Key Takeaways

- Burberry's brand elevation, digital acceleration, and unique market positioning are driving faster-than-expected revenue, margin, and customer growth versus industry expectations.

- Focus on sustainability and ESG, plus innovative, data-driven merchandising, is enhancing pricing power, retention, and long-term global market share.

- Heavy reliance on traditional branding, shrinking wholesale business, and slow digital adaptation threaten Burberry's revenue growth, market share, and ability to appeal to new consumer segments.

Catalysts

About Burberry Group- Engages in manufacturing, retail, and wholesale of luxury goods under the Burberry brand in the Asia Pacific, Europe, the Middle East, India, Africa, and the Americas.

- Analyst consensus expects Burberry's brand elevation to drive top-line growth and higher average selling prices, but the current momentum in brand affinity and rapid conversion of runway desirability into commercial success suggests Burberry could return to £3 billion in revenue and 70% gross margin significantly sooner, with upside from rapid sellouts and organic scarcity, directly lifting revenue and margin recovery above expectations.

- Whereas analyst consensus sees digital and omnichannel investments restoring e-commerce growth and boosting margin, early evidence of reaccelerating digital sales and data-driven merchandise optimization points to a step-change in revenue per customer and store productivity, implying faster-than-expected net margin and earnings expansion through both operating leverage and fixed cost absorption.

- The ongoing global democratization of wealth, especially in Asia-Pacific and among younger, digitally savvy luxury buyers, creates a powerful, underappreciated demand tailwind for Burberry's newly sharpened, authentically British brand proposition, positioning the company to achieve outpaced growth versus peers and drive a structural uplift in both international revenues and long-term market share.

- Burberry is uniquely positioned to monetize growing consumer demand for ethical and sustainable luxury, with scalable in-store circularity initiatives and a deepened commitment to UK manufacturing enhancing pricing power, capturing share from ESG-oriented customers, and supporting both gross margin and brand goodwill over time.

- The unprecedented alignment of design, merchandising, and data-led commercial teams is generating product innovation and customer-centric execution at a pace rarely seen in legacy luxury houses, likely leading to accelerated new customer acquisition, higher retention, and a meaningful step up in direct-to-consumer earnings and free cash flow.

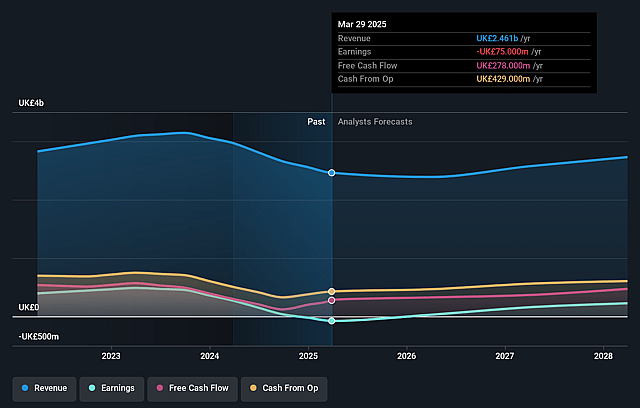

Burberry Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Burberry Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Burberry Group's revenue will grow by 6.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -3.0% today to 10.2% in 3 years time.

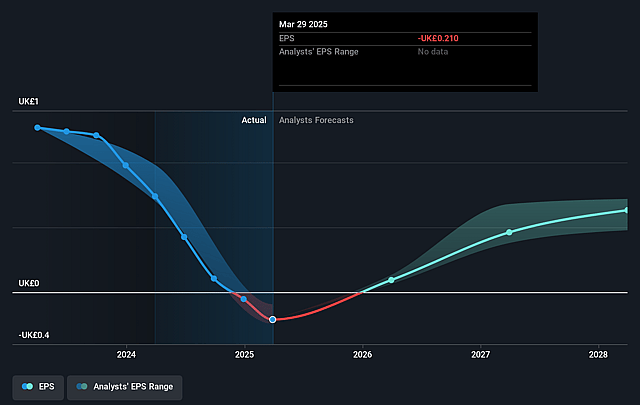

- The bullish analysts expect earnings to reach £305.9 million (and earnings per share of £0.85) by about September 2028, up from £-75.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.9x on those 2028 earnings, up from -55.9x today. This future PE is lower than the current PE for the GB Luxury industry at 109.1x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.02%, as per the Simply Wall St company report.

Burberry Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Burberry is facing a structural decline in wholesale revenue, which fell 35% year-on-year, and ongoing cuts to wholesale partners and door closures in Europe are expected to weigh on revenue growth and limit global expansion over the medium term.

- Demographic shifts and changing consumer preferences, particularly among millennials and Gen Z who are less drawn to heritage brands, place Burberry's reliance on classic "Timeless British Luxury" at risk and could result in lower demand and reduced sales growth.

- Geopolitical uncertainties and trade tensions, especially potential tariffs and ongoing volatility in key regions like China and the U.S., threaten to disrupt Burberry's international footprint and introduce unpredictable impacts on revenue and operating margins.

- There is ongoing risk of brand dilution and inconsistent product elevation, with the company still in the early stages of its turnaround and no full proof that recent initiatives will restore pricing power and gross margin to historic highs, creating downside risk to earnings targets.

- Despite initial improvements, Burberry's slow digital transformation and continued focus on physical retail-including the maintenance of a large global store network-raise concerns about its ability to keep pace with luxury industry trends toward omni-channel retailing, thereby risking both revenue growth and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Burberry Group is £16.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Burberry Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £16.0, and the most bearish reporting a price target of just £5.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £3.0 billion, earnings will come to £305.9 million, and it would be trading on a PE ratio of 24.9x, assuming you use a discount rate of 10.0%.

- Given the current share price of £11.72, the bullish analyst price target of £16.0 is 26.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.