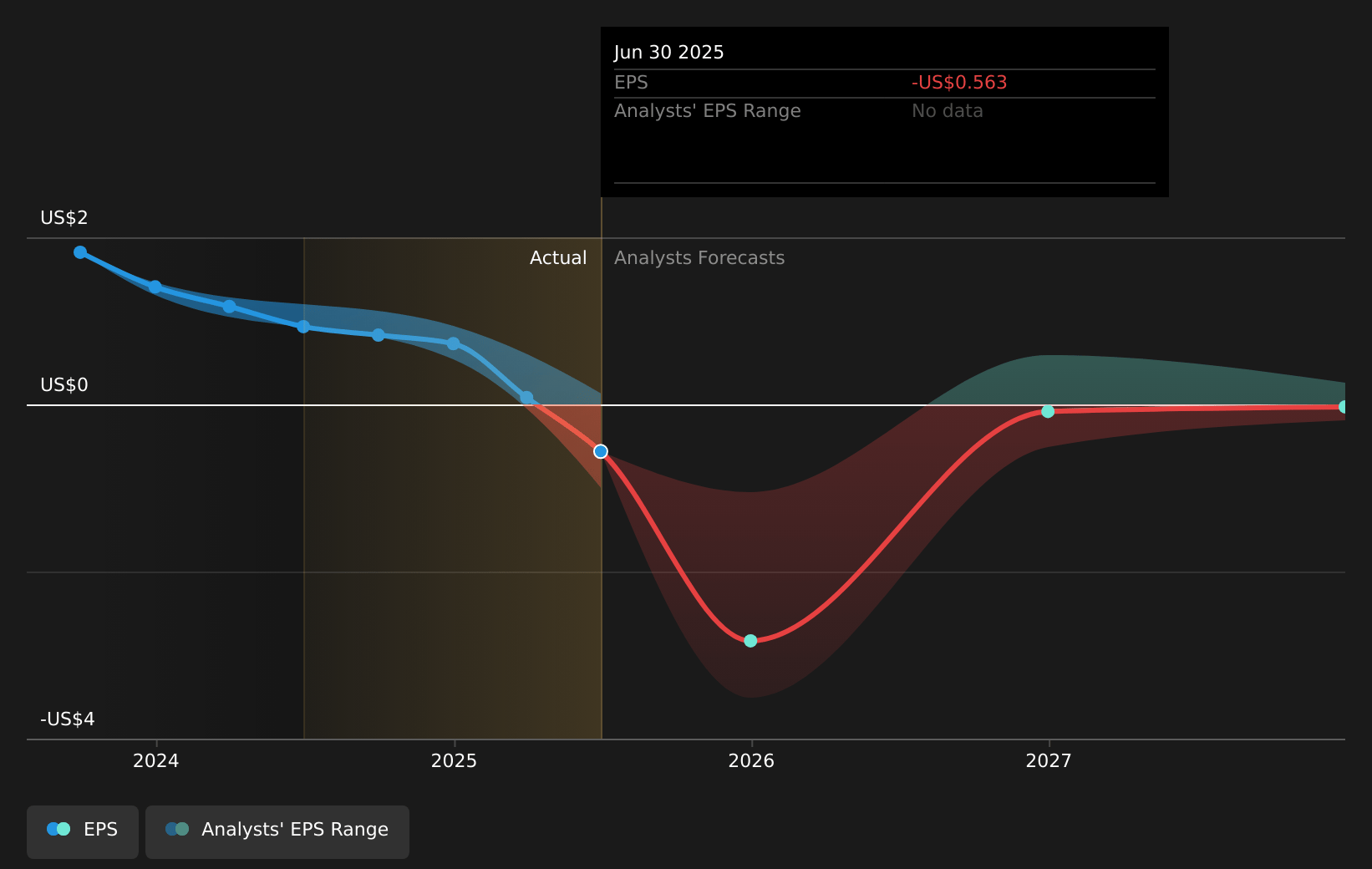

- The bearish analysts expect earnings to reach $42.9 million (and earnings per share of $0.48) by about July 2028, down from $64.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 6.1x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 9.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

Kenmare Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent entry of new concentrate producers has led to a period of oversupply and weaker market visibility for titanium feedstocks, which could depress prices further and negatively impact Kenmare's revenues and profitability in the long term.

- Ongoing operational reliance on the single Moma mine means Kenmare remains highly exposed to political instability, regulatory changes, and local disruptions in Mozambique, putting both revenues and net earnings at risk if material events occur.

- Rising costs associated with complex mining operations, intensive capital projects, and CPI-linked labor and power contracts could erode the company's historically strong EBITDA margins, especially if commodity prices remain subdued.

- Increasing regulatory scrutiny and fiscal renegotiations with the Mozambican government-or more aggressive terms in future renewals-may further raise tax, royalty, or compliance costs, reducing net margins and long-term earnings potential.

- The accelerating shift towards sustainable and circular economy practices globally could, over time, lead to substitution away from virgin mined titanium products, diminishing topline growth if Kenmare is unable to adapt its portfolio or customer base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kenmare Resources is £3.71, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kenmare Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.48, and the most bearish reporting a price target of just £3.71.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $427.4 million, earnings will come to $42.9 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 7.9%.

- Given the current share price of £3.29, the bearish analyst price target of £3.71 is 11.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.