Key Takeaways

- Strong exposure to electrification and clean energy trends is offset by weak end markets, inventory overhang, and reliance on cyclical sectors, pressuring near-term revenues.

- Innovation and cost-saving initiatives may drive future growth, but risks from slow market recovery, rising alternatives, and fixed cost inflexibility could limit margin and earnings improvement.

- Overreliance on cyclical markets, persistent semiconductor weakness, and inflexible costs are pressuring revenue, margins, and profitability, with heightened competition further threatening future returns.

Catalysts

About Morgan Advanced Materials- Manufactures and sells various carbon and ceramic products.

- While long-term trends such as electrification and decarbonization position Morgan Advanced Materials to benefit from growth in EV, clean energy, and industrial sectors through rising demand for advanced ceramics and carbon components, the company continues to face near-term revenue pressure from weak end markets and persistent inventory overhang in high-margin segments, particularly silicon carbide semiconductors. As a result, revenue may remain subdued despite strong structural drivers.

- Although the group's ongoing simplification programme is on track to deliver £27 million of annual cost savings by 2026 and should enhance margin potential structurally, the inability to drive faster recovery in core end markets or scale up volume puts sustained pressure on operating leverage, meaning net margins may recover slower than anticipated.

- While the innovation pipeline in energy storage, semiconductors, and medical applications offers significant high-margin growth opportunities supported by digitalization and miniaturization trends, ramp-up of new production capacity-especially in semiconductors-faces risk of further delay or underutilization if customer destocking and weak end market demand persist into 2026 and beyond, limiting both earnings growth and return on capital.

- Despite investment in automation, supply chain consolidation, and data-driven procurement making the company more resilient and agile, Morgan's relatively inflexible fixed cost base and continued dependence on cyclical sectors like automotive and industrials could lead to ongoing earnings volatility and margin compression if external conditions do not rapidly improve.

- While geographic diversification efforts and strong customer relationships support Morgan's long-term growth ambitions, the increasing threat from alternative materials and advanced polymers could erode the addressable market for legacy ceramics and carbon products, dampening medium-term revenue and market share prospects even as the company positions itself for the energy transition.

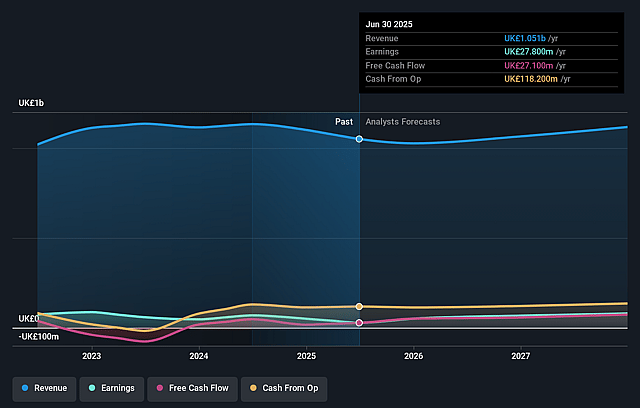

Morgan Advanced Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Morgan Advanced Materials compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Morgan Advanced Materials's revenue will decrease by 0.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.6% today to 6.8% in 3 years time.

- The bearish analysts expect earnings to reach £72.5 million (and earnings per share of £0.26) by about September 2028, up from £27.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, down from 20.7x today. This future PE is lower than the current PE for the GB Machinery industry at 22.8x.

- Analysts expect the number of shares outstanding to decline by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.08%, as per the Simply Wall St company report.

Morgan Advanced Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weakness and volatility in semiconductors, especially with persistent overstocking in the silicon carbide segment, means that the timing and level of recovery in this high-margin area is highly uncertain, which may continue to depress group revenues and operating margins.

- The company's reliance on cyclical end markets-including automotive, industrials, and metals-has led to significant volume declines and limited demand visibility, resulting in a 5.8% year-on-year revenue drop and creating ongoing risk of top-line pressure if these sectors remain subdued.

- A relatively inflexible fixed cost base, particularly in Thermal Products, has resulted in margin compression when volumes decline, making it challenging for the company to achieve significant net margin expansion during periods of weak demand.

- Although simplification and cost optimization are delivering targeted savings, there is a risk that further operational efficiency gains become harder to realize as the company approaches the end of its footprint reduction programme, potentially limiting future improvements to net earnings and operating profit.

- Heightened price competition in advanced materials and semiconductors-especially as customers gain greater supply flexibility and bargaining power-could pressure average selling prices and erode profitability, particularly given management's explicit caution around achieving expected returns from recent CapEx and the risk of underutilized assets dampening future return on investment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Morgan Advanced Materials is £2.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Morgan Advanced Materials's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.0, and the most bearish reporting a price target of just £2.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £1.1 billion, earnings will come to £72.5 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 10.1%.

- Given the current share price of £2.07, the bearish analyst price target of £2.1 is 1.4% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.