Key Takeaways

- Digital transformation and stringent cost discipline are boosting efficiency, customer retention, and operating margins.

- Strategic shift to specialist lending in larger, underpenetrated markets supports high-quality revenue growth and long-term business resilience.

- Reduced focus on vehicle finance, rising costs, digital transition risks, specialist lending exposure, and regulatory uncertainty threaten long-term profitability and earnings stability.

Catalysts

About Secure Trust Bank- Provides banking and financial products and services in the United Kingdom.

- The ongoing migration of customers to digital channels, such as the rapid adoption of the AppToPay mobile servicing app and enhanced online banking features, is driving efficiency gains, operational cost reductions, and better customer retention, with cost-income ratios continuing to improve toward a targeted 44–46%, supporting future net margin expansion.

- Refocusing away from non-core vehicle finance and reallocating capital to growing, higher-returning specialist lending businesses positions Secure Trust Bank to accelerate loan growth in large, underpenetrated markets (e.g., retail, commercial, and real estate finance), which is expected to drive sustainable, higher-quality revenue growth.

- The group's disciplined cost control and ongoing delivery of structural cost savings (including £8m annualized by year-end and further £25m reductions by 2030) provide strong operating leverage, supporting both margin improvement and higher profitability as the business scales.

- Secure Trust Bank's robust credit underwriting and risk controls, evidenced by stable and normalized cost of risk metrics even as lending grows, should underpin long-term earnings stability and minimize losses-key to maintaining attractive returns on equity.

- Demographic changes, notably the UK's aging population, are likely to sustain demand for targeted financial products in Secure Trust Bank's specialist segments, which supports resilience and growth in lending balances, ultimately benefiting recurring revenues and long-term book value.

Secure Trust Bank Future Earnings and Revenue Growth

Assumptions

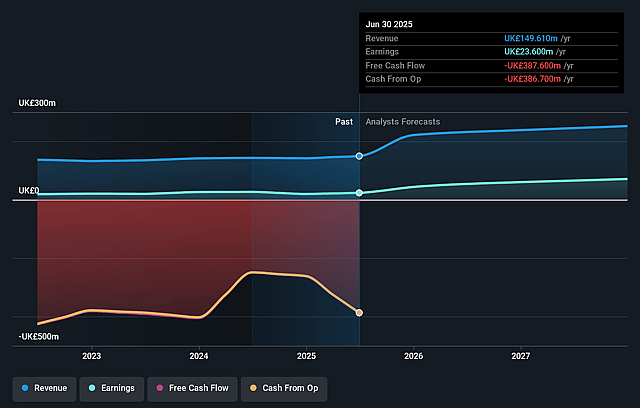

How have these above catalysts been quantified?- Analysts are assuming Secure Trust Bank's revenue will grow by 22.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.8% today to 32.5% in 3 years time.

- Analysts expect earnings to reach £89.7 million (and earnings per share of £3.65) by about September 2028, up from £23.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.8x on those 2028 earnings, down from 8.6x today. This future PE is lower than the current PE for the GB Banks industry at 8.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.34%, as per the Simply Wall St company report.

Secure Trust Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decision to cease new lending in the high-yielding Vehicle Finance segment will bring the group's Net Interest Margin (NIM) down from current levels, with management confirming it will likely be below the 5.5% historical target-directly impacting long-term revenue growth and net margins.

- The normalization of cost growth back to a guided 5% per annum (from a one-off low of 1% due to restructuring) risks eroding operational leverage gains; if cost savings from Project Fusion are not sustained or digital efficiencies stall, this could pressure future profitability and cost-to-income ratios.

- While rapid digital platform adoption is underway, the bank remains mid-transition; if Secure Trust Bank fails to keep pace with digitally native competitors or if further digital investment lags, it risks customer attrition and margin compression, impacting future revenue and market share.

- Long-term asset quality concerns persist from reliance on specialist lending (e.g., Retail Finance, Real Estate Finance); if economic conditions deteriorate, impairments and cost of risk could spike, especially as two legacy real estate cases highlighted increased provisions, threatening future earnings stability.

- Industry-wide and regulatory risks remain, including looming uncertainty around potential FCA-mandated redress for historic commission arrangements in Vehicle Finance-while currently viewed as immaterial, any adverse regulatory outcome or increased compliance costs could reduce earnings and dampen shareholder returns over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £17.84 for Secure Trust Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £21.7, and the most bearish reporting a price target of just £14.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £275.7 million, earnings will come to £89.7 million, and it would be trading on a PE ratio of 4.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of £10.6, the analyst price target of £17.84 is 40.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.