Key Takeaways

- Strong digitalization and operational efficiency are set to propel revenue, margins, and market share well above consensus expectations.

- Niche positioning and integrated ESG focus enable outsized gains from industry shifts, attracting lucrative new customer segments and diversifying income streams.

- Regulatory uncertainty, intense digital competition, and sector-specific lending risks threaten Secure Trust Bank's profitability, capital strength, and ability to maintain operational efficiency against more innovative rivals.

Catalysts

About Secure Trust Bank- Provides banking and financial products and services in the United Kingdom.

- While analyst consensus expects Secure Trust Bank to reach a £4 billion net loan book and mid-teens ROE, growth momentum is accelerating faster than expected with loan balances growing by 8.8% and consumer lending surging 86% over several years, suggesting the company may overshoot current targets and drive revenue materially above the consensus scenario.

- Analyst consensus estimates cost-to-income will drop to the 44 to 46 percent range, but increasingly aggressive digitalization and operational consolidation could push this ratio closer to 40 percent, sharply boosting net margins and earnings well beyond management targets as efficiency gains unlock further cost savings.

- Secure Trust Bank's market share gains-driven by high digital adoption rates among both new and existing customers-position it to benefit disproportionately from ongoing digital migration in the UK financial sector, amplifying its ability to scale efficiently and attract high-value customers, directly lifting long-term operating income and fee revenue.

- Sector shifts and regulatory tightening are pushing larger incumbents out of non-core lending and SME/consumer verticals, setting the stage for Secure Trust Bank to capture outsized market share; as a nimble, tech-forward and specialist lender, it is likely to extract premium margins and sustain above-market loan growth, supporting multi-year revenue and profit expansion.

- The company's integrated ESG approach and customer-centric reputation are set to capture a rising cohort of socially-conscious and younger customers looking for specialist lending and savings products, opening new green lending verticals and recurring fee streams that could structurally increase return on equity and diversify earnings.

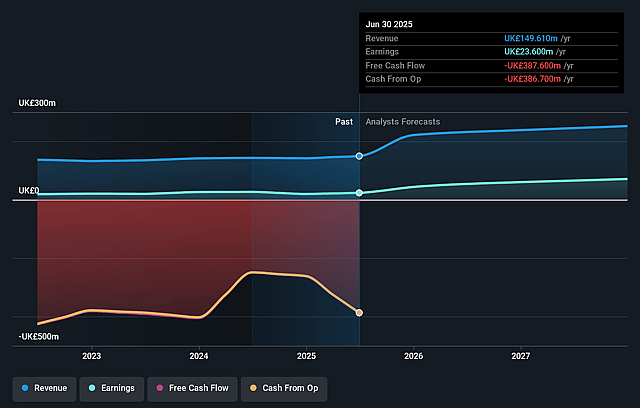

Secure Trust Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Secure Trust Bank compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Secure Trust Bank's revenue will grow by 27.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.9% today to 30.7% in 3 years time.

- The bullish analysts expect earnings to reach £89.4 million (and earnings per share of £4.67) by about August 2028, up from £19.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.3x on those 2028 earnings, down from 10.9x today. This future PE is lower than the current PE for the GB Banks industry at 8.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.34%, as per the Simply Wall St company report.

Secure Trust Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing competition from digital-only banks and fintech lenders could erode Secure Trust Bank's market share over time, potentially putting downward pressure on both revenue growth and net margins as customers migrate to more innovative and cost-efficient platforms.

- Persistent regulatory risk remains from ongoing legal uncertainty around historic motor finance commissions and potential redress, posing the threat of materially higher than anticipated costs or provisions, which could reduce earnings and capital ratios.

- The company's specialist lending focus, particularly in vehicle finance and commercial finance, makes Secure Trust Bank vulnerable to sector-specific downturns and credit cycle risks, potentially resulting in increased loan losses and higher impairment charges, which in turn could weaken profits and return on equity.

- A slower pace of digital transformation relative to industry leaders limits Secure Trust Bank's ability to achieve further operational efficiencies and cost reductions, risking structurally higher cost-to-income ratios and constrained earnings growth compared to more technologically advanced peers.

- Ongoing reliance on relatively short-duration, retail-sourced deposits and limited wholesale funding diversification exposes Secure Trust Bank to interest rate sensitivity and deposit competition, which may squeeze net interest margins and make revenue streams less resilient in a prolonged low or negative real interest rate environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Secure Trust Bank is £19.7, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Secure Trust Bank's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £19.7, and the most bearish reporting a price target of just £14.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £291.4 million, earnings will come to £89.4 million, and it would be trading on a PE ratio of 5.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of £11.25, the bullish analyst price target of £19.7 is 42.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.