Last Update 26 Nov 25

Fair value Decreased 6.22%MGAM: Future Performance Will Reflect Resilience Despite Revised Price Expectations

Narrative Update on Morgan Advanced Materials

Analysts have lowered their price target for Morgan Advanced Materials from approximately £2.35 to £2.05. This change reflects recent reductions in growth expectations, profit margins, and fair value estimates.

Analyst Commentary

Recent updates from the analyst community provide insights into both the positive and concerning factors influencing Morgan Advanced Materials' valuation and outlook.

Bullish Takeaways

- Bullish analysts cite the company's sustained Hold rating, which indicates confidence in its capacity to maintain value despite current headwinds.

- There remains underlying resilience in Morgan Advanced Materials’ business model, with no dramatic downgrades. This reflects ongoing execution strength.

- Analysts note that while price targets have been reduced, they still see Morgan Advanced Materials trading near fair value. This suggests there is limited downside risk in current market conditions.

Bearish Takeaways

- Bearish analysts highlight that the company’s growth expectations have softened, prompting sequential downward adjustments to price targets over recent months.

- There are concerns about compressing profit margins, which could weigh on near-term earnings and ultimately limit upside potential.

- Some caution that lower fair value estimates reflect a more challenging operating environment. There may be a need for sustained improvement in order volumes or profitability to justify higher valuations.

- The Hold rating, amid multiple target reductions, signals lingering uncertainty about Morgan Advanced Materials’ ability to reaccelerate growth.

What's in the News

- Deutsche Bank lowered Morgan Advanced Materials’ price target to 205 GBp from 235 GBp and maintained a Hold rating (Deutsche Bank).

- Morgan Advanced Materials provided 2025 earnings guidance, expecting revenue to be approximately 4% lower than the prior year on an organic constant currency basis (Company announcement).

- The company anticipates delivering an adjusted operating profit margin of 10% for 2025. This reflects under-recovered costs from lower sales volumes, a weaker mix, and foreign exchange impacts (Company announcement).

Valuation Changes

- Fair Value Estimate has decreased from £2.50 to approximately £2.34, reflecting a lower overall valuation.

- Discount Rate has increased from 9.99% to 10.73%, indicating a higher perceived risk in the company's future cash flows.

- Revenue Growth expectations have declined significantly, shifting from a positive 2.34% to a negative 0.25%.

- Net Profit Margin has dropped from 7.83% to 6.29%, suggesting a notable reduction in profitability forecasts.

- Future P/E Ratio has risen from 10.1x to 13.2x, implying a higher relative price for the company’s expected future earnings.

Key Takeaways

- Expanded capacity and ongoing cost reductions position the company for margin growth and improved operating leverage as demand recovers and global electrification accelerates.

- Focus on advanced materials, innovation, and agile manufacturing boosts product differentiation, pricing power, and recurring revenues across high-growth, sustainability-driven end markets.

- Prolonged sector weakness, rising competition, and shifting technology challenge profitability, while slow demand recovery and underused investments threaten margins and future growth.

Catalysts

About Morgan Advanced Materials- Manufactures and sells various carbon and ceramic products.

- The company has nearly completed a significant capex program to expand semiconductor production capacity, positioning it to capture strong, double-digit market growth once inventory destocking is resolved and electrification/EV trends accelerate; this provides a clear pathway to revenue growth and higher operating margins as the cycle turns.

- The group's ongoing simplification programme, which will deliver £27 million of annual cost savings in 2026 and additional benefits from further upcoming optimization, creates a structurally lower fixed-cost base-enhancing net margins and operating leverage as demand recovers.

- Morgan Advanced Materials is well-placed to benefit from the global shift toward decarbonization and electrification, with advanced ceramics and carbon products solving complex material challenges in aerospace, clean energy, and power electronics; as customers' sustainability efforts intensify, this is likely to support growth in both revenues and pricing power.

- Investments in proprietary material science and co-development with customers have resulted in a differentiated, higher-margin product portfolio (e.g., for advanced jet engines and miniaturized medical devices), enabling margin expansion and stickier, recurring earnings as these segments continue to grow.

- Modular, agile manufacturing capabilities and data-driven operational improvements allow the company to rapidly scale capacity and improve delivery as end-markets recover, supporting both top-line growth and sustainable expansion of returns on invested capital.

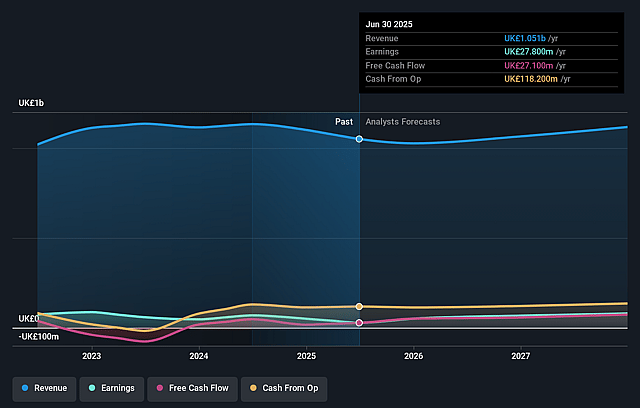

Morgan Advanced Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Morgan Advanced Materials's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.6% today to 7.8% in 3 years time.

- Analysts expect earnings to reach £88.2 million (and earnings per share of £0.25) by about September 2028, up from £27.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, down from 20.7x today. This future PE is lower than the current PE for the GB Machinery industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.99%, as per the Simply Wall St company report.

Morgan Advanced Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weakness in the semiconductor segment-particularly in silicon carbide semiconductors due to elevated inventory across the supply chain-continues to negatively impact sales volumes and profitability, with no clear timing for recovery. This poses a risk of underutilized capacity and weak revenue contribution from what is normally a high-margin business, dragging down overall group margins and earnings.

- Ongoing market softness in core industrials, metals, petrochemical, and automotive sectors, despite recent stabilization, raises concerns about long-term demand recovery; a sluggish rebound or a prolonged downturn would constrain top-line growth and limit opportunities to achieve operating leverage and scale efficiencies, thereby impacting revenue and net margins.

- Rising price competition and potential commoditization in core product lines (e.g., ceramics and carbon), especially if customers gain greater supply options or exert more buyer power during market downturns, may pressure average selling prices and compress margins, leading to weaker earnings quality and inhibited margin expansion.

- Customer deferrals and uncertain contract volumes-particularly in fast-growing but currently depressed adjacent markets (like semiconductors and certain healthcare applications)-increase the risk of reduced utilization of recent capacity investments, potentially resulting in stranded costs, delayed returns on capital expenditure, and lower future cash generation.

- Technological disruption or shifts in customer requirements-such as advancements in alternative materials (e.g., polymers, new composites, or biomaterials)-could erode demand for traditional products, while any underinvestment or misalignment in R&D may cause Morgan to lose market relevance or pricing power, ultimately pressuring long-term revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.5 for Morgan Advanced Materials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.0, and the most bearish reporting a price target of just £2.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.1 billion, earnings will come to £88.2 million, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 10.0%.

- Given the current share price of £2.07, the analyst price target of £2.5 is 17.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.