Key Takeaways

- Shifting consumer preferences toward healthier options and aggregators, along with economic pressures, are set to dampen revenue growth and erode direct channel strength.

- Rising technology, labor, and compliance costs threaten margins and franchise profitability, risking slower reinvestment and weaker long-term earnings potential.

- Expanding store footprint, digital upgrades, and franchisee alignment drive operational efficiency, brand strength, and shareholder value through improved margins, reinvestment, and robust customer demand.

Catalysts

About Domino's Pizza Group- Domino’s Pizza Group plc owns, operates, and franchises Domino’s Pizza stores in the United Kingdom and Ireland.

- The ongoing shift toward healthier lifestyles and consumer preferences for less processed and lower-calorie foods threatens to erode long-term demand for traditional pizza offerings, placing sustained downward pressure on Domino's future same-store sales growth and dampening its top-line revenue prospects.

- Intensifying investments in digital platforms and supply chain automation, necessary to keep pace with accelerating digital disruption and rising consumer expectations, are expected to raise operational costs substantially, eroding Domino's operating leverage and resulting in structural pressure on net margins as technology demands escalate.

- Rapid urbanization and a persistently high cost of living in key UK and European markets are shrinking consumer discretionary budgets, likely depressing order frequency and average ticket size for Domino's in the long run, directly impacting revenue growth and cash generation.

- Franchisee profitability is increasingly vulnerable due to continued cost inflation in wages, food, utilities, and compliance with stricter regulation, which may discourage franchise expansion, limit reinvestment, and ultimately squeeze group margins and EBITDA growth below expectations.

- Growing consumer preference for multi-brand delivery aggregators, combined with labor shortages and industry-wide quick-service restaurant headwinds, is set to weaken Domino's direct-to-consumer channel, driving higher marketing spend and increased customer acquisition costs, which could compress earnings growth rates over time.

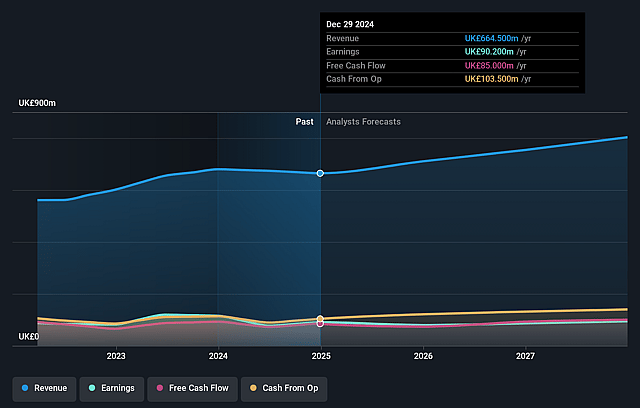

Domino's Pizza Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Domino's Pizza Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Domino's Pizza Group's revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 13.6% today to 11.0% in 3 years time.

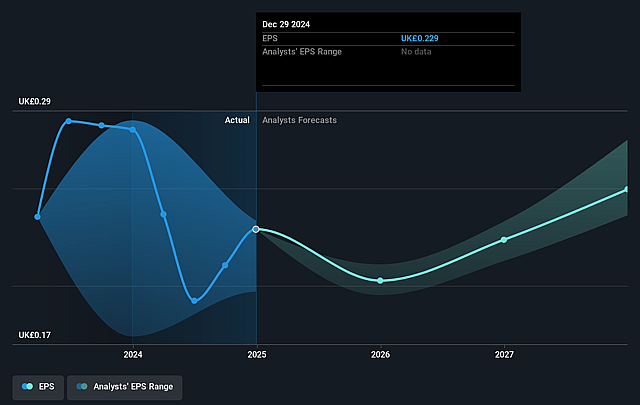

- The bearish analysts expect earnings to reach £88.7 million (and earnings per share of £0.24) by about July 2028, down from £90.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 10.7x today. This future PE is lower than the current PE for the GB Hospitality industry at 17.1x.

- Analysts expect the number of shares outstanding to decline by 1.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.22%, as per the Simply Wall St company report.

Domino's Pizza Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Domino's Pizza Group is experiencing strong long-term store expansion, particularly in underpenetrated regions like Ireland and smaller UK towns, which creates significant white space for organic growth and supports increased revenue and system sales in future years.

- Continued investment in supply chain automation and digital infrastructure-including rollout of a new ERP and e-commerce platform-is driving operational efficiency, enhancing order accuracy and capacity, and leading to improved net margins and free cash flow generation.

- The company's resilient brand strength, increasing market share even in tough conditions, and high customer loyalty-including a robust and growing loyalty database-suggest sustained customer demand, which positively impacts like-for-like sales and earnings over the long term.

- The alignment of franchisees through a newly established Profit Growth Framework (PGF) underpins stable and increasing franchisee profitability, incentivizing ongoing reinvestment, new store openings, and ultimately supporting group EBITDA and earnings per share growth.

- A strong, cash-generative business model-with disciplined capital allocation towards core business investment, sustained dividend growth, and continued share buybacks-provides financial flexibility for both shareholder returns and future growth opportunities, ensuring steady or growing net earnings and dividends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Domino's Pizza Group is £2.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Domino's Pizza Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.0, and the most bearish reporting a price target of just £2.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £803.7 million, earnings will come to £88.7 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 10.2%.

- Given the current share price of £2.47, the bearish analyst price target of £2.5 is 1.3% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.