Key Takeaways

- Strong digital adoption and niche lending drive growth, but limited scale and heavy sector reliance create challenges against larger competitors and economic shifts.

- Regulatory uncertainty, rising compliance costs, and interest rate sensitivity threaten margins and could increase earnings volatility.

- Legacy legal risks, concentrated lending exposures, funding vulnerabilities, and intensifying competition threaten profitability, capital strength, and limit sustainable long-term growth opportunities.

Catalysts

About Secure Trust Bank- Provides banking and financial products and services in the United Kingdom.

- While Secure Trust Bank is well positioned to benefit from ongoing digital adoption in UK banking-having made significant progress in automation, launching new self-service capabilities, and driving high digital adoption across its savings and retail finance customers-there remains a risk that investments in digital infrastructure may not keep pace with larger competitors or new fintech entrants, which could pressure long-term customer acquisition and retention and ultimately constrain revenue growth.

- Although the company is poised to capture growth from demographic changes and the needs of SMEs-underpinned by a resilient and expanding small business sector and a proven track record in specialist lending-Secure Trust Bank's relatively smaller scale compared to major UK banks means it may struggle to absorb rising regulatory costs and technological investments, leading to sustained cost pressures and potentially limiting improvements in net margins.

- While industry-wide advances in open banking and data sharing could expand the bank's ability to innovate and deepen customer relationships through new partnerships and personalized offerings, there is significant uncertainty regarding the future regulatory environment, particularly related to motor finance commissions; any adverse legal or regulatory outcomes could drive up compliance costs and drag on net profit growth.

- Despite recent success in cost control, demonstrated by ongoing annualized savings from Project Fusion and a declining cost-to-income ratio, the bank remains exposed to interest rate sensitivity in its short-term deposit funding and the risk of prolonged low interest rates eroding net interest margins, which could hinder earnings momentum if market conditions don't improve.

- While operational leverage from continued loan book expansion and a shifting mix toward higher margin consumer lending has supported improved profitability, heavy reliance on niche lending areas such as Motor and Retail Finance exposes the business to sector-specific downturns; faltering growth or unexpected credit losses in these segments could increase earnings volatility and delay the trajectory toward targeted returns on equity.

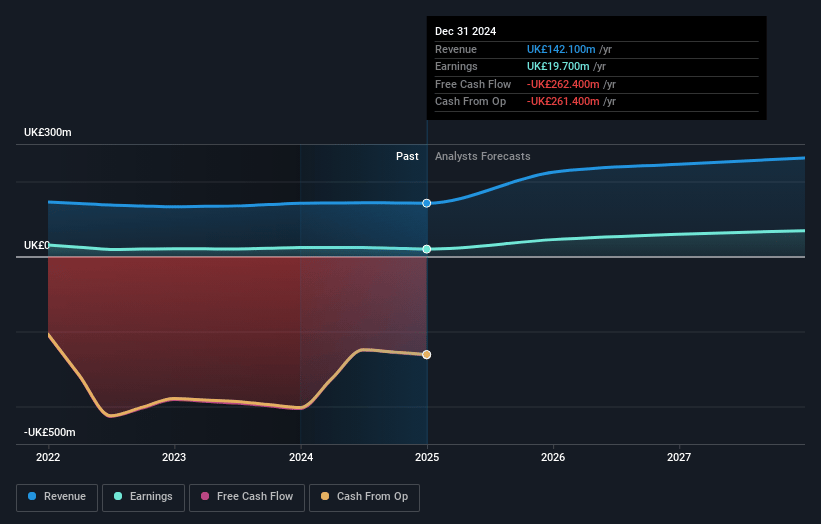

Secure Trust Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Secure Trust Bank compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Secure Trust Bank's revenue will grow by 22.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 13.9% today to 30.6% in 3 years time.

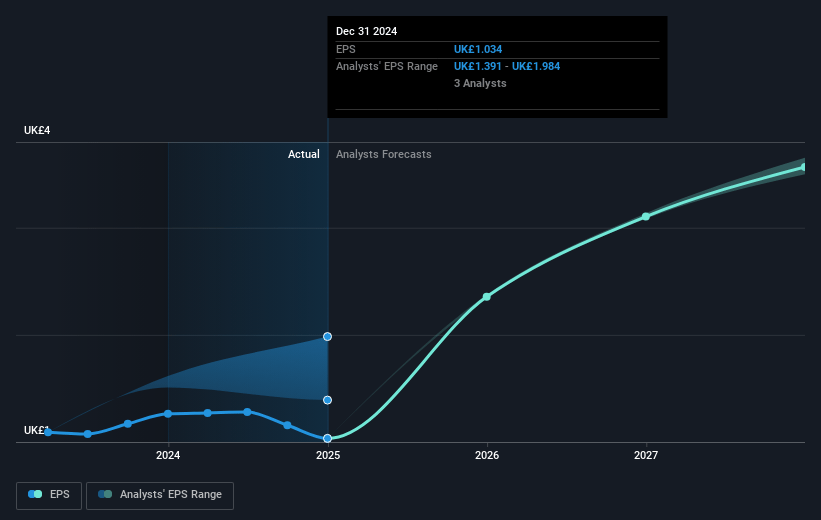

- The bearish analysts expect earnings to reach £79.6 million (and earnings per share of £4.09) by about July 2028, up from £19.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.3x on those 2028 earnings, down from 9.7x today. This future PE is lower than the current PE for the GB Banks industry at 9.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.08%, as per the Simply Wall St company report.

Secure Trust Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unresolved legal and regulatory risks in the Vehicle Finance division, particularly around historic commissions and potential redress, could result in materially higher provisions and impact future earnings and capital adequacy.

- The bank's cost of funding is increasingly exposed to short-duration retail deposits, with over 68% having a maturity under one year, making the group vulnerable to rising interest rates or changes in depositor behaviour, which could pressure net interest margin and future profitability.

- Heavy reliance on niche segments like Vehicle Finance and Retail Finance concentrates risk, so sector downturns, increased market competition, or regulatory tightening in these areas may destabilize revenues and increase earnings volatility.

- While the group touts progress in digitalization, persistent competition from more agile challenger banks and fintechs could erode market share and require further investment in technology, increasing costs and threatening long-term revenue growth.

- Diminishing loan growth rates as the business scales beyond the current £4 billion target, together with capital constraints from regulatory buffers and legal uncertainties, may limit the group's ability to sustainably grow net lending and deliver higher returns on equity in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Secure Trust Bank is £14.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Secure Trust Bank's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £19.7, and the most bearish reporting a price target of just £14.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £260.0 million, earnings will come to £79.6 million, and it would be trading on a PE ratio of 4.3x, assuming you use a discount rate of 8.1%.

- Given the current share price of £10.05, the bearish analyst price target of £14.2 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.