Last Update09 Oct 25Fair value Increased 2.24%

Burberry Group's fair value estimate has been raised to £12.68 per share from £12.40. Analysts cite a sector-wide recovery and optimism over sales momentum in China as key factors behind the upward revision.

Analyst Commentary

Recent updates from street research firms reflect growing optimism around Burberry Group, as well as a measured perspective on the road ahead. Analysts have weighed positive sector dynamics and company-specific factors while also noting some ongoing risks.

Bullish Takeaways

- Bullish analysts highlight that the luxury sector may be entering an early phase of recovery. This could improve overall growth and investor sentiment for Burberry.

- There is an expectation that stronger sales momentum in China could serve as a critical growth lever and further strengthen Burberry’s valuation outlook.

- Upward price target revisions suggest confidence in execution and management’s ability to capitalize on favorable regional trends.

- Analysts assign a Buy rating in anticipation of further upside potential if market conditions in key regions, particularly Asia, continue to improve.

Bearish Takeaways

- Some analysts remain cautious and emphasize that the recovery in the European luxury sector is still nascent and could face setbacks.

- Uncertainties persist around the sustainability of demand in China. This may impact Burberry’s medium-term growth if momentum slows.

- Valuation upgrades are partly contingent on external macroeconomic trends. This exposes the stock to broader market volatility and shifts in consumer sentiment.

What's in the News

- Burberry Group plc has been added to the FTSE 100 Index (Key Developments)

- Burberry Group plc has been removed from the FTSE 250 Index (Key Developments)

- Burberry Group plc has been removed from the FTSE 250 (Ex Investment Companies) Index (GBP) (Key Developments)

Valuation Changes

- The Fair Value Estimate has risen slightly, moving from £12.40 to £12.68 per share.

- The Discount Rate has increased marginally from 9.90% to 10.06%.

- The Revenue Growth projection has declined modestly, from 3.49% to 3.32%.

- The Net Profit Margin forecast has fallen slightly, dropping from 8.32% to 8.06%.

- The Future P/E Ratio has increased, rising from 25.95x to 27.64x.

Key Takeaways

- Revitalized brand positioning and digital investments are strengthening direct-to-consumer engagement and supporting margin improvement through operational efficiency.

- Store network upgrades and localized marketing enhance productivity and brand appeal among affluent, younger consumers in key global markets.

- Persistent wholesale decline, global risks, asset inefficiency, heavy investment needs, and sustainability pressures threaten margins, revenue growth, and brand strength if not effectively managed.

Catalysts

About Burberry Group- Manufactures, retails, and wholesales luxury goods under the Burberry brand.

- The Burberry Forward strategy's focus on brand elevation and a renewed Timeless British Luxury positioning has already reignited brand desirability and affinity, which, if sustained, is likely to enable future revenue growth through higher average selling prices and improved gross margins.

- Acceleration in Burberry’s digital and omnichannel initiatives, particularly the recent return to growth in e-commerce after three years of decline and investments in data-driven capabilities, positions the company to capture a larger share of direct-to-consumer sales and expand earnings through margin improvement and operational efficiency.

- The ongoing expansion and optimization of Burberry’s physical store network—including targeted investments in new product-centric fixtures like the scarf bar, and a holistic approach to visual merchandising—are expected to improve store productivity and same-store sales, supporting top-line growth and operational leverage.

- Burberry’s enhanced focus on localization, brand storytelling, and cultural relevance in key growth markets (especially Asia-Pacific and the U.S.) allows it to capture rising demand among affluent, younger, and digitally savvy consumers, expanding long-term revenue potential even as sector headwinds persist.

- Ongoing cost reduction and operational simplification efforts (targeting £100 million in annualized savings by FY27) are structurally lowering the cost base, enabling margin expansion and increased free cash flow conversion as top-line growth resumes.

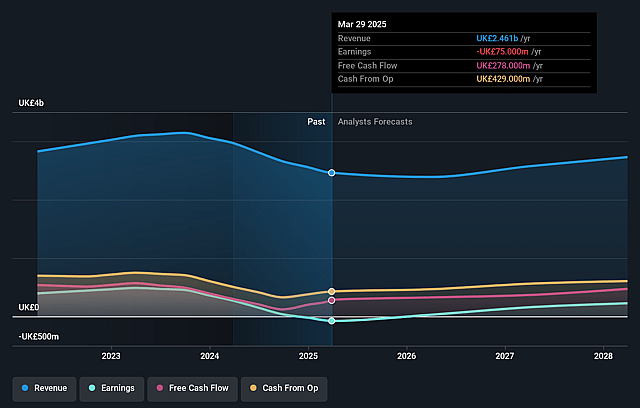

Burberry Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Burberry Group's revenue will grow by 3.5% annually over the next 3 years.

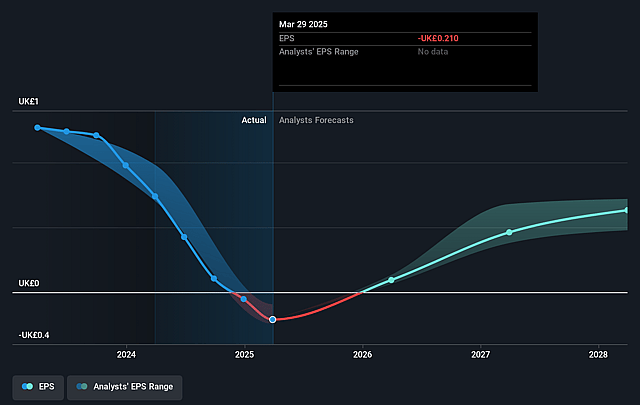

- Analysts assume that profit margins will increase from -3.0% today to 8.3% in 3 years time.

- Analysts expect earnings to reach £227.1 million (and earnings per share of £0.62) by about September 2028, up from £-75.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £259 million in earnings, and the most bearish expecting £171.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.9x on those 2028 earnings, up from -60.7x today. This future PE is lower than the current PE for the GB Luxury industry at 109.3x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.9%, as per the Simply Wall St company report.

Burberry Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued structural decline of the wholesale channel—highlighted by a mid-teens percentage revenue decline expected in H1 and door closures in Europe—poses long-term risks to revenue stability and growth, especially if Burberry’s efforts to pivot towards strategic partners and own-store productivity do not sufficiently offset this trend.

- Burberry’s significant exposure to Asia and the Americas, combined with heightened geopolitical uncertainty, potential tariffs, and fluctuating tourist dynamics, increases vulnerability to external shocks; such pressures can result in revenue volatility and compress operating margins.

- The decision to maintain a large global store network (with ~420 stores and 13% in outlets) amid ongoing investment cuts and the absence of a meaningful store closure program risks underutilized assets and persistent inefficiency, potentially constraining net margin and returns on capital if store productivity does not improve as envisioned.

- The ongoing and substantial investment requirements for brand turnaround (Burberry Forward), upgrading manufacturing, and supporting omnichannel initiatives—coupled with the suspension of dividends and increased debt—may strain free cash flow and elevate balance sheet risk if top-line growth fails to rebound as planned.

- The luxury sector’s rising focus on sustainability, circular business models, and the proliferation of second-hand and counterfeit goods could undermine Burberry’s full-price sales channels and pricing power over time, especially if consumer attitudes shift or competitive ESG/innovation advancements outpace Burberry’s own efforts, negatively affecting revenue and gross margin.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £12.397 for Burberry Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £16.0, and the most bearish reporting a price target of just £5.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £2.7 billion, earnings will come to £227.1 million, and it would be trading on a PE ratio of 25.9x, assuming you use a discount rate of 9.9%.

- Given the current share price of £12.74, the analyst price target of £12.4 is 2.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.