Key Takeaways

- Shifting consumer health trends, regulatory pressures, and intensifying competition threaten Domino's long-term market share, volume growth, and topline expansion.

- Rising input costs, market saturation, and uncertain returns from digital investments may compress margins and hinder sustained earnings growth.

- Strengthening brand, operational efficiencies, geographic expansion, and customer loyalty initiatives drive reliable growth prospects and shareholder returns despite industry headwinds.

Catalysts

About Domino's Pizza Group- Owns, operates, and franchises Domino’s Pizza stores in the United Kingdom and Ireland.

- Shifting consumer preferences towards healthier diets and growing adoption of anti-obesity measures, such as GLP-1 weight loss drugs, threaten to undermine long-term sales growth for Domino's Pizza Group, particularly as regulatory environments get tougher on high-calorie and high-sodium foods. These forces pose structural risks to both volume growth and topline revenue over the next decade.

- Rising input costs driven by climate change policy, ongoing inflation, and resource scarcity are expected to pressure Domino's cost base, especially for key ingredients like dairy and packaging materials, resulting in sustained margin compression and weaker net earnings growth.

- The company's traditional focus on pizza-centric fast food faces increasing long-term competition from premium fast-casual brands, third-party aggregators, and direct-to-home meal alternatives, eroding Domino's ability to maintain market share, pricing power and achieve significant same-store sales expansion.

- Market saturation in the UK, along with limited international expansion opportunities outside a mature core market, constrains Domino's ability to achieve outsized top-line growth beyond its current footprint, making long-term revenue and earnings targets such as 2,000 stores increasingly ambitious and potentially unattainable without significant cannibalization.

- Ongoing investments in automation, digital platforms, and menu innovation may not keep pace with consumer expectations for customization, quality, and sustainability, resulting in elevated capital expenditures and execution risk, while failing to deliver the revenue growth and expanded net margins implied by a premium valuation.

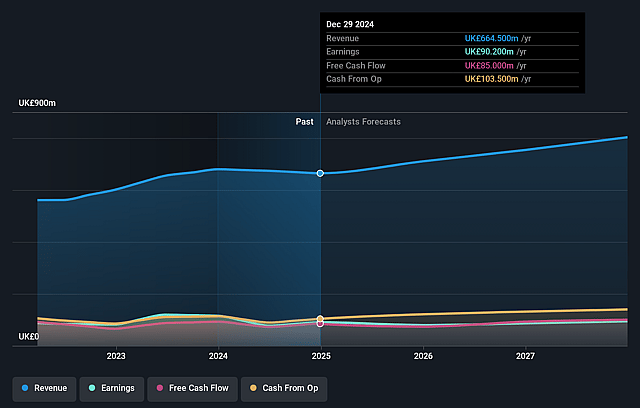

Domino's Pizza Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Domino's Pizza Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Domino's Pizza Group's revenue will grow by 3.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 11.6% today to 10.6% in 3 years time.

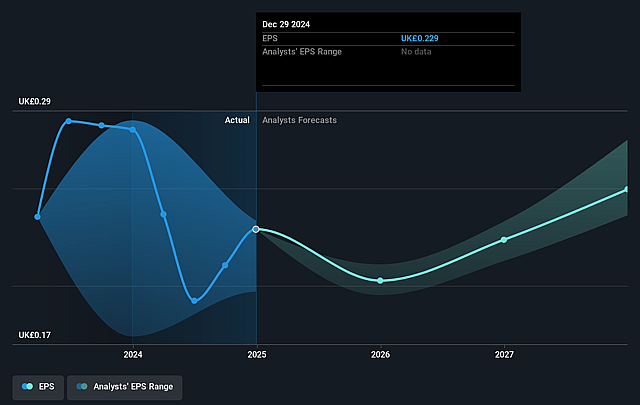

- The bearish analysts expect earnings to reach £78.4 million (and earnings per share of £0.21) by about August 2028, up from £77.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 10.4x today. This future PE is lower than the current PE for the GB Hospitality industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 1.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.83%, as per the Simply Wall St company report.

Domino's Pizza Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Domino's Pizza Group continues to gain significant market share even as the overall UK takeaway and pizza markets are declining, signaling increasing brand strength and the potential to capture customers and revenues left behind by struggling competitors.

- Strategic investment in supply chain automation, robotics, and digital platforms is already delivering measurable efficiency gains, lowering production, warehousing and labor costs, and is expected to bolster net margins and earnings growth in the medium to long term.

- Store expansion into underpenetrated regions, particularly small towns and Ireland, is showing outsized sales per address and rapid profitability, supporting a long runway for topline revenue and EBITDA growth through network growth.

- The company's successful loyalty programme is driving double-digit incrementality in order frequency, keeping customers within its ecosystem and underpinning reliable recurring revenue, which could drive both revenue and margin growth as adoption broadens.

- Robust free cash flow generation, ongoing dividend increases, and disciplined capital allocation, including the potential for accretive acquisitions or buybacks, position Domino's to support shareholder value and earnings per share growth even in a challenging consumer environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Domino's Pizza Group is £1.95, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Domino's Pizza Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.5, and the most bearish reporting a price target of just £1.95.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £740.1 million, earnings will come to £78.4 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 10.8%.

- Given the current share price of £2.06, the bearish analyst price target of £1.95 is 5.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.