Key Takeaways

- Strong digital and niche lending positions could be undermined by fintech competition, sector-specific risks, and rapidly rising technology and cybersecurity costs.

- Smaller scale and new regulatory dynamics may limit margin improvements and expose the bank to greater earnings volatility and customer attrition risks.

- The bank's profitability and growth are threatened by its exit from vehicle finance, sector-specific lending risks, digital competition, and escalating cost pressures.

Catalysts

About Secure Trust Bank- Provides banking and financial products and services in the United Kingdom.

- While Secure Trust Bank is well positioned to benefit from the long-term digital transformation of UK financial services-with recent investments in digital platforms like AppToPay and strong mobile and online banking uptake expected to yield further operational efficiencies-there is a risk that rapid technological change, rising cybersecurity costs, and aggressive fintech competition could erode these efficiency gains, potentially pressuring future cost-to-income ratios.

- Although the shift of capital away from vehicle finance into growing specialist lending markets should enable Secure Trust Bank to capitalize on the sustained demand for alternative lending and niche finance, its continued reliance on these segments means the bank is more exposed to sector-specific downturns and credit concentrations, which may lead to higher credit losses in adverse cycles and thus greater earnings volatility.

- Despite the group's track record of disciplined cost management and the expectation of further cost savings from simplification, the bank's smaller scale compared to larger UK peers may limit its ability to invest in next-generation technology and spread compliance or fixed costs as regulatory requirements intensify, which could ultimately constrain improvements in net margins over the longer term.

- While regulatory support for increased competition in UK retail and SME banking can accelerate Secure Trust Bank's market share gains, the broader secular trend toward open banking and customer data portability heightens attrition risk and can drive up customer acquisition costs, limiting both revenue growth and profitability as switching frictions fall industrywide.

- Although prudent risk management and strong balance sheet capital ratios currently underpin Secure Trust Bank's ability to redeploy capital for growth, uncertainties around the evolving legal and regulatory environment-particularly potential costs from legacy issues or new obligations-could present unexpected headwinds to stable long-term earnings and return on equity ambitions.

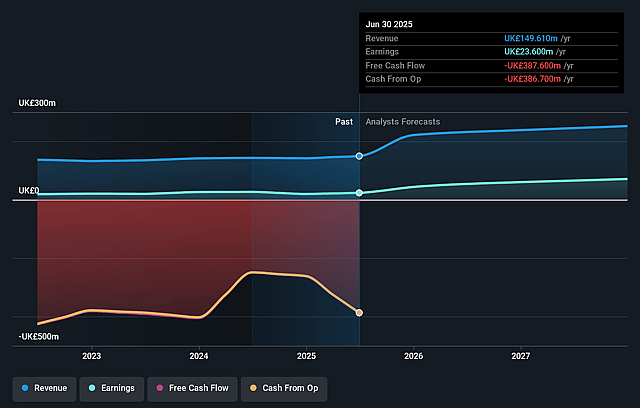

Secure Trust Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Secure Trust Bank compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Secure Trust Bank's revenue will grow by 18.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.8% today to 33.6% in 3 years time.

- The bearish analysts expect earnings to reach £83.2 million (and earnings per share of £4.26) by about September 2028, up from £23.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.1x on those 2028 earnings, down from 8.6x today. This future PE is lower than the current PE for the GB Banks industry at 8.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.34%, as per the Simply Wall St company report.

Secure Trust Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned wind-down of the high-yielding vehicle finance segment will lead to a decline in net interest margin from its current level, reducing overall profitability and hampering the company's ability to sustain historic levels of earnings.

- The company's continued reliance on specialist and niche lending markets increases its exposure to sector-specific credit risks in downturns, which could result in elevated credit losses and pressure net income during adverse economic cycles.

- Secure Trust Bank's limited scale and narrower business mix compared to major UK banks may restrict its ability to make competitive investments in digital transformation, threatening operating efficiency and the potential for margin enhancement.

- The ongoing shift in the UK banking market toward fintech-driven and digital-only challengers presents long-term risks of customer attrition and pricing pressure, potentially undermining future revenue growth and cost-to-income improvements.

- The bank faces cost normalization following organizational restructuring, with management guiding to a return to medium-term cost growth of 5 percent per year instead of the anomalously low 1 percent seen recently, which could erode operating leverage and net margin gains if income growth falters.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Secure Trust Bank is £14.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Secure Trust Bank's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £21.7, and the most bearish reporting a price target of just £14.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £247.2 million, earnings will come to £83.2 million, and it would be trading on a PE ratio of 4.1x, assuming you use a discount rate of 8.3%.

- Given the current share price of £10.6, the bearish analyst price target of £14.2 is 25.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.