Key Takeaways

- Expansion into higher-margin regions and digitalization boosts prospects, but overreliance on mature markets and integration risks could limit short-term earnings growth.

- Transition to sustainable materials and compliance with tightening regulations may inflate costs, challenging profit margins despite improved sustainability offerings.

- Heavy reliance on plastics, slowing European growth, weak volume trends, and working capital issues threaten profitability and cash flow despite efficiency gains and acquisition activity.

Catalysts

About Essentra- Engages in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal items in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

- While Essentra is leveraging portfolio optimization and expanding into higher-margin, higher-growth geographies like Asia-Pacific and North America-which should, over time, support a return to organic revenue growth and improve overall operating margins-the persistent reliance on mature European markets and exposure to macroeconomic headwinds in that region continue to cap near-term revenue acceleration.

- Although the company is well-positioned to benefit from global demand for lightweight, sustainable, and recyclable materials, its core product base remains predominantly plastic, and the transition to sustainable raw materials, particularly for more engineered items, introduces higher input costs that could limit profit margin expansion if customers are slow to accept price increases.

- Despite the secular trend of increasing regulatory standards for product safety, traceability, and anti-counterfeiting supporting price premium opportunities, Essentra faces a risk that widespread automation and digitization in the manufacturing sector will reduce demand for traditional physical components, putting long-term pressure on both the size of the addressable market and revenue growth.

- While investments in digitalization (including ERP rollouts, CRM improvements, and connected supply chain planning) are expected to deliver operational efficiency and cash conversion upside, the integration of newly acquired businesses and ongoing ERP deployment bring the risk of one-off costs, operational disruption, and slower realization of synergies, potentially suppressing near-term earnings and return on invested capital.

- Although ongoing progress has been made to accelerate the rollout of recycled and bio-based products and advance emission-reduction efforts-sharply improving the sustainability profile-tightening global ESG and zero-waste regulations may continue to drive up compliance and R&D spend, outpacing operational savings and compressing net margins in the long term.

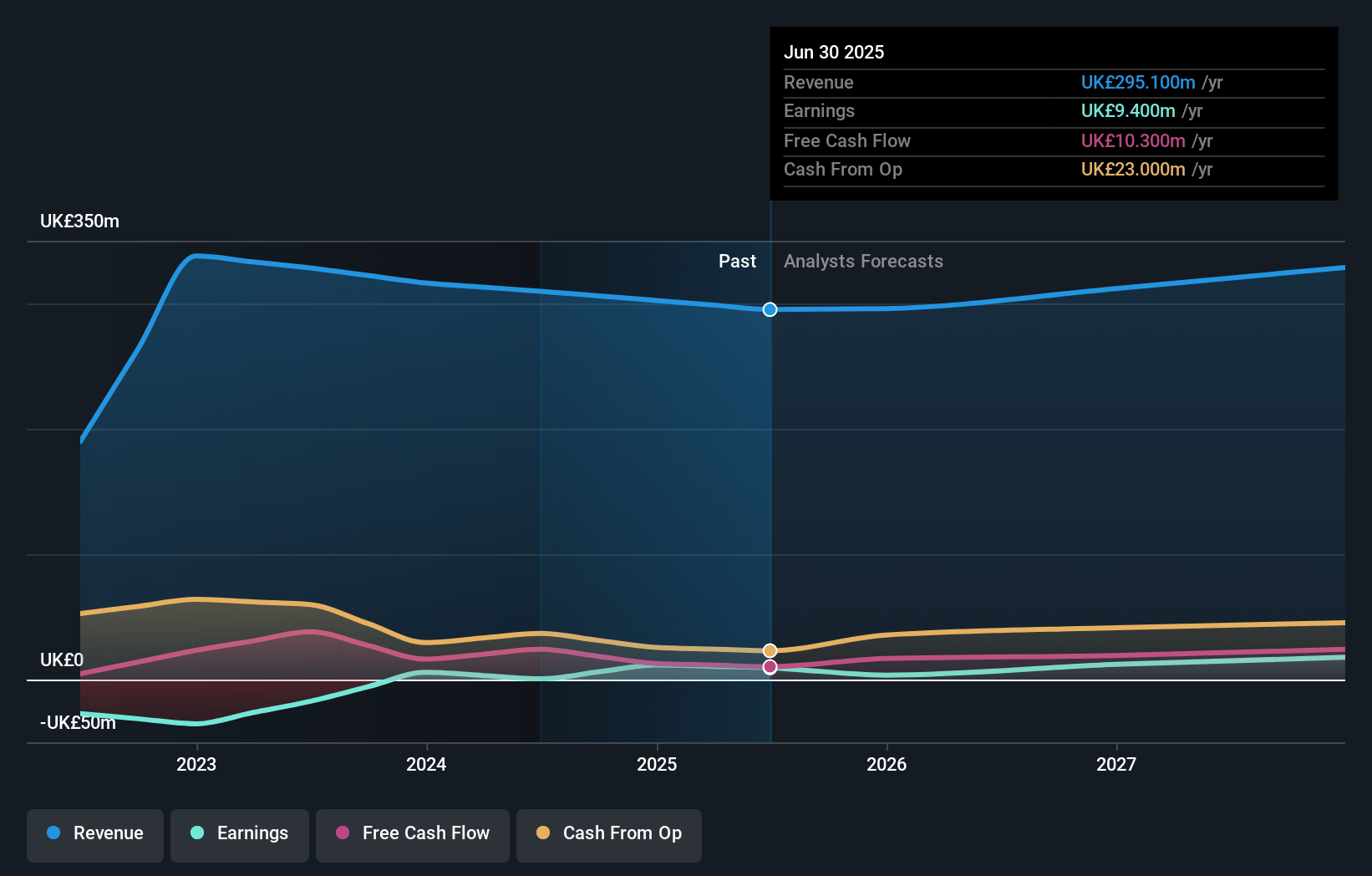

Essentra Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Essentra compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Essentra's revenue will grow by 2.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.8% today to 5.8% in 3 years time.

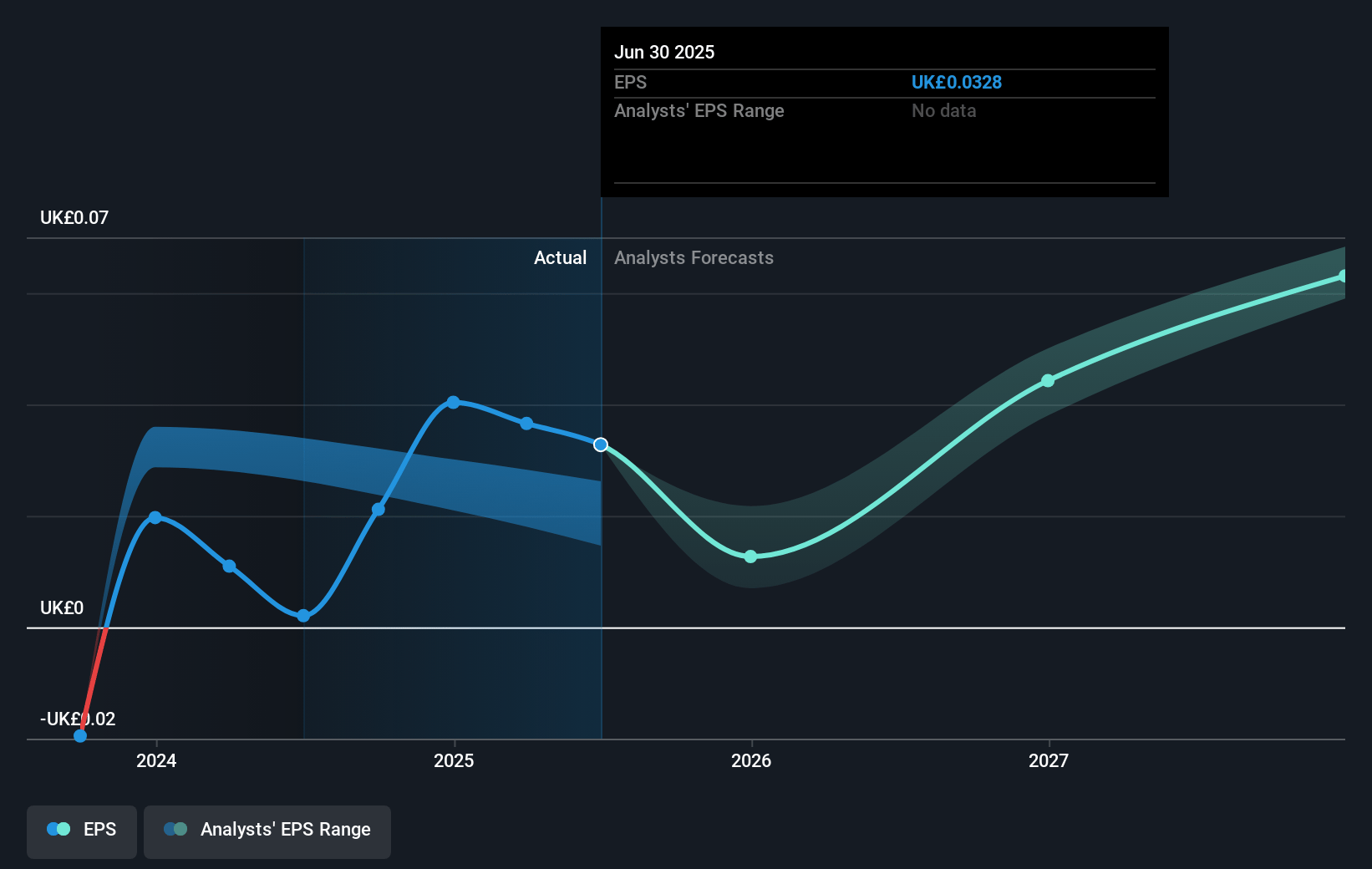

- The bearish analysts expect earnings to reach £18.9 million (and earnings per share of £0.07) by about July 2028, up from £11.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 30.5x on those 2028 earnings, up from 25.8x today. This future PE is greater than the current PE for the GB Chemicals industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

Essentra Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's like-for-like revenues declined by 2.7% year-on-year, and management acknowledges that growth in the key higher-margin European region is expected to lag behind the Americas and Asia, exerting downward pressure on group margins and potentially limiting future profitability.

- Essentra's high exposure to plastic-based products (around two-thirds of its portfolio) poses a significant long-term risk as accelerating ESG and sustainability regulations, as well as shifting customer preferences toward biodegradable and circular materials, could erode demand for traditional offerings and increase compliance costs, both of which would put pressure on revenues and net margins.

- The company's recent margin expansion largely relied on cost efficiencies and holding sale prices rather than significant volume or organic top-line growth, leaving it vulnerable to sustained softness in industrial production and unfavorable Purchasing Managers' Indices, especially since their underlying volumes are closely correlated with these external macroeconomic cycles, which could suppress revenue and earnings.

- While acquisitions are touted as a growth engine, there is an ongoing risk of integration challenges, unexpected costs, and impairment charges-especially as the company maintains leverage targets close to 1.5 times EBITDA-potentially impacting long-term earnings predictability and return on invested capital.

- Persistent elevated working capital levels (currently at 23% of sales, well above the targeted 18%) and recent stock builds suggest ongoing operational and cash flow management challenges; difficulties in normalizing working capital could weigh on free cash flow generation and, in turn, limit reinvestment or return of capital to shareholders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Essentra is £1.6, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Essentra's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.15, and the most bearish reporting a price target of just £1.6.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £326.1 million, earnings will come to £18.9 million, and it would be trading on a PE ratio of 30.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of £1.05, the bearish analyst price target of £1.6 is 34.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.