Last Update 27 Nov 25

Fair value Decreased 0.20%SSPG: Shares Will Advance on Buyback Momentum and Expanding US and India Presence

Analysts have slightly reduced their target price for SSP Group, with recent updates citing a new range from £1.90 to £3.10 per share. This adjustment largely reflects tempered revenue growth expectations and ongoing shifts in international market exposure.

Analyst Commentary

Recent updates from research analysts provide a mixed outlook for SSP Group. The adjustments to target prices indicate nuanced perspectives on the company’s valuation, market exposure, and growth trajectory. Below is a summary of the main takeaways from current street research coverage.

Bullish Takeaways- Bullish analysts highlight SSP Group’s attractive exposure to the United States and rapidly expanding presence in the Indian market, which are viewed as key drivers of future growth.

- There is increased confidence in the company’s ability to capitalize on international market trends, with certain upgrades citing long-term growth potential in emerging regions.

- Some maintain a positive outlook on execution and believe that recent strategic moves position SSP Group well to outperform sector peers.

- Despite minor target price reductions, select analysts continue to rate the shares as a buy, reflecting confidence in valuation relative to underlying fundamentals.

- Bearish analysts are cautious about tempered revenue growth expectations, which have prompted the recent adjustments in target prices.

- Concerns remain regarding the consistent execution of SSP Group’s international expansion plans, particularly in challenging macroeconomic conditions.

- Some express reservations about the pace at which the company can realize further margin improvements and raise questions on near-term upside.

- Ongoing shifts in global market exposure add uncertainty and contribute to more conservative price targets and neutral ratings from a portion of the street.

What's in the News

- SSP Group has announced a share repurchase program worth up to £100 million. Barclays Bank PLC will assist in the buyback. The program is set to end no later than October 9, 2026. (Key Developments)

- The company provided earnings guidance for 2025 and 2026, forecasting group revenue of approximately £3.7 billion for 2025 and operating profit of about £230 million, with expected EPS within current market expectations. (Key Developments)

- Irenic Capital Management LP is advocating for SSP Group to consider a take-private transaction. The firm suggests the company could be valued at a 50 percent premium and highlights growth opportunities in US airports. (Key Developments)

Valuation Changes

- Fair Value Estimate has decreased marginally from £2.24 to £2.24 per share.

- Discount Rate remains unchanged at 13.19 percent.

- Revenue Growth expectations have declined slightly from 4.71 percent to 4.52 percent.

- Net Profit Margin forecast has increased modestly from 4.31 percent to 4.33 percent.

- Future P/E Ratio has edged down from 14.82x to 14.66x.

Key Takeaways

- Strategic exits from loss-making businesses and efficiency improvements aim to boost profitability by cutting costs and increasing net margins.

- Focus on long-term sustainable growth and contract wins, especially in high-growth markets, positions SSP Group for future revenue and earnings growth.

- Profitability in European markets is pressured by macroeconomic factors, execution issues, and contract renewals, while labor costs challenge North America margins.

Catalysts

About SSP Group- Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

- SSP Group's focus on long-term growth through contract renewals and new wins, particularly in high-growth markets like North America, Asia, and the Middle East, positions the company for future revenue growth due to a stronger competitive position and market expansion.

- The planned strategic exit from loss-making operations, such as the German motorway service business, and efficiency improvements in Continental Europe are poised to positively impact net margins by reducing costs and increasing profitability.

- With significant recent investments maturing and the integration of acquisitions underway, SSP Group expects to enhance operating profit margins through increased returns on these investments, thereby driving future earnings growth.

- The implementation of cost-efficiency programs, including menu optimization and technological advancements across various regions, is anticipated to improve net margins by mitigating inflationary pressures and enhancing labor productivity.

- SSP Group’s emphasis on driving sustainable growth through like-for-like improvements and contract extensions, alongside maintaining a disciplined approach to future capital expenditure, is expected to bolster free cash flow and facilitate shareholder returns, ultimately supporting long-term earnings growth.

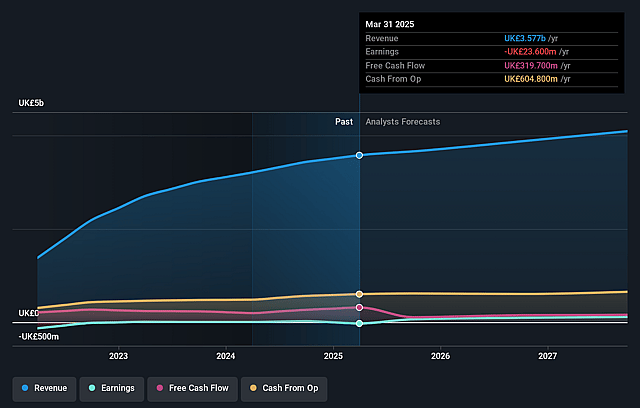

SSP Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SSP Group's revenue will grow by 5.3% annually over the next 3 years.

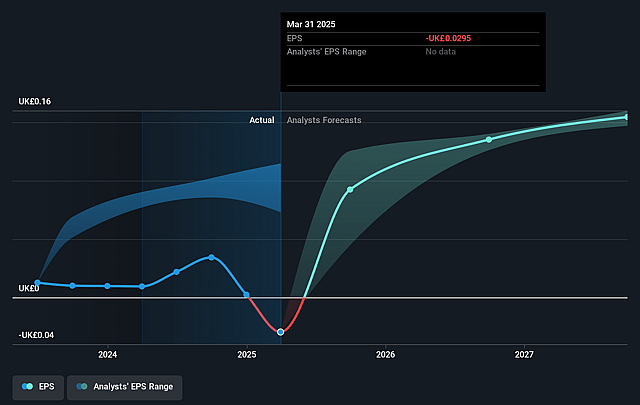

- Analysts assume that profit margins will increase from -0.7% today to 4.2% in 3 years time.

- Analysts expect earnings to reach £176.2 million (and earnings per share of £0.15) by about September 2028, up from £-23.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, up from -51.7x today. This future PE is lower than the current PE for the GB Hospitality industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.94%, as per the Simply Wall St company report.

SSP Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The profitability in parts of the Continental European region has fallen short of expectations due to macroeconomic, structural, temporary, and executional headwinds, negatively impacting regional margins and overall earnings.

- The company faces challenges in recovering rail passenger numbers to pre-COVID levels, particularly in Northern Europe, potentially affecting future revenue growth in this segment.

- Disruptions and costs associated with the high volume of contract renewals, especially in the Nordic countries, have put additional pressure on profitability and projected net margins.

- The ongoing exit from the loss-making motorway service business in Germany will require cost management and strategic focus, impacting cash flows and short-term net income.

- In North America, labor inflation and supply-side labor shortages continue to put pressure on costs, which could challenge the company's ability to maintain or improve operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.292 for SSP Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.3, and the most bearish reporting a price target of just £1.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £4.2 billion, earnings will come to £176.2 million, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 12.9%.

- Given the current share price of £1.52, the analyst price target of £2.29 is 33.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SSP Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.