Key Takeaways

- Aggressive restructuring, digital transformation, and manufacturing consolidation could drive stronger margin expansion and operational leverage than currently forecast.

- Advancements in proprietary technology, exposure to clean energy, and strategic R&D position Morgan for premium growth across semiconductors, renewables, and specialized high-margin sectors.

- Vulnerability to market cycles, rising costs, competition, and innovation pressures threaten revenue stability, margins, and long-term market position.

Catalysts

About Morgan Advanced Materials- Manufactures and sells various carbon and ceramic products.

- While analyst consensus expects the accelerated restructuring to deliver £27 million in annualized savings by 2026, the significant site reduction-from 85 to 60 over ten years-alongside ongoing digital transformation and manufacturing consolidation, could drive much greater margin expansion and operational leverage than currently anticipated, potentially pushing net margins well beyond the initial 12.5% target.

- Analysts broadly agree that new capital investments will support core and high-growth markets, but consensus underappreciates the rapid scaling opportunity as inventory destocking in semiconductors ends; Morgan's headroom to quickly reinvest in capacity, coupled with robust proprietary process technology, could enable a faster and sharper rebound in semiconductor-driven revenues and profits by 2026 and beyond.

- Morgan is uniquely positioned to benefit from the accelerating shift toward renewable energy and electrification, with over half its clean energy exposure in the U.S. and differentiated materials for applications like wind, solar, and EVs; this positions the group for sustained double-digit revenue growth as global policy, grid investments, and decarbonization imperatives intensify.

- The company's advanced materials R&D is enabling new, higher-value applications across healthcare (such as implantable devices and biocompatible ceramics) and high-growth sectors like aerospace and defense, unlocking premium pricing and high-margin contract wins that can materially uplift group-wide earnings quality.

- As industry supply chains regionalize and onshore-especially in semiconductors and defense-Morgan's established local manufacturing footprint and trusted supplier status will open major new contract opportunities, supporting long-term, diversified topline growth and a progressive increase in return on invested capital.

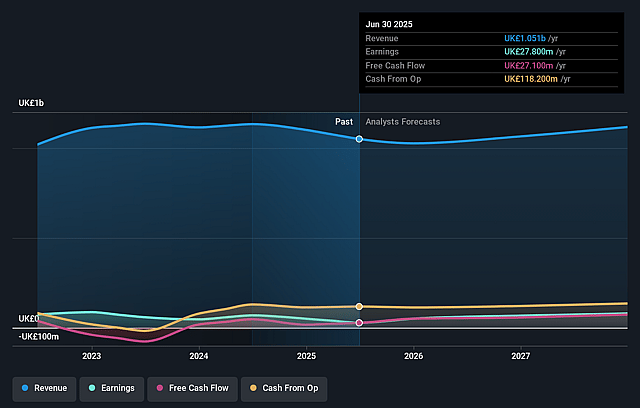

Morgan Advanced Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Morgan Advanced Materials compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Morgan Advanced Materials's revenue will grow by 1.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.6% today to 8.3% in 3 years time.

- The bullish analysts expect earnings to reach £94.7 million (and earnings per share of £0.36) by about August 2028, up from £50.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 12.4x today. This future PE is lower than the current PE for the GB Machinery industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.75%, as per the Simply Wall St company report.

Morgan Advanced Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Morgan Advanced Materials' exposure to cyclical end markets such as industrials, transportation, and semiconductors makes it vulnerable to ongoing demand volatility, as highlighted by the recent declines in industrial and metals markets as well as a 10% revenue drop in semiconductor sales during the second half of 2024, directly threatening future revenue stability and growth.

- Intensifying global trade protectionism and moves toward reshoring can disrupt Morgan's complex supply chains, potentially increasing costs for raw materials and reducing competitive pricing power, thereby exerting downward pressure on net margins over the long term.

- The company faces persistently elevated R&D and capital expenditure requirements to maintain pace with innovations in ceramics and composites, as evidenced by gross capital expenditure of £90 million in 2024 and continued high investment guidance; if these outlays do not yield superior returns amid growing capital intensity, net margins and overall earnings could be materially impacted.

- The continued commoditization of certain advanced material segments, especially for thermal products with high exposure to China and Europe, exposes Morgan to pricing pressure from lower-cost competitors in Asia, a trend that has already led to stagnant or declining volumes in some business units and will likely squeeze profitability further if not offset by significant differentiation or innovation.

- The emergence of disruptive material technologies and the risk of increased bargaining power among consolidated key customers, in tandem with a talent shortage and aging technical workforce, threaten Morgan's long-term ability to retain market share, drive innovation, and protect its revenue streams and earnings power in a rapidly evolving industrial landscape.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Morgan Advanced Materials is £3.4, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Morgan Advanced Materials's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.4, and the most bearish reporting a price target of just £2.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £1.1 billion, earnings will come to £94.7 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 9.7%.

- Given the current share price of £2.24, the bullish analyst price target of £3.4 is 34.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.