Key Takeaways

- Deep management changes and digital initiatives could drive structural margin gains and earnings growth well ahead of market expectations.

- Rapid footprint expansion and strategic moves in underpenetrated travel markets may unlock top-line growth and shareholder returns that consensus significantly underestimates.

- Structural shifts in travel, rising labor and compliance costs, and changing consumer preferences threaten SSP Group's revenue growth, margins, and market position amid high leverage.

Catalysts

About SSP Group- Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

- Analyst consensus expects margin improvement from contract exits and cost efficiency, but this understates potential upside: SSP's deep management overhaul, faster-than-expected resets of rent profiles, and "no sacred cows" approach in Continental Europe set the stage for margin expansion above current targets, possibly creating structural uplift to group earnings much sooner than consensus anticipates.

- While consensus highlights steady returns on recent investments, it overlooks the accelerating pace of payback: The normalization of renewals, dramatic CapEx reduction, and rapid integration of high-IRR acquisitions-combined with technology-led margin initiatives-could drive operating profits and cash flows materially above current forecasts over the next 18 months.

- SSP's footprint in key North American and Asia-Pacific air travel markets positions it to fully capture the next wave of passenger growth from rising middle classes and massive infrastructure build-out; as underpenetrated markets scale up, top-line growth and operating leverage could materially outpace broader industry expectations.

- The company's digital transformation-spanning menu standardization, AI-driven labor scheduling, and enhanced customer ordering-unlocks higher average spend per traveler, improved productivity, and structurally better margins, which are likely being underestimated in forward earnings projections.

- The imminent IPO of the Indian TFS joint venture and a credible, programmatic buyback program-enabled by a rebased, highly cash-generative SSP-offer substantial and unappreciated catalysts for EPS expansion, capital returns, and balance sheet optimization well beyond consensus scenarios.

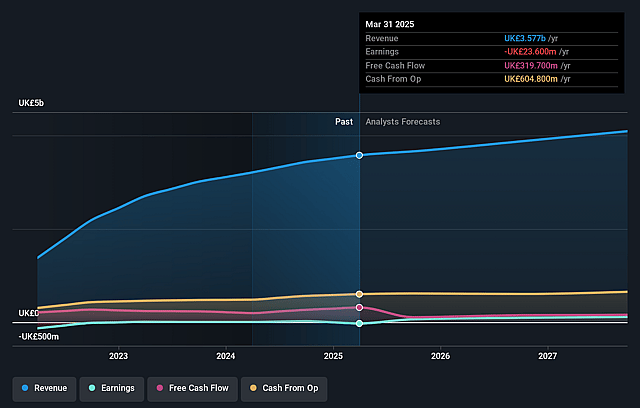

SSP Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SSP Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SSP Group's revenue will grow by 7.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.7% today to 4.6% in 3 years time.

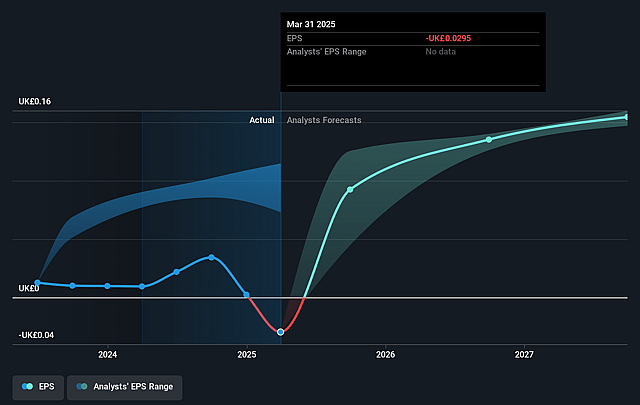

- The bullish analysts expect earnings to reach £203.5 million (and earnings per share of £0.25) by about September 2028, up from £-23.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, up from -50.9x today. This future PE is greater than the current PE for the GB Hospitality industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.94%, as per the Simply Wall St company report.

SSP Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating trend of remote work and virtual meetings is likely to result in structurally lower business travel over the long term, reducing passenger volumes in airports and rail stations, which could cap SSP Group's like-for-like revenue growth and slow recovery in key geographies such as North America and Continental Europe.

- Persistent labor shortages and rising wage costs in the hospitality sector, as noted in North America and other regions, have driven up labor expenses to 32.4% of sales and may further erode operating margins if these cost pressures outpace efficiency initiatives.

- Heightened regulatory scrutiny on sustainability and climate change is set to increase compliance costs for energy usage, packaging, and supply chains within travel catering, putting incremental pressure on net margins as the industry shifts towards greener operations.

- Evolving consumer preferences towards healthier and plant-based food options could challenge SSP Group's legacy food offerings, potentially diminishing sales growth and threatening market share if menu innovation does not keep pace with these secular changes.

- The group remains highly leveraged, with net debt at £764 million and leverage at 2.2 times EBITDA, exposing it to risks from higher interest rates or tightening capital markets, which could elevate interest expense and constrain future net income and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SSP Group is £3.3, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SSP Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.3, and the most bearish reporting a price target of just £1.6.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £4.4 billion, earnings will come to £203.5 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 12.9%.

- Given the current share price of £1.5, the bullish analyst price target of £3.3 is 54.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.