Key Takeaways

- Higher financing and compliance costs, along with stringent ESG rules, are expected to pressure profitability and limit Antin's ability to efficiently deploy capital.

- Intensifying competition, sector concentration, and rising expenses threaten revenue growth, management fee stability, and long-term earnings capacity.

- Strong sector trends, fundraising success, portfolio growth, disciplined capital deployment, and robust liquidity position Antin for sustained expansion, value creation, and shareholder returns.

Catalysts

About Antin Infrastructure Partners SAS- A private equity firm specializing in infrastructure investments.

- Persistently high global interest rates and uncertainty around the pace of cuts are set to increase financing costs for new infrastructure deals, limiting Antin's ability to deploy capital efficiently and straining the achievement of targeted risk-adjusted portfolio returns, which is likely to pressure both future fee income and fund performance.

- Ongoing and increasingly stringent ESG regulations are expected to drive up operational and compliance costs across Antin's portfolio, eroding net margins and reducing the profitability of fee and carry-based earnings as more resources are diverted to meet regulatory demands.

- Antin's growing reliance on large flagship fund launches and high AUM growth is exposed to intensifying competition from larger and more diversified asset managers, which will likely compress management fees and slow fundraising momentum, ultimately weighing on revenue growth and operating leverage in the medium term.

- The firm's concentration in specific sectors such as renewables and digital infrastructure magnifies the risk from sector-wide downturns, exacerbated by recent sell-offs in listed renewables and operational headwinds, leading to potentially lower exit valuations and unpredictability in realization of carried interest.

- Increasing fee compression industry-wide and higher operating expenses-heightened by aggressive hiring and investments in new strategies-threaten to outpace recurring revenue growth, ultimately resulting in lasting pressure on Antin's EBITDA margins and long-term earnings capacity.

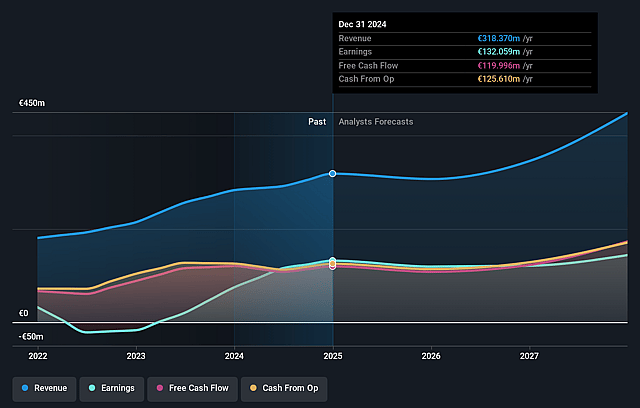

Antin Infrastructure Partners SAS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Antin Infrastructure Partners SAS compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Antin Infrastructure Partners SAS's revenue will grow by 11.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 41.5% today to 24.3% in 3 years time.

- The bearish analysts expect earnings to reach €106.5 million (and earnings per share of €0.59) by about September 2028, down from €132.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 23.4x on those 2028 earnings, up from 15.3x today. This future PE is greater than the current PE for the FR Capital Markets industry at 19.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

Antin Infrastructure Partners SAS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The infrastructure asset class is benefiting from strong long-term secular trends such as electrification, decarbonization, and exponential data growth, which position Antin to continue growing its assets under management and recurring management fees, supporting both revenue and net income over the long term.

- Antin demonstrated significant fundraising success for Flagship Fund V, closing above target at €10.2 billion-a 56% increase over the predecessor fund-and broadening its investor base across geographies and new channels, which enhances fund inflows and management fee growth.

- Portfolio companies reported robust performance with average 12% revenue and 20% EBITDA growth in 2024 driven by both organic and acquisition-led expansion, indicating strong value creation potential and the likelihood of future carried interest income boosting overall earnings.

- The company's disciplined capital deployment and proven track record of delivering above-target performance-such as a 2.6x gross multiple for Flagship Fund II-suggest it is well-placed to capture investor confidence and successfully raise new funds, feeding future revenue and profitability.

- Antin's substantial cash position combined with an ongoing commitment to shareholder returns, stable or growing dividends, and active investment in strategic growth initiatives provide flexibility to fund further expansion and strengthen net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Antin Infrastructure Partners SAS is €11.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Antin Infrastructure Partners SAS's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.0, and the most bearish reporting a price target of just €11.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €438.5 million, earnings will come to €106.5 million, and it would be trading on a PE ratio of 23.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of €11.28, the bearish analyst price target of €11.3 is 0.2% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.