Key Takeaways

- Widespread digital adoption and advanced AI credit models position the company to attract more small businesses and drive sustained revenue growth.

- Expanding product offerings and strong recurring revenue from flexible lending solutions reduce risk and support higher, more stable margins.

- Loan growth and profitability are at risk from reliance on institutional funding, economic headwinds, early-stage products, expiring government schemes, and rising competition.

Catalysts

About Funding Circle Holdings- Provides online lending platforms in the United Kingdom and internationally.

- Accelerated digital adoption among SMEs seeking streamlined online lending, combined with Funding Circle's industry-leading data/AI-powered credit models and enhanced customer experience, is expected to capture increased origination volumes and boost revenue growth as more small businesses migrate online.

- The strong momentum in FlexiPay and credit card products-with recurring revenue, expanding use cases, and high customer retention-suggests scaling these solutions will drive reliable, higher-margin, fee-based earnings less sensitive to origination cycles.

- Ongoing expansion into new SME customer segments (via short-term loans and broader product suite) and growth in distribution channels are expected to diversify revenue streams, reduce geographic and product concentration risk, and support sustained top-line growth.

- Continued investment in AI-driven underwriting, product iteration, and operational efficiency (including productivity gains from GenAI applications) points to further reductions in credit losses and operational costs, supporting net margin improvement.

- Robust and growing institutional investor appetite for SME loan assets-backed by Funding Circle's consistent delivery of attractive returns above the cost of capital-secures the funding base and enables scalable lending capacity, underpinning future revenue and profit expansion.

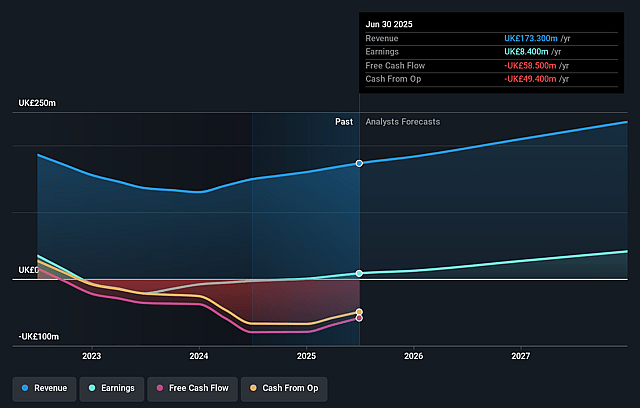

Funding Circle Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Funding Circle Holdings's revenue will grow by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 21.8% in 3 years time.

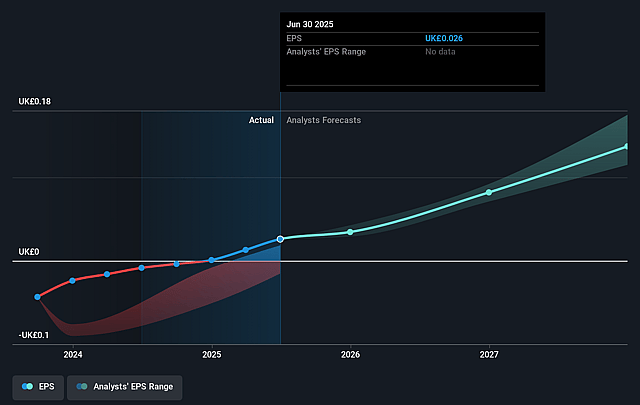

- Analysts expect earnings to reach £54.6 million (and earnings per share of £0.14) by about September 2028, up from £8.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, down from 44.4x today. This future PE is greater than the current PE for the GB Consumer Finance industry at 7.1x.

- Analysts expect the number of shares outstanding to decline by 2.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.44%, as per the Simply Wall St company report.

Funding Circle Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's origination growth and loan volumes are heavily reliant on continued strong institutional "forward flow" funding. Any slowdown or disruption in these institutional capital commitments-potentially due to shifts in risk appetite or funding market conditions-could directly constrain lending capacity and depress future revenues and profits.

- Economic uncertainty and persistent macro headwinds (e.g., flat inflation-adjusted GDP, low business confidence, company insolvencies above long-term trend) indicate an ongoing challenging environment for SMEs. This could result in higher default rates, increased credit losses, or slower demand growth, negatively impacting net margins and earnings.

- FlexiPay and credit card products are still in their early "J-curve" phase and require sustained upfront investment in marketing and credit losses; if usage retention or profitability lags expectations, or if credit losses worsen, anticipated margin expansion could be delayed, thus suppressing group earnings growth.

- A significant portion of recent loan growth has come from variables like government guarantee schemes and newer product launches. As legacy COVID scheme loans wind down and new products require time to scale and transition to platform funding, there is a risk that overall loan origination growth could slow, affecting topline revenue momentum.

- While management contends that direct competition from banks in their specific SME segments remains limited for now, the broader secular trend is increased interest from both traditional banks and fintechs in SME lending. If competition intensifies, it could put pressure on pricing, customer acquisition costs, and ultimately Funding Circle's market share and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.633 for Funding Circle Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.8, and the most bearish reporting a price target of just £1.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £250.3 million, earnings will come to £54.6 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 9.4%.

- Given the current share price of £1.18, the analyst price target of £1.63 is 27.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Funding Circle Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.