Key Takeaways

- Persistent fee pressure, digital disruption, and regulatory costs threaten Aberdeen's traditional model, compressing margins and risking revenue as clients move to lower-cost alternatives.

- Limited success in capturing high-value inflows and ongoing outflows in core segments undermine sustainable growth and put long-term earnings targets at risk.

- Continued growth in key business areas, cost-saving measures, and expansion into higher-margin segments position the company for improved profitability and long-term shareholder returns.

Catalysts

About Aberdeen Group- Provides asset management services in the United Kingdom, Europe, North America, and Asia.

- Aberdeen Group faces persistent structural fee pressure and a long-term shift from active management towards lower-cost passive vehicles, which is expected to erode its revenue base and compress net margins despite near-term cost-saving efforts.

- Ongoing digital disruption, including the rise of direct-to-consumer investing platforms and robo-advisors, threatens Aberdeen's traditional wealth and investment model, risking revenue attrition and client outflows as customers migrate to newer, lower-fee digital alternatives.

- Heightened regulatory scrutiny, especially regarding fee transparency and ESG reporting, is likely to increase compliance costs and operational expenses, with little opportunity to pass these costs on to clients, thereby reducing long-term profitability.

- The group's continued exposure to net outflows in high-margin adviser and investment segments, especially in mature or structurally declining markets, suggests Aberdeen may struggle to achieve sustainable revenue or asset growth, even as it invests in efficiency and new products.

- Despite management's expectations of structural uplift from cost savings and pension surplus realisation, the anticipated contraction in revenue yield across key investments, coupled with limited progress in capturing high-value inflows, puts the company's long-term earnings growth and capital generation targets at risk.

Aberdeen Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Aberdeen Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Aberdeen Group's revenue will decrease by 2.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 17.3% today to 10.8% in 3 years time.

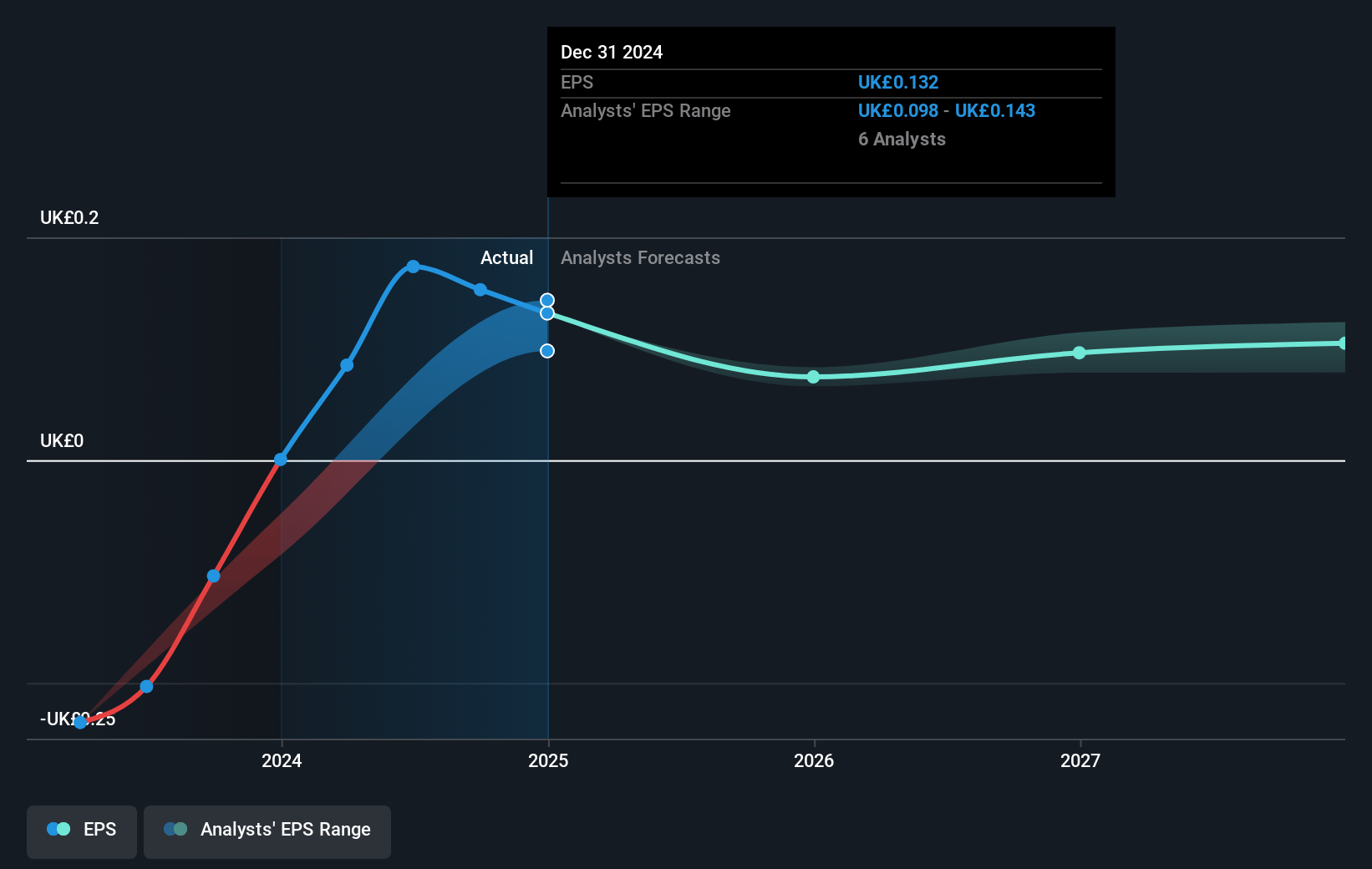

- The bearish analysts expect earnings to reach £137.9 million (and earnings per share of £0.08) by about July 2028, down from £237.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 23.4x on those 2028 earnings, up from 14.6x today. This future PE is greater than the current PE for the GB Capital Markets industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Aberdeen Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong growth in the interactive investor business, which is #1 in the U.K. direct-to-consumer platform by net flows, with customer numbers growing at 8% per year and momentum expected to continue, has the potential to drive revenue and operating profit higher across the group.

- The company is executing a transformation program that is on track to deliver at least £150 million in annualized cost savings by the end of 2025, which will directly increase net capital generation and operating margins, supporting improved earnings and dividend sustainability.

- Expansion into higher-margin segments such as private markets and alternatives, with real assets and alternatives AUM already at £70 billion and margins typically 1.5 to 2 times higher than traditional business, offers the group pathways to improved revenue mix and profitability.

- A large and resilient capital base, including a strong CET1 ratio well above regulatory requirements and a £35 million annual boost to capital generation from the pension surplus agreement starting mid-2025, provides stability and supports the current dividend, which could enhance shareholder returns.

- Long-term secular tailwinds-such as the expected £5.5 trillion intergenerational wealth transfer in the U.K. over the next 25 years and increasing demand for digital, ESG, and retirement solutions-position the company well to capture new assets under management and drive sustainable revenue and profit growth over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Aberdeen Group is £1.4, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Aberdeen Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.2, and the most bearish reporting a price target of just £1.4.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £1.3 billion, earnings will come to £137.9 million, and it would be trading on a PE ratio of 23.4x, assuming you use a discount rate of 8.7%.

- Given the current share price of £1.94, the bearish analyst price target of £1.4 is 38.6% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.