Last Update 05 Nov 25

Fair value Increased 6.43%HSBK: Share Buybacks And Dividend Decisions Will Influence Future Performance Margins

Analysts have raised their price target for Halyk Bank of Kazakhstan from $25.93 to $27.60, citing slight adjustments in growth forecasts and financial metrics.

What's in the News

- Halyk Bank has announced a share repurchase program to buy back up to $50 million worth of Global Depositary Receipts, not to exceed 1% of its total common shares. The aim of the program is to optimize its capital structure. The program will conclude by October 1, 2026. (Key Developments)

- The Board of Directors authorized a new buyback plan that will be effective from September 29, 2025. (Key Developments)

- Between April 1 and June 30, 2025, Halyk Bank repurchased 452,256 shares for $10.46 million. This brought the total to 1,109,057 shares worth $23.09 million under an earlier buyback plan initiated in September 2024. (Key Developments)

- An extraordinary shareholders meeting is scheduled for September 22, 2025. The agenda includes dividend payments on common shares. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $25.93 to $27.60.

- Discount Rate has decreased marginally from 9.95% to 9.79%.

- Revenue Growth forecasts have declined slightly from 4.97% to 4.77%.

- Net Profit Margin has eased moderately from 57.00% to 56.13%.

- Future P/E has increased from 4.16x to 4.38x.

Key Takeaways

- Higher regulatory burdens and tightening lending criteria are expected to erode profitability and constrain future loan growth.

- Rising competition from fintechs and limited diversification outside Kazakhstan could pressure margins and increase vulnerability to local economic shocks.

- Robust digital growth, regional expansion, strong market leadership, disciplined risk controls, and shareholder-friendly policies position Halyk Bank for sustained profitability and long-term stability.

Catalysts

About Halyk Bank of Kazakhstan- Provides corporate and retail banking services primarily in the Republic of Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan.

- Higher regulatory burdens-including increases in minimum reserve requirements (scheduled to rise further through 2026) and new corporate tax rates-are set to directly erode net interest margins and reduce future earnings, as more capital will be tied up and effective tax rates will rise.

- Increasing digitization in Kazakhstan's financial sector is intensifying competition from fintechs, both domestically and from digital-first players in adjacent markets; if Halyk's continued digital investments are not sufficiently agile, this may compress long-term revenue and net margins.

- Kazakhstan's economy remains highly linked to commodity cycles and is exposed to global macro volatility; persistent uncertainty or volatility in oil and commodity prices could lead to slower loan growth and heightened credit risk, negatively impacting loan book expansion and asset quality.

- Halyk's core business is still heavily concentrated in Kazakhstan, leaving it exposed to local economic or political shocks; despite progress expanding into Uzbekistan, a lack of significant international diversification could constrain earnings growth and increase risk to future revenue streams.

- Ongoing regulatory tightening-including stricter lending criteria and caps on mortgage rates-may slow future retail loan growth and reduce profitability, especially if regulators continue to prioritize financial stability over credit expansion.

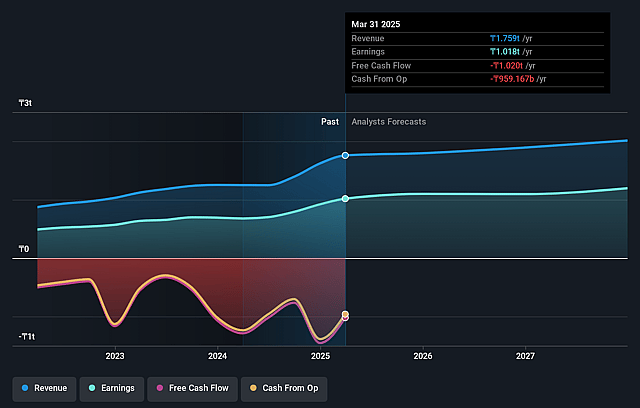

Halyk Bank of Kazakhstan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Halyk Bank of Kazakhstan's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 57.9% today to 57.0% in 3 years time.

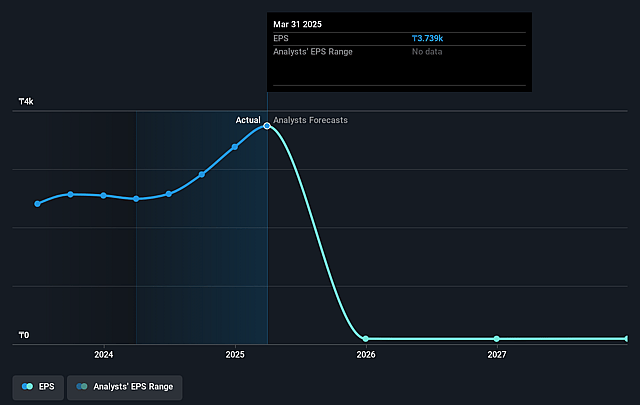

- Analysts expect earnings to reach KZT 1219.2 billion (and earnings per share of KZT 92.78) by about September 2028, up from KZT 1070.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting KZT1418.9 billion in earnings, and the most bearish expecting KZT989.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.2x on those 2028 earnings, up from 3.5x today. This future PE is lower than the current PE for the GB Banks industry at 8.5x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.95%, as per the Simply Wall St company report.

Halyk Bank of Kazakhstan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained digital transformation and ecosystem growth: Halyk Bank's digital Super-App and Onlinebank platforms continue to see robust user growth, high transaction increases (32% in volume for Super-App, 25% in B2B online transactions), and rising product penetration, which supports revenue expansion and long-term improvement in operational efficiency and net margins.

- Diversification and cross-border partnership potential: The strategic partnership with Click in Uzbekistan materially expands Halyk's total addressable market, unlocking access to 33 million aggregate B2C clients and new cross-sell and fee-based income opportunities in one of Central Asia's fastest-growing digital financial markets, potentially supporting earnings growth.

- Strong market leadership and deposit franchise: Halyk maintains sector-leading market shares in retail loans (19%) and deposits (28.7%), along with a dominant position in SME and corporate banking (serving 86% of the largest taxpayers, 49% of corporate loans), which underpin low funding costs and strong net interest margins, supporting stable long-term revenue streams.

- Resilient profitability and disciplined risk management: The bank boasts a high net interest margin (7.2%) and a best-in-class cost-to-income ratio (17.2%), while asset quality remains stable (Stage 3 loans declining to 6.6%), suggesting the bank's ability to protect net margins and absorb regulatory/tax shocks through efficiency and strong risk controls.

- Healthy capital and dividend policy: Halyk continues to generate capital (capital adequacy at 18.1%) and has demonstrated a willingness to return profits to shareholders via high payout ratios (60% of net 2024 profit), while a share buyback program enhances shareholder returns-bolstering the potential for sustained long-term total returns, even amid sectoral or regulatory headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of KZT25.933 for Halyk Bank of Kazakhstan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KZT28.8, and the most bearish reporting a price target of just KZT24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be KZT2139.1 billion, earnings will come to KZT1219.2 billion, and it would be trading on a PE ratio of 4.2x, assuming you use a discount rate of 10.0%.

- Given the current share price of KZT25.6, the analyst price target of KZT25.93 is 1.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.