Last Update 03 Dec 25

STEM: Future Earnings Multiple Should Support Resilient Margins And Upside Potential

Analysts have modestly raised their price target on SThree to reflect a slightly higher assumed future earnings multiple and a marginally increased discount rate. This results in a small upward revision in the company’s estimated equity value by several pence per share.

What's in the News

- SThree plc has scheduled a special or extraordinary shareholders meeting for October 1, 2025, to be held at level 16, 8 Bishopsgate, London EC2N 4BQ, United Kingdom (company event filing).

Valuation Changes

- Fair value estimate remains unchanged at £2.49 per share, indicating no material reassessment of intrinsic value.

- The discount rate has risen slightly from 7.73 percent to 7.73 percent, reflecting a marginally higher assumed cost of capital.

- Revenue growth is effectively unchanged at approximately 0.54 percent, suggesting stable top line growth expectations.

- The net profit margin is broadly unchanged at around 1.84 percent, implying no significant shift in profitability assumptions.

- The future P/E has risen slightly from 13.02x to 13.03x, supporting the modest uplift in the overall equity valuation.

Key Takeaways

- Expanding demand for flexible STEM talent and digital services, combined with strategic focus on complex contract placements, is driving stronger pricing power and resilient margins.

- Automation, AI integration, and global expansion into compliance-driven staffing solutions are boosting operational efficiency, diversifying revenue streams, and supporting sustainable long-term growth.

- Heavy reliance on STEM contracting and high tech investment risk eroding revenue and margins amid market uncertainty, automation trends, and intensified digital competition.

Catalysts

About SThree- Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan, and the United Arab Emirates.

- SThree is positioned to capture substantial upside as pent-up demand for flexible STEM talent is released, with organizations across industries investing in digital transformation and AI adoption-likely increasing revenue and average placement fees once economic confidence returns.

- The company's strategic focus on high-value, complex contract placements and the employed contractor model (ECM) enables greater pricing power and thicker margins, further reinforced by aging workforce demographics and tightening STEM skill shortages-supporting higher net margins and more resilient earnings.

- The near-completion of SThree's end-to-end digital technology infrastructure (TIP) is already driving operational efficiency and cost savings; as TIP matures, further automation, AI-driven candidate matching, and real-time insights are expected to scale productivity and lower cost-to-serve, raising net margins and sustainable earnings.

- SThree is leveraging global demand for flexible and remote work by differentiating with compliance-heavy, cross-border staffing solutions, expanding its market in regions like North America and DACH; this should diversify revenue streams and smooth cyclical volatility.

- Enhanced ability to engage enterprise clients and strategic accounts through deeper data-led workforce consultancy and proprietary STEM talent analytics is expected to drive higher account penetration, improving revenue visibility and supporting medium-to-long-term top-line growth.

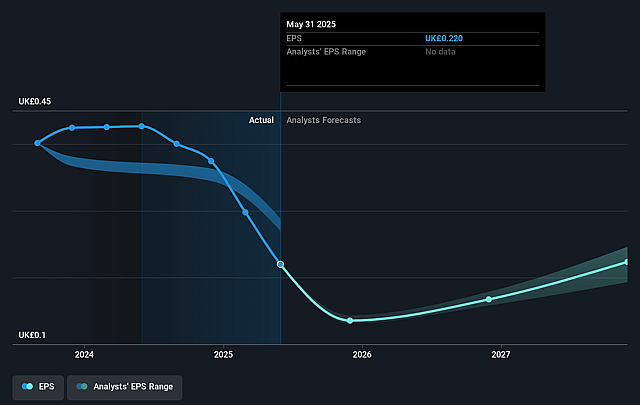

SThree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SThree's revenue will grow by 4.3% annually over the next 3 years.

- Analysts are assuming SThree's profit margins will remain the same at 2.1% over the next 3 years.

- Analysts expect earnings to reach £33.3 million (and earnings per share of £0.27) by about September 2028, up from £28.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from 8.5x today. This future PE is lower than the current PE for the GB Professional Services industry at 21.3x.

- Analysts expect the number of shares outstanding to decline by 4.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

SThree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent softness in new business activity, with net fees down 14% and operating profit dropping 72% year-on-year, could indicate that SThree's revenue growth and net margins are vulnerable to prolonged market uncertainty or slower-than-expected recovery cycles.

- SThree's high concentration in STEM and contract staffing exposes it to sector-specific downturns-if STEM hiring demand trends down due to technological disruption (e.g., AI automation reducing human staffing needs), this could reduce revenue stability and future earnings.

- The company's contract order book fell 8% year-on-year amid a continued slowdown in new placements, suggesting that even with strong contract extension rates, forward revenue visibility and topline growth could be negatively impacted if new client acquisition does not materially improve.

- SThree's expanded investment in technology (TIP) and digital infrastructure, while yielding efficiency gains, incurs significant OpEx and CapEx outlays; if these investments do not translate into commensurate revenue growth or market share gains, future net margins and profitability could be compressed.

- The accelerating adoption of AI and automated recruitment platforms in the industry poses a risk of commoditization, potentially eroding SThree's pricing power and margins, especially if large clients increasingly bypass traditional agencies and digital competitors scale more rapidly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.6 for SThree based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.5, and the most bearish reporting a price target of just £2.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.6 billion, earnings will come to £33.3 million, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of £1.93, the analyst price target of £3.6 is 46.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SThree?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.