Key Takeaways

- SThree is poised for accelerated growth and margin improvement due to early AI adoption, integrated cloud platforms, and rapid expansion into high-growth STEM verticals.

- Structural advantages, including early-mover status and unified global strategies, position SThree to gain market share, boost recurring revenues, and maintain strong long-term earnings.

- Accelerating AI adoption, economic cycles, regulatory hurdles, European concentration, and industry digitalization threaten SThree's revenue growth, margins, and long-term resilience.

Catalysts

About SThree- Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan, and the United Arab Emirates.

- Analyst consensus believes SThree will benefit from a rebound in technology-driven STEM hiring, but this may be understated as accelerating enterprise adoption of generative AI, data infrastructure and automation could lead to an even sharper and longer-lasting surge in complex STEM talent demand, potentially enabling SThree to deliver revenue growth well ahead of market expectations.

- While analysts broadly expect TIP (Technology Improvement Program) to drive margin expansion through automation and AI, SThree's fully integrated cloud-native platform is already unlocking faster-than-planned cost savings and productivity gains, indicating potential for significant outperformance in net margin improvement as next-generation AI innovations are layered in.

- SThree's early-mover advantage and unrivaled exposure to fast-growing employed contractor solutions in STEM-bolstered by high barriers to entry and ongoing regulatory changes-positions it to gain market share at scale as talent shortages persist, supporting sustained net fee growth and robust long-term earnings visibility.

- The expansion into high-growth, high-margin verticals such as clean energy and life sciences, combined with proactive investments in candidate data ecosystems, provides an embedded structural advantage to capture spend as clients deploy major budgets to meet new decarbonization and healthcare mandates, driving both revenue and operating margin leverage.

- SThree's deepening push into enterprise partnerships, combined with new digital-first go-to-market strategies and the recent unification of its global brands, sets the stage for a step-change in client penetration and cross-selling, accelerating both recurring revenues and bottom-line earnings through stronger retention and greater share of client spend.

SThree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SThree compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SThree's revenue will grow by 5.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.1% today to 2.2% in 3 years time.

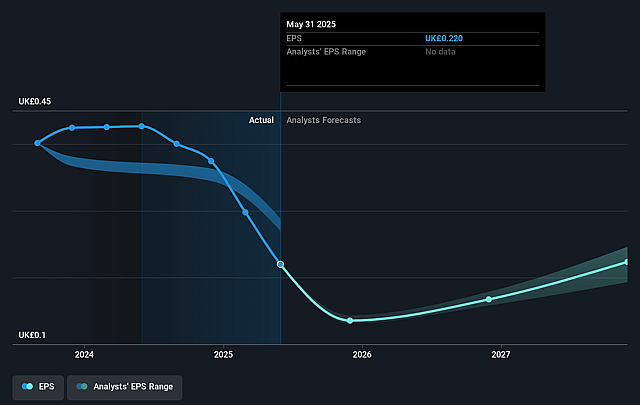

- The bullish analysts expect earnings to reach £34.8 million (and earnings per share of £0.27) by about September 2028, up from £28.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.5x on those 2028 earnings, up from 8.1x today. This future PE is lower than the current PE for the GB Professional Services industry at 21.7x.

- Analysts expect the number of shares outstanding to decline by 4.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

SThree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid adoption of artificial intelligence and automation in client industries could reduce long-term demand for human STEM labor, which would negatively impact SThree's placement volumes and ultimately result in lower revenues and operating profits.

- SThree's heavy reliance on contract staffing exposes the company to economic cycles, as evidenced by their 14 percent year-on-year decline in net fees and a 72 percent drop in operating profit; prolonged economic downturns could further compress revenues and earnings consistency.

- Increased regulatory restrictions on global labor mobility or stricter immigration policies may limit SThree's international candidate pool, constraining their ability to service cross-border placements and dampening potential revenue growth.

- High exposure to the European market, particularly the DACH region which accounts for one-third of net fees, leaves SThree vulnerable to regional macroeconomic risks and protectionist trends, which could put downward pressure on both revenues and net margins.

- Industry-wide digital transformation, including AI-powered direct hiring tools and the trend for in-house talent acquisition, could disintermediate external agencies like SThree, shrink the addressable market, increase competitive pressures, and result in margin compression over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SThree is £4.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SThree's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.5, and the most bearish reporting a price target of just £2.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £1.6 billion, earnings will come to £34.8 million, and it would be trading on a PE ratio of 17.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of £1.85, the bullish analyst price target of £4.5 is 58.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.