Key Takeaways

- SThree's growth prospects face headwinds from weak new business activity, economic cycles, and unresolved productivity gains from recent digital investments.

- Reliance on contract placements and exposure to disruptive technology and shifting regional conditions may constrain revenue growth and pressure margins.

- Prolonged market weakness, concentrated exposure, and industry shifts threaten both short-term growth and long-term profitability despite ongoing cost-saving initiatives.

Catalysts

About SThree- Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan, and the United Arab Emirates.

- While SThree is poised to benefit from persistent global STEM skills shortages and the growing technological complexity across all industries-which should underpin long-term demand for its specialist recruitment services and support volume growth-prolonged weakness in new business activity and low business confidence have led to a 14% year-on-year decline in net fees and a 72% drop in operating profit, raising concerns about how soon these secular tailwinds will translate into a sustained recovery in revenue.

- Although the large-scale rollout of SThree's fully integrated digital platform (TIP) is resulting in operational efficiencies and is expected to deliver higher net margins through automation, AI-driven candidate matching, and cost savings, the company has not yet fully realized the uplift in consultant productivity and scalable margin gains needed to offset the recent profitability decline, leaving future margin expansion highly dependent on successful adoption and market normalization.

- While SThree's strategic focus on flexible, high-value contract placements in STEM markets offers resilience and greater forward visibility relative to permanent-dominant peers, the heavy reliance on contract recruitment makes the company particularly vulnerable to ongoing economic cycles and delayed client hiring decisions, which-if persistent-may continue to dampen top-line recovery and earnings growth despite expected secular demand.

- Despite the company's expansion into new geographies and efforts to rebalance the client mix towards higher-margin enterprise accounts, current softness in key regions such as DACH and tepid demand in both technology and life sciences segments highlight the risk that regional macro headwinds or regulatory shifts could further constrain revenue growth and expose SThree to volatility in specific high-growth markets.

- While the industry-wide digital transformation and increasing demand for specialist consulting solutions outside traditional recruitment bode well for SThree's recurring revenue streams, the threat of disruptive technology-such as direct hiring platforms and corporates internalizing recruitment functions-remains material, as widespread adoption of these alternatives could erode SThree's market share and pressure gross margins over the medium to long term.

SThree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SThree compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SThree's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 2.1% today to 1.8% in 3 years time.

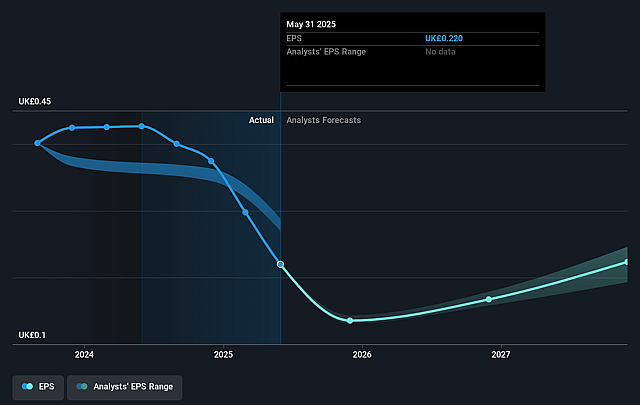

- The bearish analysts expect earnings to reach £25.7 million (and earnings per share of £0.25) by about September 2028, down from £28.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, up from 8.5x today. This future PE is lower than the current PE for the GB Professional Services industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 4.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

SThree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's net fees declined by fourteen percent year-on-year and operating profit was down seventy-two percent, largely due to reduced new business activity amid prolonged market uncertainty and low business confidence, which could continue to pressure revenue and earnings if cyclical weakness persists or becomes structural.

- SThree's contract business, which is eighty-four percent of total revenue, experienced an eight percent year-on-year decline in its contractor order book and persistent softness in new placements, pointing to a near-term weakness in top-line growth and subdued revenue visibility despite good extension rates.

- Although the Technology Improvement Program (TIP) rollout is delivering cost efficiencies and margin improvements, the company is still incurring increased operating expenditure and capital expenditure with annual TIP spend running toward the upper end of its original range, which may weigh on net margins if the anticipated top-line growth does not materialize.

- There is an ongoing risk of structural industry changes such as accelerated automation, AI, and alternative remote work platforms that could potentially reduce demand for traditional specialist recruiters or compress fees over time, undermining SThree's long-term revenue growth and profitability.

- The company's geographic and skill mix exposes it to concentrated risks, as DACH remains its largest market (thirty-three percent of net fees) and technology is forty-five percent of net fees, meaning any region-specific economic or sector demand shocks could result in volatile earnings and inconsistent revenue performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SThree is £2.4, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SThree's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.5, and the most bearish reporting a price target of just £2.4.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £1.4 billion, earnings will come to £25.7 million, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of £1.93, the bearish analyst price target of £2.4 is 19.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SThree?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.