Last Update06 Aug 25Fair value Decreased 13%

The consensus price target for Domino's Pizza Group has been revised downward, primarily due to a decline in net profit margin and an increased discount rate, resulting in a new fair value estimate of £3.38.

Valuation Changes

Summary of Valuation Changes for Domino's Pizza Group

- The Consensus Analyst Price Target has fallen from £3.64 to £3.38.

- The Net Profit Margin for Domino's Pizza Group has fallen from 11.72% to 10.75%.

- The Discount Rate for Domino's Pizza Group has risen from 10.24% to 10.85%.

Key Takeaways

- Supply chain automation, digital payments, and loyalty initiatives are driving cost efficiencies, operational leverage, and higher customer lifetime value for Domino's.

- Expansion in underserved areas and innovative, diversified menu offerings position the company for accelerated growth and broader market reach.

- Stagnant sales, rising costs, and cautious consumer sentiment threaten Domino's growth, margins, and returns, with ongoing reinvestment needed to sustain competitiveness amid market saturation.

Catalysts

About Domino's Pizza Group- Owns, operates, and franchises Domino’s Pizza stores in the United Kingdom and Ireland.

- The company's deepening investment in supply chain automation and logistics (including robotics and ERP rollout) is already leading to material cost efficiencies in freight, warehousing, and production-setting up for further operational margin expansion as these projects scale through 2026 and beyond.

- Market share gains in a declining sector, combined with the significant outperformance of newly opened stores in small towns and white-space expansion in Ireland, suggest Domino's is well positioned to accelerate top-line growth as consumer sentiment recovers and competitors exit.

- The digital-first ordering platform and upcoming national rollout of a data-driven loyalty program (showing early double-digit incrementality) will allow Domino's to capture higher frequency and larger user cohorts, driving both revenue growth and increased customer lifetime value.

- Strategic emphasis on product innovation (including healthier and lower-calorie options) and menu diversification is enabling the company to tap into evolving consumer preferences, likely supporting broader addressable market and sustained same-store sales growth.

- Ongoing transition to digital payments-facilitated by Domino's technology investments-will further reduce transactional friction, supporting higher average order values and facilitating operational leverage that benefits earnings and net margin over the medium to long-term.

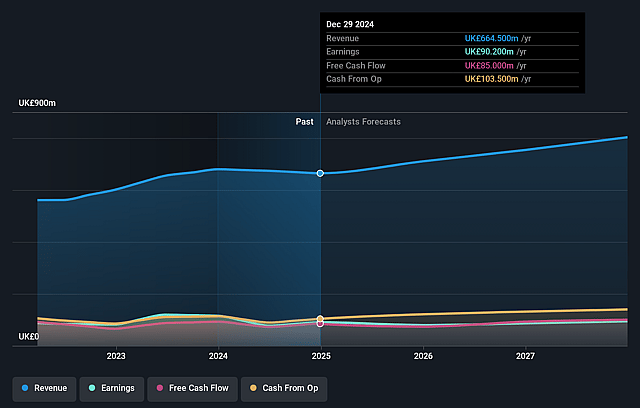

Domino's Pizza Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Domino's Pizza Group's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.6% today to 10.2% in 3 years time.

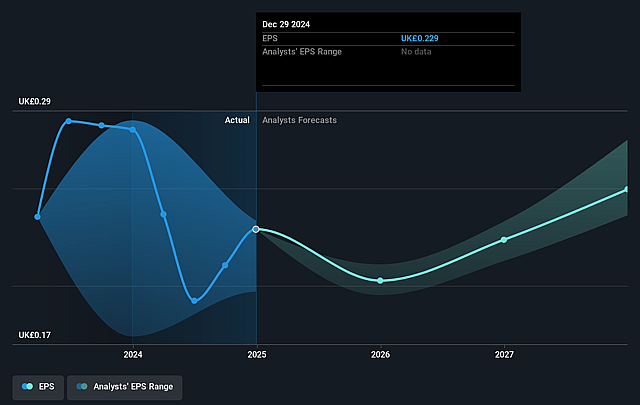

- Analysts expect earnings to reach £79.8 million (and earnings per share of £0.21) by about August 2028, up from £77.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.0x on those 2028 earnings, up from 10.4x today. This future PE is greater than the current PE for the GB Hospitality industry at 17.3x.

- Analysts expect the number of shares outstanding to decline by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.79%, as per the Simply Wall St company report.

Domino's Pizza Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Stagnant order growth and declining like-for-like sales, coupled with weakness in the overall pizza and takeaway market, suggest brand maturity and potential market saturation, risking constrained future revenue growth and slower store expansion.

- Higher employment costs, additional investment in technology, and labor-related increases such as national insurance are raising operating expenses, placing ongoing pressure on net margins and potentially compressing future earnings.

- Lower volumes in the supply chain, with customers putting fewer items in their baskets, leading to reduced supply chain EBITDA and indicating shifts in consumer spending habits that could drag on both top-line revenue and profitability.

- Rising costs due to environmental compliance, sustainability initiatives, and investments in automation and distribution infrastructure require significant capital outlays, which may suppress near-term free cash flow and require continuous reinvestment to sustain competitiveness.

- Heightened economic uncertainty, cautious consumer sentiment, and reliance on disciplined execution of expansion and acquisition plans create risks of delayed growth, missed targets, and shareholder returns being potentially limited if market conditions do not improve.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.175 for Domino's Pizza Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.5, and the most bearish reporting a price target of just £1.95.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £780.1 million, earnings will come to £79.8 million, and it would be trading on a PE ratio of 21.0x, assuming you use a discount rate of 10.8%.

- Given the current share price of £2.07, the analyst price target of £3.18 is 34.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.