Key Takeaways

- Structural shifts in travel, consumer preferences, and retail technology threaten SSP's core business model and undermine sales and margin growth prospects.

- Reliance on concession contracts and exposure to rising costs and regulatory pressures create ongoing volatility and sustained pressure on profitability.

- Strong sales growth, efficiency gains, strategic expansions, and disciplined capital management are enhancing profitability, diversifying revenue streams, and boosting prospects for shareholder returns.

Catalysts

About SSP Group- Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

- A long-term decline in air travel demand due to increasing climate concerns and the widespread adoption of virtual business solutions threatens the core airport concession business, directly reducing foot traffic, sales volumes and long-term revenue growth for SSP Group.

- Heightened consumer demand for healthier, local, and more sustainable food offerings could outpace SSP's ability to evolve its largely standardized quick-service model, leading to sustained loss of market share, weakened pricing power and structural downward pressure on both revenue and net margins.

- Rapid disruption from new retail technologies, including accelerated adoption of mobile app ordering and food delivery via third-party services or automated models, risks reducing SSP's in-hub impulse transactions, which would lower transaction volumes and compress like-for-like sales growth.

- Over-reliance on airport and rail concession contracts leaves SSP increasingly vulnerable to contract renegotiations, higher concession fees and landlord consolidation, resulting in volatile revenue streams, potential site losses and chronic pressure on gross and operating margins as competitors and landlords gain greater bargaining leverage.

- Persistent cost inflation, especially in labor-intensive regions like North America and Europe, coupled with steadily rising regulatory compliance and sustainability costs, will put structural pressure on margins and net earnings, severely limiting the company's ability to improve profitability even if top-line sales grow.

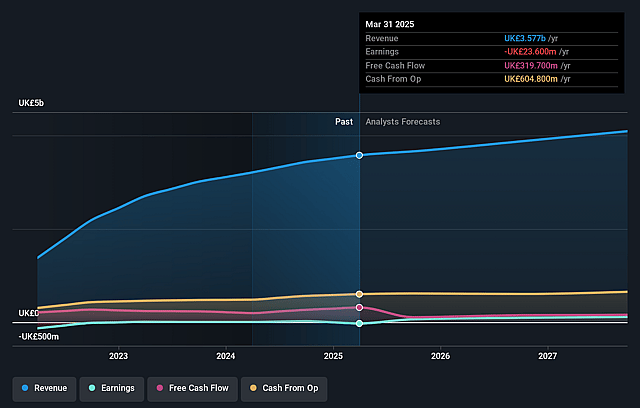

SSP Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SSP Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SSP Group's revenue will grow by 4.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.7% today to 3.5% in 3 years time.

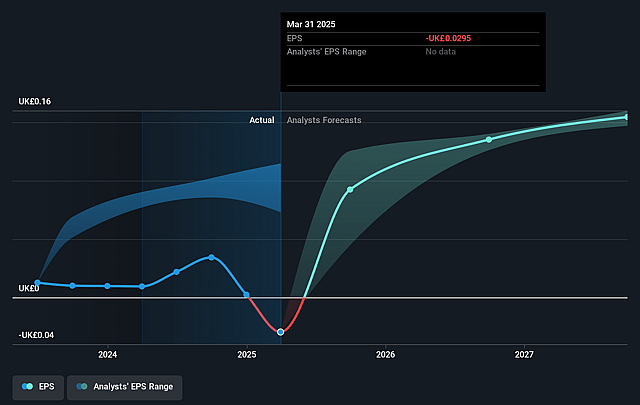

- The bearish analysts expect earnings to reach £141.5 million (and earnings per share of £0.21) by about July 2028, up from £-23.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from -57.9x today. This future PE is lower than the current PE for the GB Hospitality industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.8%, as per the Simply Wall St company report.

SSP Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SSP Group is seeing robust sales growth in key markets such as the UK, Asia, and the Middle East, supported by structural tailwinds like long-term increases in global air travel, which should sustainably boost group revenue and underpin medium-term earnings growth.

- New efficiency programs and aggressive cost reduction initiatives, including labor optimization and menu standardization, are being rolled out across the group, which are already delivering tangible savings in core markets and are expected to drive improvement in net margins and overall profitability.

- Strategic investments in high-growth regions and successful acquisitions in Asia-Pacific, the Middle East, and Australia have positioned the company to benefit from above-average passenger growth, improving SSP's revenue mix and diversifying its earnings base.

- The company is implementing targeted turnaround plans in underperforming European units, with credible management changes, reset of rent profiles, and capital reallocation, which management believes will enable Continental Europe to move to a 5% operating margin and add materially to group earnings.

- Improved capital discipline, reduced capex, and expectations of significantly enhanced free cash flow are positioning SSP to consider initiating a share buyback and deliver direct returns to shareholders, supporting future earnings per share and potentially supporting share price appreciation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SSP Group is £1.68, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SSP Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.3, and the most bearish reporting a price target of just £1.68.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £4.0 billion, earnings will come to £141.5 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 12.8%.

- Given the current share price of £1.71, the bearish analyst price target of £1.68 is 1.5% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.