Key Takeaways

- Heavy reliance on traditional retail and geographic concentration leave Burberry vulnerable to digital disruption and geopolitical risks, threatening long-term sales and profit stability.

- Brand dilution, sustainability trends, and cost pressures challenge pricing power and margin recovery, raising concerns over maintaining profitability amid evolving luxury market dynamics.

- Strategy combining brand revitalization, disciplined cost control, digital expansion, and product innovation positions Burberry for improved profitability, stronger margins, and long-term global brand growth.

Catalysts

About Burberry Group- Engages in manufacturing, retail, and wholesale of luxury goods under the Burberry brand in the Asia Pacific, Europe, the Middle East, India, Africa, and the Americas.

- Burberry's long-term revenue growth is threatened by persistent shifts toward digital-first purchasing and the rise of digitally native luxury competitors, as the company still relies heavily on legacy retail and struggles to achieve meaningful e-commerce and direct-to-consumer scale, risking further erosion of market share and a potential structural decline in top line sales over time.

- The company's geographic concentration in Asia-Pacific exposes it to significant geopolitical instability, protectionism, and currency volatility, amplifying unpredictability in revenue and profits amid trade tensions, fluctuating tariffs, and regulatory risks that are only expected to intensify in the medium

- to long-term.

- An overextension into non-core or lower-priced products, combined with efforts to optimize store productivity without a reduction in the absolute store count, elevates the risk of brand dilution, reduction in exclusivity, and compressed net margins, all of which undermine Burberry's historic pricing power and threaten long-term profitability.

- The accelerating growth of the second-hand and circular luxury market, coupled with increasing consumer preference for true sustainability and new definitions of value, places persistent downward pressure on full-price sales and inventory turnover, making it harder for Burberry to restore historic margin levels or maintain gross margins in the 70 percent range.

- Inflationary pressures, continued escalation of talent and premium raw material costs, and ongoing global supply chain disruptions are likely to weigh on operating margins and net earnings, as even aggressive cost-cutting and restructuring initiatives are expected to be insufficient to offset these secular industry-wide headwinds.

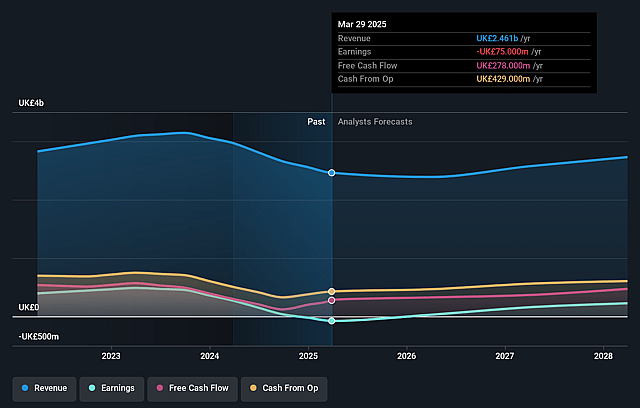

Burberry Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Burberry Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Burberry Group's revenue will grow by 1.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -3.0% today to 7.9% in 3 years time.

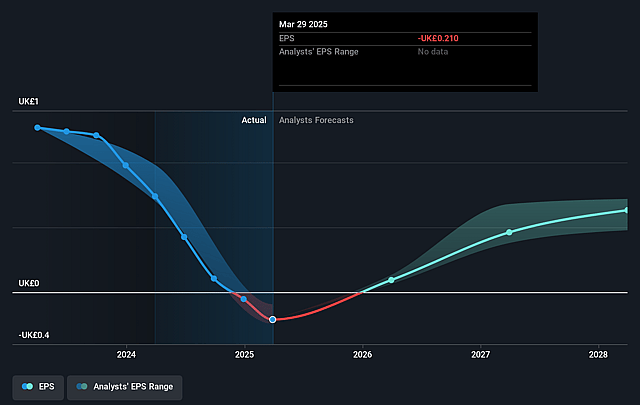

- The bearish analysts expect earnings to reach £202.5 million (and earnings per share of £0.56) by about September 2028, up from £-75.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from -55.9x today. This future PE is lower than the current PE for the GB Luxury industry at 109.1x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.02%, as per the Simply Wall St company report.

Burberry Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Burberry Forward strategy is focused on reigniting brand desire and returning to sustainable, profitable growth, with early signs of success in improving brand sentiment, indicating a potential for top-line growth and improved net margins if this momentum continues.

- Investments in digital transformation, e-commerce acceleration, and omni-channel sales (such as strong growth in burberry.com after three years of decline) position Burberry to capture value from long-term shifts to online luxury retail, supporting revenue and operating margin expansion.

- The cost base reduction program targeting around £100 million in annualized savings by full year 2027, combined with disciplined capital allocation and operational streamlining, creates capacity for reinvestment and margin improvement, enhancing future earnings and cash flow.

- Burberry's focus on product innovation, expanding good-better-best pricing, and scarcity inventory models have driven early sellouts and positive wholesale partner reengagement, suggesting the potential for better gross margin recovery and revival in both retail and wholesale revenue.

- Increasing brand heat globally-evidenced by record levels of brand affinity since 2019 across diverse regions, including China-coupled with a renewed emphasis on heritage, exclusivity, and authenticity, may attract affluent consumers, boost pricing power, and support revenue growth and long-term brand equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Burberry Group is £6.65, which represents two standard deviations below the consensus price target of £12.4. This valuation is based on what can be assumed as the expectations of Burberry Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £16.0, and the most bearish reporting a price target of just £5.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £2.6 billion, earnings will come to £202.5 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 10.0%.

- Given the current share price of £11.72, the bearish analyst price target of £6.65 is 76.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Burberry Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.