Key Takeaways

- Rapid digital platform enhancements, operational efficiency, and store expansion position Domino's for significant market share, sales, and margin gains beyond current forecasts.

- Automation, improved infrastructure, and B2B logistics services create new revenue streams and unlock outsized growth potential relative to industry averages.

- Shifting consumer preferences, regulatory pressures, rising costs, intense competition, and limited expansion opportunities collectively threaten Domino's Pizza Group's future growth and profitability.

Catalysts

About Domino's Pizza Group- Domino’s Pizza Group plc owns, operates, and franchises Domino’s Pizza stores in the United Kingdom and Ireland.

- Analyst consensus anticipates meaningful revenue and net margin expansion from the Profit Growth Framework and alignment with franchisees, but this may significantly understate the upside-execution has already driven robust order count growth and sub-25-minute delivery, which positions Domino's to gain far more market share as rivals retrench, driving both higher top-line growth and incremental EBITDA gains ahead of expectations.

- Analysts broadly agree that Irish expansion provides organic revenue growth, yet the acceleration and scale-doubling prior store openings, taking majority control, and leveraging upgraded commissary infrastructure-could enable Domino's to more than double EBITDA contribution from Ireland over the medium term, with store count, profitability, and market share gains all outpacing industry averages.

- Domino's proprietary digital platform evolution-rapidly scaling its loyalty scheme and amassing more granular customer and order data-unlocks potential for machine learning-driven dynamic pricing and hyper-personalized marketing, which could meaningfully increase order frequency and average ticket size, driving sustained like-for-like sales growth and margin uplift.

- Automation investments being fast-tracked across the supply chain network deliver industry-leading efficiency and, uniquely, create surplus capacity; this opens the door to high-margin B2B revenue streams by offering logistics services to compatible food brands, with the potential for significant EBITDA and free cash flow accretion beyond current store economics.

- Very substantial white space remains for store penetration, with Domino's underleveraged points-of-sale model (roughly double the household coverage per store versus key global peers) suggesting a credible pathway not just to 2,000 stores, but far beyond-as consumer lifestyles become more urban and convenience-oriented, store count and system sales could compound at rates not yet reflected in forecasts, driving long-term revenue, EBITDA, and earnings growth.

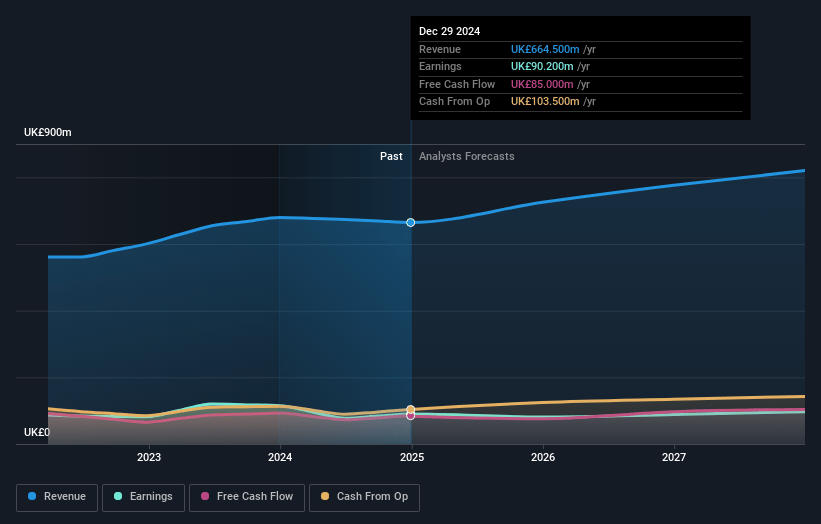

Domino's Pizza Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Domino's Pizza Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Domino's Pizza Group's revenue will grow by 9.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 13.6% today to 12.1% in 3 years time.

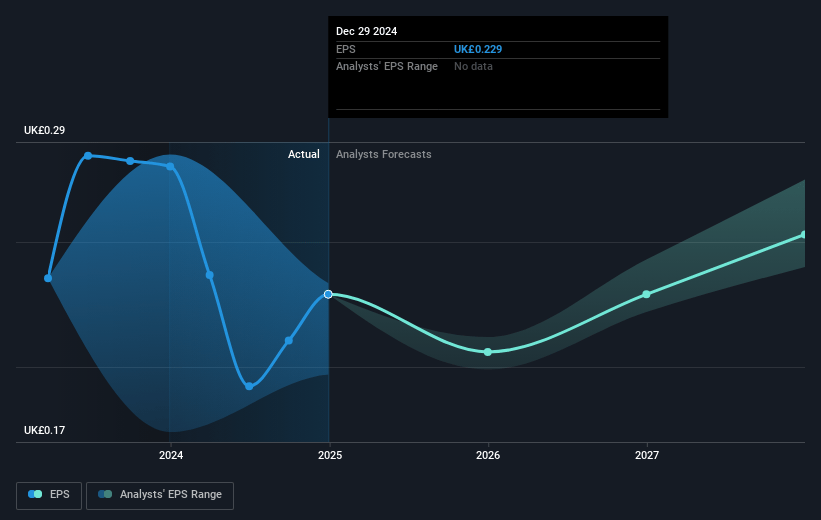

- The bullish analysts expect earnings to reach £106.9 million (and earnings per share of £0.28) by about July 2028, up from £90.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.7x on those 2028 earnings, up from 10.7x today. This future PE is greater than the current PE for the GB Hospitality industry at 17.1x.

- Analysts expect the number of shares outstanding to decline by 1.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.22%, as per the Simply Wall St company report.

Domino's Pizza Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rising consumer demand for health and wellness, combined with increased attention to nutritional content, poses a risk that could erode Domino's Pizza Group's long-term customer base, potentially causing a structural decline in revenue as more consumers choose healthier or alternative meal options.

- Ongoing regulatory changes related to nutrition disclosure, food ingredient restrictions, and advertising to children are likely to increase compliance costs and operational complexity for Domino's Pizza Group, which could compress net margins and create additional financial headwinds.

- Intensifying competition from new food delivery aggregators, emerging direct-to-consumer brands, and restaurants offering healthier, more experiential, or sustainable options could reduce brand loyalty and chip away at Domino's Pizza Group's market share, negatively impacting both revenues and long-term earnings power.

- Persistent inflation in food and wage costs, coupled with franchisee pressures around profitability and rising operational expenses, creates a risk that franchisees may demand more favorable terms or even exit, which could erode Domino's Pizza Group's revenue base and push down overall net earnings.

- Geographic saturation in the core UK and Ireland markets, with a limited ability for significant store unit expansion relative to addressable market constraints, may result in stalled same-store sales growth and hamper Domino's Pizza Group's capacity for sustained top-line revenue growth in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Domino's Pizza Group is £5.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Domino's Pizza Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.0, and the most bearish reporting a price target of just £2.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £879.9 million, earnings will come to £106.9 million, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 10.2%.

- Given the current share price of £2.47, the bullish analyst price target of £5.0 is 50.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.